Answered step by step

Verified Expert Solution

Question

1 Approved Answer

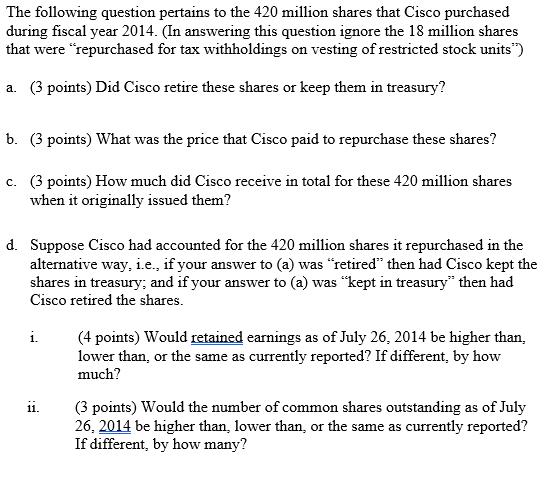

The following question pertains to the 420 million shares that Cisco purchased during fiscal year 2014. (In answering this question ignore the 18 million

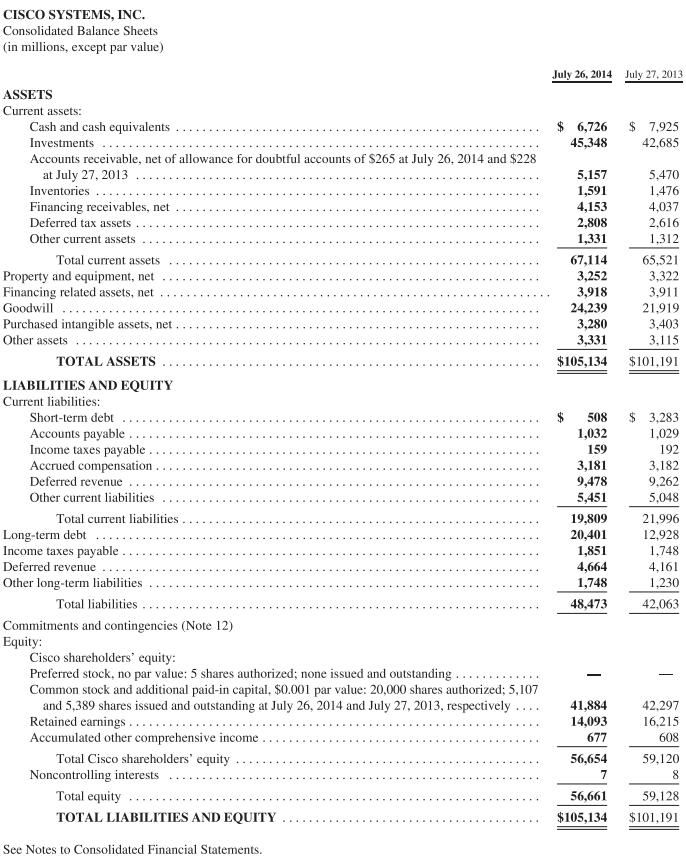

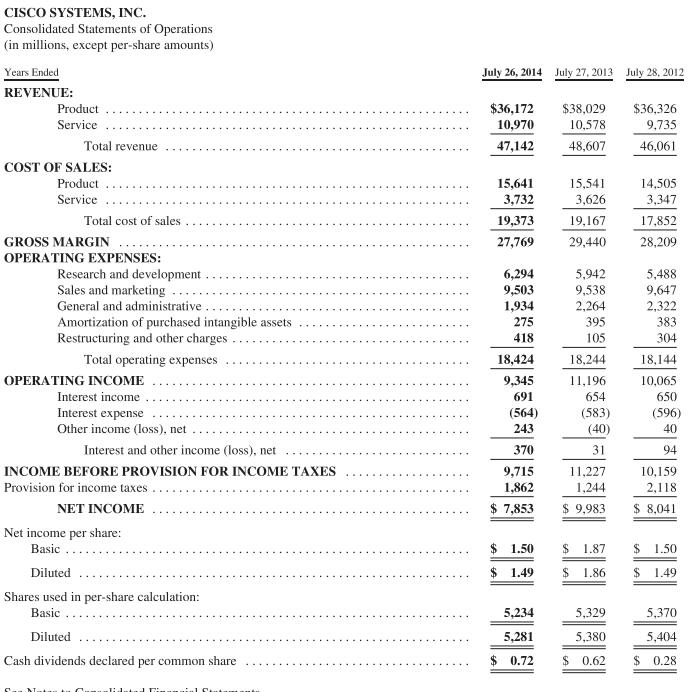

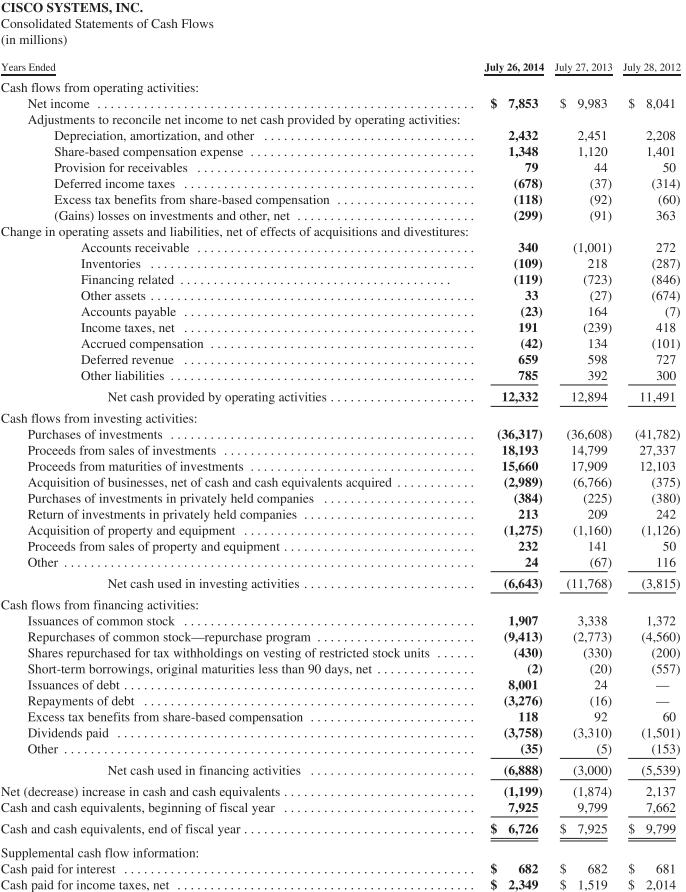

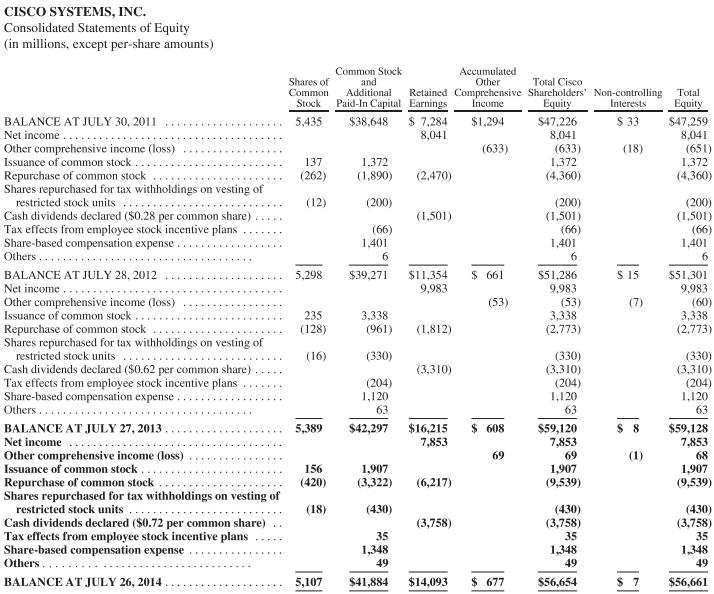

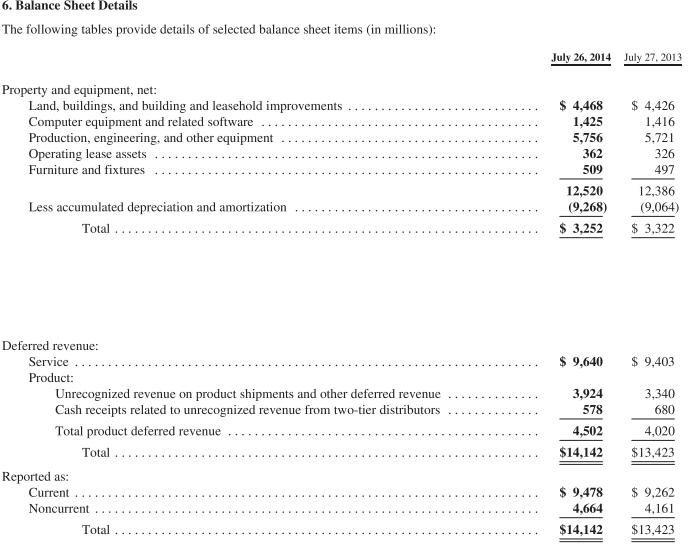

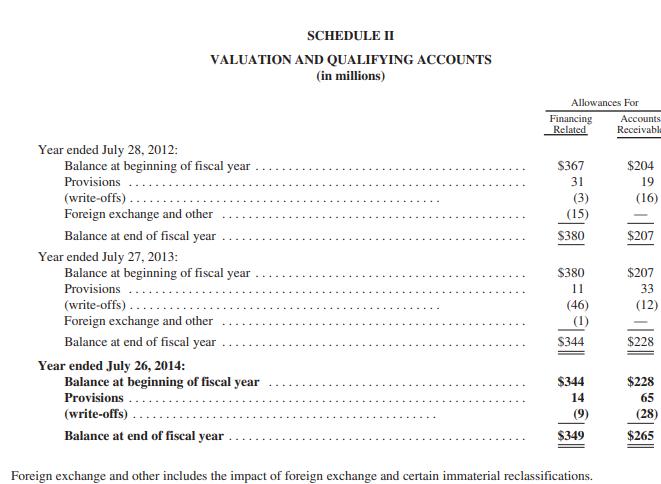

The following question pertains to the 420 million shares that Cisco purchased during fiscal year 2014. (In answering this question ignore the 18 million shares that were "repurchased for tax withholdings on vesting of restricted stock units") a. (3 points) Did Cisco retire these shares or keep them in treasury? b. (3 points) What was the price that Cisco paid to repurchase these shares? c. (3 points) How much did Cisco receive in total for these 420 million shares when it originally issued them? d. Suppose Cisco had accounted for the 420 million shares it repurchased in the alternative way, i.e., if your answer to (a) was "retired" then had Cisco kept the shares in treasury; and if your answer to (a) was "kept in treasury" then had Cisco retired the shares. i. 11. (4 points) Would retained earnings as of July 26, 2014 be higher than, lower than, or the same as currently reported? If different, by how much? (3 points) Would the number of common shares outstanding as of July 26, 2014 be higher than, lower than, or the same as currently reported? If different, by how many? CISCO SYSTEMS, INC. Consolidated Balance Sheets (in millions, except par value) ASSETS Current assets: Cash and cash equivalents Investments Accounts receivable, net of allowance for doubtful accounts of $265 at July 26, 2014 and $228 at July 27, 2013 Inventories Financing receivables, net Deferred tax assets Other current assets Total current assets Property and equipment, net Financing related assets, net Goodwill Purchased intangible assets, net. Other assets TOTAL ASSETS LIABILITIES AND EQUITY Current liabilities: Short-term debt Accounts payable. Income taxes payable. Accrued compensation. Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable. Deferred revenue Other long-term liabilities Total liabilities Commitments and contingencies (Note 12) Equity: Cisco shareholders' equity: Preferred stock, no par value: 5 shares authorized; none issued and outstanding.. Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,107 and 5,389 shares issued and outstanding at July 26, 2014 and July 27, 2013, respectively Retained earnings..... Accumulated other comprehensive income Total Cisco shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY See Notes to Consolidated Financial Statements. July 26, 2014 July 27, 2013 6,726 45,348 5,157 1,591 4,153 2,808 1,331 67,114 3,252 3,918 24,239 3,280 3,331 $105,134 508 1,032 159 3,181 9,478 5,451 19,809 20,401 1,851 4,664 1,748 48,473 41,884 14,093 677 56,654 7 $ 7,925 42,685 5,470 1,476 4,037 2,616 1,312 65,521 3,322 3,911 21,919 3,403 3,115 $101,191 $3,283 1,029 192 3,182 9,262 5,048 21,996 12,928 1,748 4,161 1,230 42,063 - 42,297 16,215 608 59,120 8 56,661 59,128 $105,134 $101,191 CISCO SYSTEMS, INC. Consolidated Statements of Operations (in millions, except per-share amounts) Years Ended REVENUE: Product Service Total revenue COST OF SALES: Product Service Total cost of sales GROSS MARGIN OPERATING EXPENSES: Research and development. Sales and marketing General and administrative. Amortization of purchased intangible assets Restructuring and other charges Total operating expenses OPERATING INCOME Interest income Interest expense Other income (loss), net Interest and other income (loss), net INCOME BEFORE PROVISION FOR INCOME TAXES Provision for income taxes NET INCOME Net income per share: Basic... Diluted Shares used in per-share calculation: Basic. Diluted Cash dividends declared per common share July 26, 2014 July 27, 2013 July 28, 2012 $36,172 10,970 47,142 15,641 3,732 19,373 27,769 6,294 9,503 1,934 275 418 18,424 9,345 691 (564) 243 370 9,715 1,862 $ 7,853 $ 1.50 $1.49 5,234 5,281 $ 0.72 $38,029 10,578 48,607 15,541 3,626 19,167 29,440 5,942 9,538 2,264 395 105 18,244 11,196 654 (583) (40) 31 11,227 1,244 $ 9,983 $ 1.87 $ 1.86 5,329 5,380 $ 0.62 $36,326 