Question

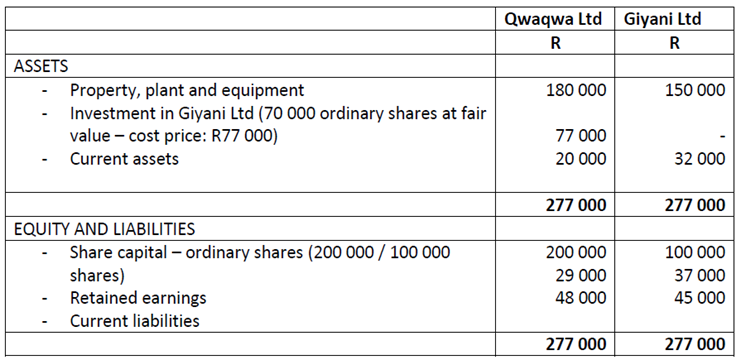

The following represents the abridged statements of Qwaqwa Ltd and its subsidiary, Giyani Ltd, at 31 December 20.20. Statement of financial position as at 31

The following represents the abridged statements of Qwaqwa Ltd and its subsidiary, Giyani Ltd, at 31 December 20.20.

Statement of financial position as at 31 December 20.20

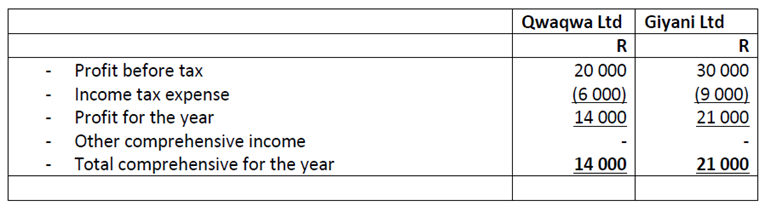

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOMEFOR THE YEAR ENDED 31 DECEMBER 20.20

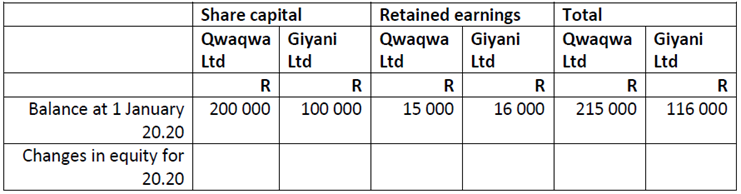

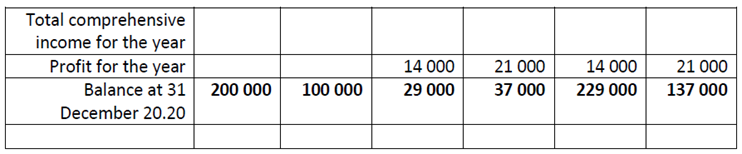

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 20.20

Additional information

1. Qwaqwa Ltd acquired its interest in Giyani Ltd on 1 January 20.17, on which date Giyani Ltds retained earnings amounted to R10 000. Consider the carrying amount of the assets and liabilities of Giyani Ltd to be equal to the fair value thereof at the date of acquisition.

2. On 1 January 20.18, Qwaqwa Ltd bought property with a carrying amount of R40 000 from Giyani Ltd. Giyani Ltd made a profit of R10 000

. REQUIRED Draft the following consolidated financial statements of Qwaqwa Ltd for the year ended 31 December 20.20 in compliance with the relevant IFRS.

1.2 Consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20.20

\begin{tabular}{|l|r|r|} \hline & Qwaqwa Ltd & \multicolumn{1}{l|}{ Giyani Ltd } \\ \hline & R & R \\ \hline - Profit before tax & 20000 & 30000 \\ - Income tax expense & (6000) & (9000) \\ - Profit for the year & 14000 & 21000 \\ - Other comprehensive income & - & - \\ - Total comprehensive for the year & 14000 & 21000 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|r|r|r|} \hline \begin{tabular}{r} Total comprehensive \\ income for the year \end{tabular} & & & & & & \\ \hline Profit for the year & & & 14000 & 21000 & 14000 & 21000 \\ \hline \begin{tabular}{r} Balance at 31 \\ December 20.20 \end{tabular} & 200000 & 100000 & 29000 & 37000 & 229000 & 137000 \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Share capital } & \multicolumn{2}{|c|}{ Retained earnings } & \multicolumn{2}{|l|}{ Total } \\ \hline & \begin{tabular}{l} Qwaqwa \\ Ltd \end{tabular} & \begin{tabular}{l} Giyani \\ Ltd \end{tabular} & \begin{tabular}{l} Qwaqwa \\ Ltd \end{tabular} & \begin{tabular}{l} Giyani \\ Ltd \end{tabular} & \begin{tabular}{l} Qwaqwa \\ Ltd \end{tabular} & \begin{tabular}{l} Giyani \\ Ltd \end{tabular} \\ \hline & R & R & R & R & R & R \\ \hline \begin{tabular}{r} Balance at 1 January \\ 20.20 \end{tabular} & 200000 & 100000 & 15000 & 16000 & 215000 & 116000 \\ \hline \begin{tabular}{r} Changes in equity for \\ 20.20 \end{tabular} & & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started