Question

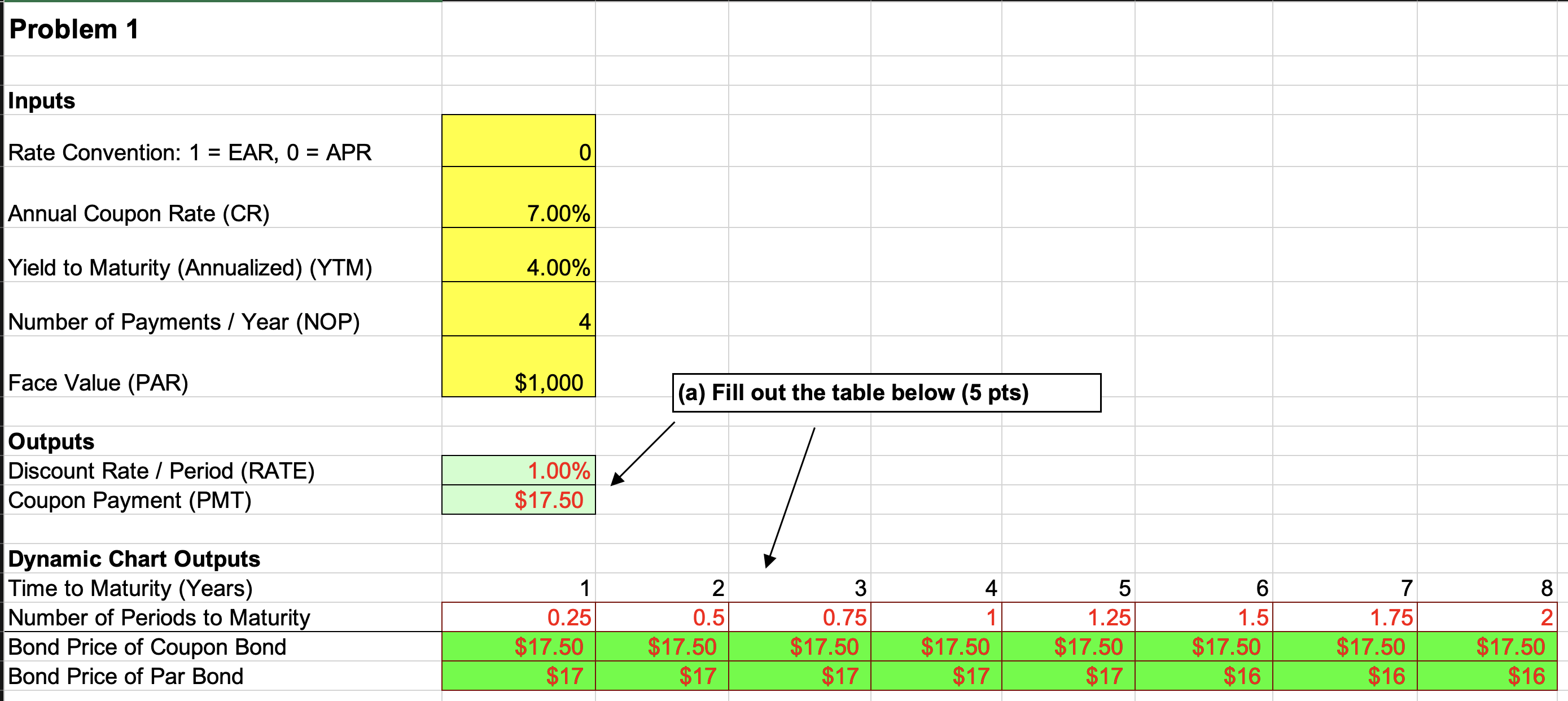

The following questions relate to the coupon and par bond described above (a) Is the bond price ofthis coupon bond ever below the price of

The following questions relate to the coupon and par bond described above

(a) Is the bond price of this coupon bond ever below the price of the par bond? Explain your answer

(b.) What happens to the price of this coupon bond as time to maturity declines? Explain your answer

(c) What is the bond price of a coupon bond maturing in 8 quarters?

(d) Now assume that the yield to maturity is 9% instead, all else remaining the same, how would the priceof this coupon bond change as time maturity decreases? Would it increase, decrease or remain the same as the bond approaches maturity?