9,735 46,061 14,505 3,347 17,852 28,209 5,488 9,647 2,322 383 304 18,144 10,065 650 (596) 40 94 10,159 2,118. $ 8,041 $ 1.50 $ 1.49 5,370 5,404 $ 0.28 CISCO SYSTEMS, INC. Consolidated Statements of Cash Flows (in millions) Years Ended Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization, and other Share-based compensation expense Provision for receivables Deferred income taxes Excess tax benefits from share-based compensation (Gains) losses on investments and other, net Change in operating assets and liabilities, net of effects of acquisitions and divestitures: Accounts receivable Inventories Financing related Other assets Accounts payable Income taxes, net Accrued compensation Deferred revenue Other liabilities Net cash provided by operating activities. Cash flows from investing activities: Purchases of investments Proceeds from sales of investments Proceeds from maturities of investments Acquisition of businesses, net of cash and cash equivalents acquired Purchases of investments in privately held companies Return of investments in privately held companies Acquisition of property and equipment Proceeds from sales of property and equipment Other.... Net cash used in investing activities Cash flows from financing activities: Issuances of common stock Repurchases of common stock-repurchase program Shares repurchased for tax withholdings on vesting of restricted stock units Short-term borrowings, original maturities less than 90 days, net Issuances of debt.. Repayments of debt Excess tax benefits from share-based compensation Dividends paid Other Net cash used in financing activities Net (decrease) increase in cash and cash equivalents. Cash and cash equivalents, beginning of fiscal year Cash and cash equivalents, end of fiscal year. Supplemental cash flow information: Cash paid for interest Cash paid for income taxes, net July 26, 2014 July 27, 2013 July 28, 2012 $ 7,853 2,432 1,348 79 (678) (118) (299) 340 (109) (119) 33 (23) 191 (42) 659 785 12,332 (1,275) 232 24 (6,643) $ 9,983 2,451 1,120 44 (37) (92) (91) 1,907 (9,413) (430) (2) (1,001) 218 (723) (27) 164 (36,317) (36,608) 18,193 14,799 15,660 17,909 (2,989) (6,766) (384) (225) 213 209 (239) 134 598 392 12,894 (1,160) 141 (67) (11,768) 3,338 (2,773) (330) (20) 24 8,001 (3,276) 118 (3,758) (35) (6,888) (3,000) (1,874) (1,199) 7,925 9,799 $ 6,726 $ 7,925 (16) 92 (3,310) (5) $ 682 $ 682 $ 2,349 $ 1,519 $8,041 2,208 1,401 50 (314) (60) 363 272 (287) (846) (674) (7) 418 (101) 727 300 11,491 (41,782) 27,337 12,103 (375) (380) 242 (1,126) 50 116 (3,815) 1,372 (4,560) (200) (557) 60 (1,501) (153) (5,539) 2,137 7,662 $ 9,799 681 $ 2,014 CISCO SYSTEMS, INC. Consolidated Statements of Equity (in millions, except per-share amounts) BALANCE AT JULY 30, 2011 Net income Other comprehensive income (loss) Issuance of common stock. Repurchase of common stock Shares repurchased for tax withholdings on vesting of restricted stock units Cash dividends declared ($0.28 per common share) Tax effects from employee stock incentive plans Share-based compensation expense Others... BALANCE AT JULY 28, 2012 Net income Other comprehensive income (loss) Issuance of common stock. Repurchase of common stock Shares repurchased for tax withholdings on vesting of restricted stock units Cash dividends declared ($0.62 per common share) Tax effects from employee stock incentive plans Share-based compensation expense.. Others. BALANCE AT JULY 27, 2013 Net income Other comprehensive income (loss) Issuance of common stock Repurchase of common stock Shares repurchased for tax withholdings on vesting of restricted stock units Cash dividends declared ($0.72 per common share) Tax effects from employee stock incentive plans Share-based compensation expense Others... BALANCE AT JULY 26, 2014 Common Stock Accumulated Other Shares of Common and Total Cisco Additional Retained Comprehensive Shareholders' Non-controlling Total Stock Paid-In Capital Earnings Income Equity Interests Equity 5,435 $38,648 $1,294 $ 33 (18) 137 (262) (12) 5,298 235 (128) (16) 5,389 156 (420) (18) 5,107 1,372 (1,890) (200) (66) 1,401 6 $39,271 3,338 (961) (330) (204) 1,120 63 $42,297 1,907 (3,322) (430) 35 1,348 49 $41,884 $ 7,284 8,041 (2,470) (1,501) $11,354 9,983 (1,812) (3,310) (6,217) (3,758) (633) $16,215 $ 608 7,853 $14,093 $ 661 (53) 69 $ 677 $47,226 8,041 (633) 1,372 (4,360) (200) (1,501) (66) 