Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following questions are based on the The State of South Carolina case. The case text is attached in the appendix. QUESTION 9 (30 marks)

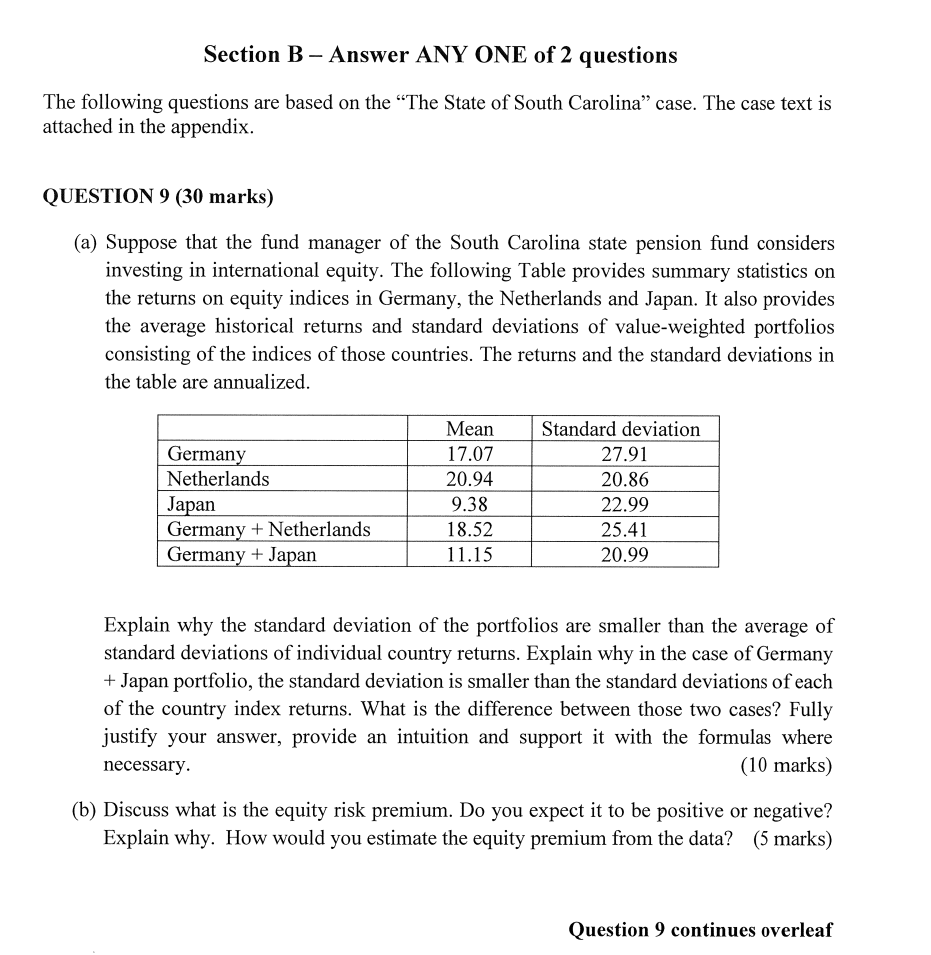

The following questions are based on the "The State of South Carolina" case. The case text is attached in the appendix. QUESTION 9 (30 marks) (a) Suppose that the fund manager of the South Carolina state pension fund considers investing in international equity. The following Table provides summary statistics on the returns on equity indices in Germany, the Netherlands and Japan. It also provides the average historical returns and standard deviations of value-weighted portfolios consisting of the indices of those countries. The returns and the standard deviations in the table are annualized. Explain why the standard deviation of the portfolios are smaller than the average of standard deviations of individual country returns. Explain why in the case of Germany + Japan portfolio, the standard deviation is smaller than the standard deviations of each of the country index returns. What is the difference between those two cases? Fully justify your answer, provide an intuition and support it with the formulas where necessary. (10 marks) (b) Discuss what is the equity risk premium. Do you expect it to be positive or negative? Explain why. How would you estimate the equity premium from the data

The following questions are based on the "The State of South Carolina" case. The case text is attached in the appendix. QUESTION 9 (30 marks) (a) Suppose that the fund manager of the South Carolina state pension fund considers investing in international equity. The following Table provides summary statistics on the returns on equity indices in Germany, the Netherlands and Japan. It also provides the average historical returns and standard deviations of value-weighted portfolios consisting of the indices of those countries. The returns and the standard deviations in the table are annualized. Explain why the standard deviation of the portfolios are smaller than the average of standard deviations of individual country returns. Explain why in the case of Germany + Japan portfolio, the standard deviation is smaller than the standard deviations of each of the country index returns. What is the difference between those two cases? Fully justify your answer, provide an intuition and support it with the formulas where necessary. (10 marks) (b) Discuss what is the equity risk premium. Do you expect it to be positive or negative? Explain why. How would you estimate the equity premium from the data Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started