Answered step by step

Verified Expert Solution

Question

1 Approved Answer

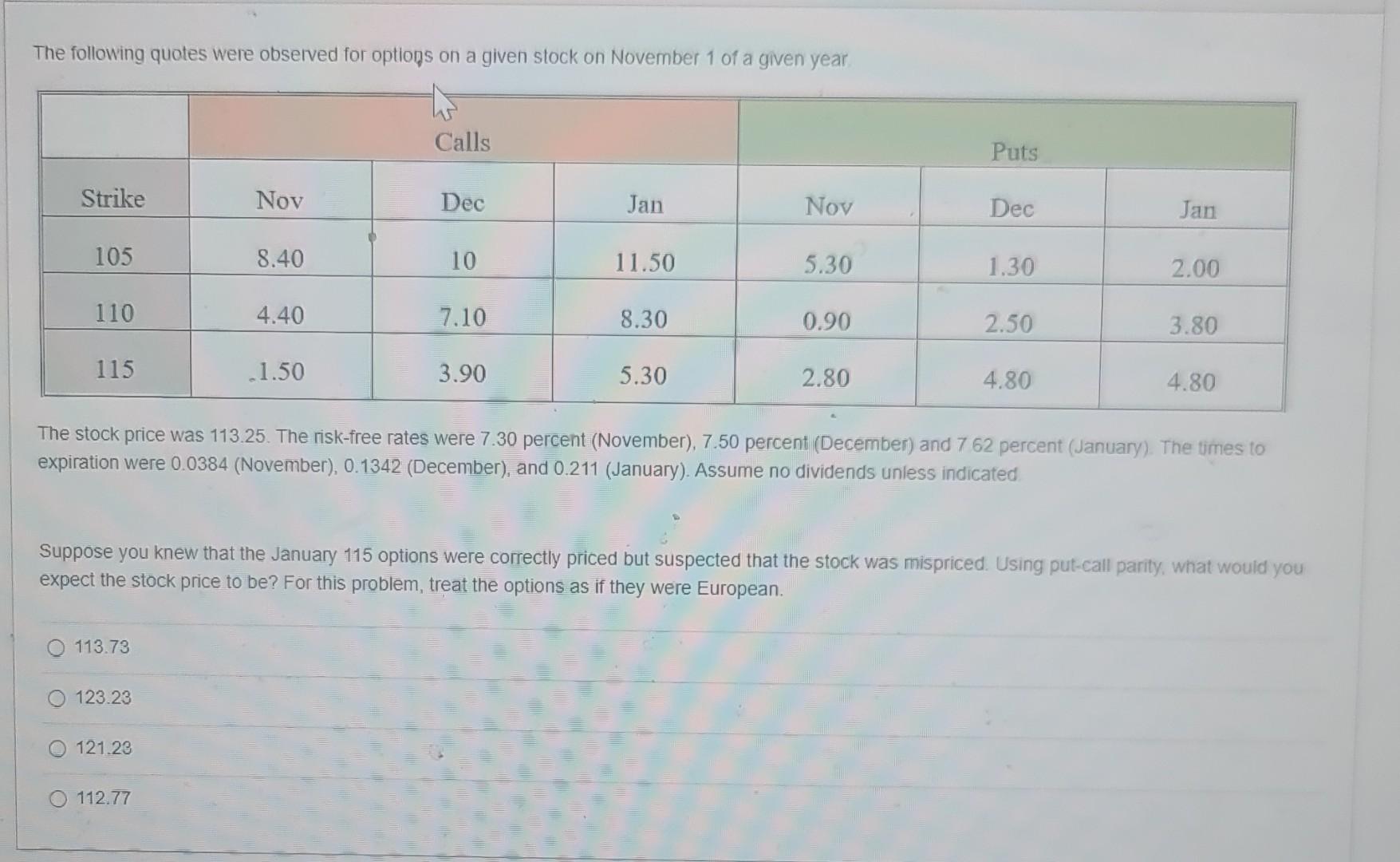

The following quotes were observed for options on a given stock on November 1 of a given year Calls Puts Strike Nov Dec Jan Nov

The following quotes were observed for options on a given stock on November 1 of a given year Calls Puts Strike Nov Dec Jan Nov Dec Jan 105 8.40 10 11.50 5.30 1.30 2.00 110 4.40 7.10 8.30 0.90 2.50 3.80 115 1.50 3.90 5.30 2.80 4.80 4.80 The stock price was 113.25. The risk-free rates were 7.30 percent (November), 7.50 percent (December) and 7 62 percent (January). The times to expiration were 0.0384 (November), 0.1342 (December), and 0.211 (January). Assume no dividends unless indicated Suppose you knew that the January 115 options were correctly priced but suspected that the stock was mispriced. Using put-call parity, what would you expect the stock price to be? For this problem, treat the options as if they were European. 113.73 123.23 121.23 112.77

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started