1,401 6 $51,286 9,983 (53) 3,338 (2,773) (330) (3,310) (204) 1,120 63 $59,120 7,853 69 1,907 (9,539) (430) (3,758) 35 1,348 49 $56,654 $ 15 (7) $8 (1) $7 $47,259 8,041 (651) 1,372 (4,360) (200) (1,501) (66) 1,401 6 $51,301 9,983 (60) 3,338 (2,773) (330) (3,310) (204) 1,120 63 $59,128 7,853 68 1,907 (9,539) (430) (3,758) 35 1,348 49 $56,661 6. Balance Sheet Details The following tables provide details of selected balance sheet items (in millions): Property and equipment, net: Land, buildings, and building and leasehold improvements Computer equipment and related software Production, engineering, and other equipment Operating lease assets Furniture and fixtures Less accumulated depreciation and amortization Total.. Deferred revenue: Service Product: Unrecognized revenue on product shipments and other deferred revenue Cash receipts related to unrecognized revenue from two-tier distributors Total product deferred revenue Total Reported as: Current Noncurrent Total July 26, 2014 July 27, 2013 $ 4,468 1,425 5,756 362 509 12,520 (9,268) 3,252 $ 9,640 3,924 578 4,502 $14,142 $ 4,426 1,416 5,721 326 497 12,386 (9,064) $ 3,322 $ 9,403 3,340 680 4,020 $13,423 $ 9,478 4,664 $ 9,262 4,161 $14,142 $13,423 Year ended July 28, 2012: Balance at beginning of fiscal year Provisions (write-offs).. SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS (in millions) Foreign exchange and other Balance at end of fiscal year Year ended July 27, 2013: Balance at beginning of fiscal year Provisions (write-offs).. Foreign exchange and other Balance at end of fiscal year Year ended July 26, 2014: Balance at beginning of fiscal year Provisions... (write-offs) Balance at end of fiscal year Allowances For Financing Accounts Related Receivable $367 31 (3) (15) $380 $380 11 (46) (1) $344 $344 14 (9) $349 Foreign exchange and other includes the impact of foreign exchange and certain immaterial reclassifications. $204 19 (16) $207 $207 33 (12) $228 $228 65 (28) $265

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a As per the extract from Note 13 to the Consolidated Financial Statements During fiscal 2014 Cisco ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started