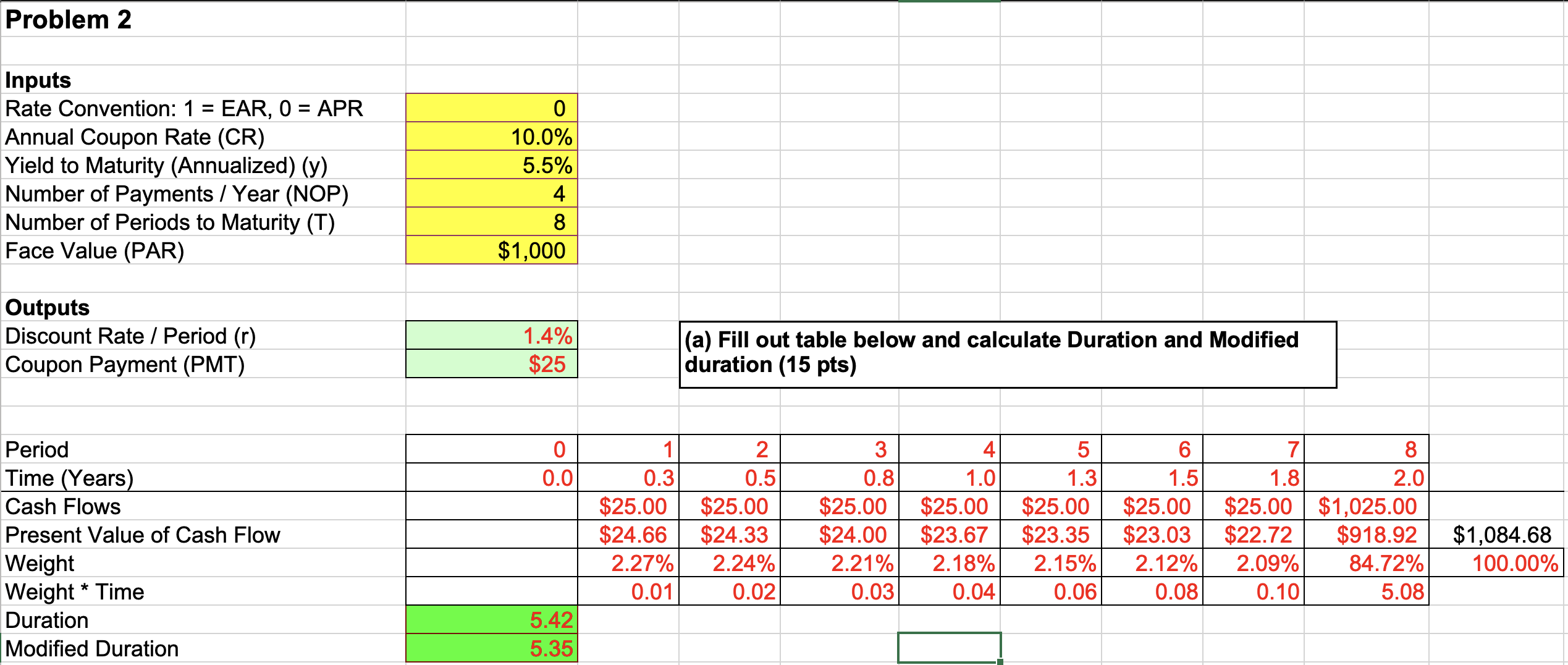

(a) Consider a zero coupon bond maturing in 1.5 years with face value of $1,000. Would this bond have longer or shorter duration than the bond above? Explain why. (5 pts)(c.) Using the bond in part a, calculate approximation to the new bond price if the yield to maturity increases by 1%. Use modified duration in your calculations.

(b.) Using the bond in excel part, calculate approximation to the new bond price if the yield to maturity increases by 1%. Use modified duration in your calculations.

Problem 1 Inputs Rate Convention: 1 = EAR, 0 = APR 0 Annual Coupon Rate (CR) 7.00% Yield to Maturity (Annualized) (YTM) 4.00% Number of Payments / Year (NOP) 4 Face Value (PAR) $1,000 (a) Fill out the table below (5 pts) Outputs Discount Rate / Period (RATE) 1.00% Coupon Payment (PMT) $17.50 Dynamic Chart Outputs Time to Maturity (Years) 1 2 3 4 Number of Periods to Maturity 0.25 0.5 0.75 1 Bond Price of Coupon Bond $17.50 $17.50 $17.50 $17.50 Bond Price of Par Bond $17 $17 $17 $17 5 1.25 $17.50 $17 6 7 8 1.5 1.75 2 $17.50 $16 $17.50 $16 $17.50 $16

Step by Step Solution

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the duration and modified duration we need to first calculate the present value of each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started