Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following questions are about TIPS. a . What is meant by the real rate? b . What is meant by the inflation - adjusted

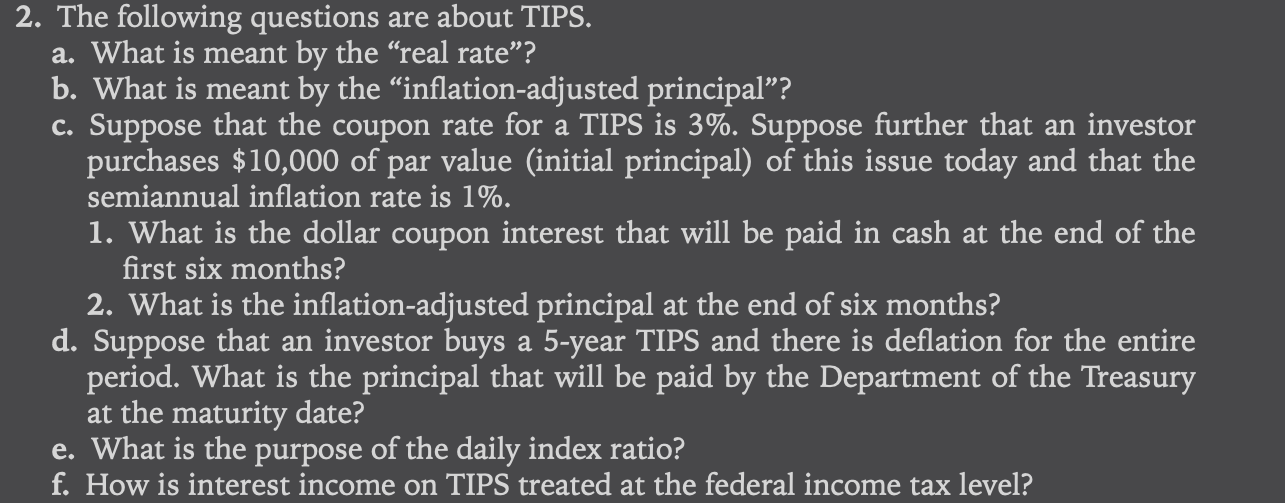

The following questions are about TIPS.

a What is meant by the "real rate"?

b What is meant by the "inflationadjusted principal"?

c Suppose that the coupon rate for a TIPS is Suppose further that an investor

purchases $ of par value initial principal of this issue today and that the semiannual inflation rate is

What is the dollar coupon interest that will be paid in cash at the end of the first six months?

What is the inflationadjusted principal at the end of six months?

d Suppose that an investor buys a year TIPS and there is deflation for the entire period. What is the principal that will be paid by the Department of the Treasury at the maturity date?

e What is the purpose of the daily index ratio?

f How is interest income on TIPS treated at the federal income tax level?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started