Question

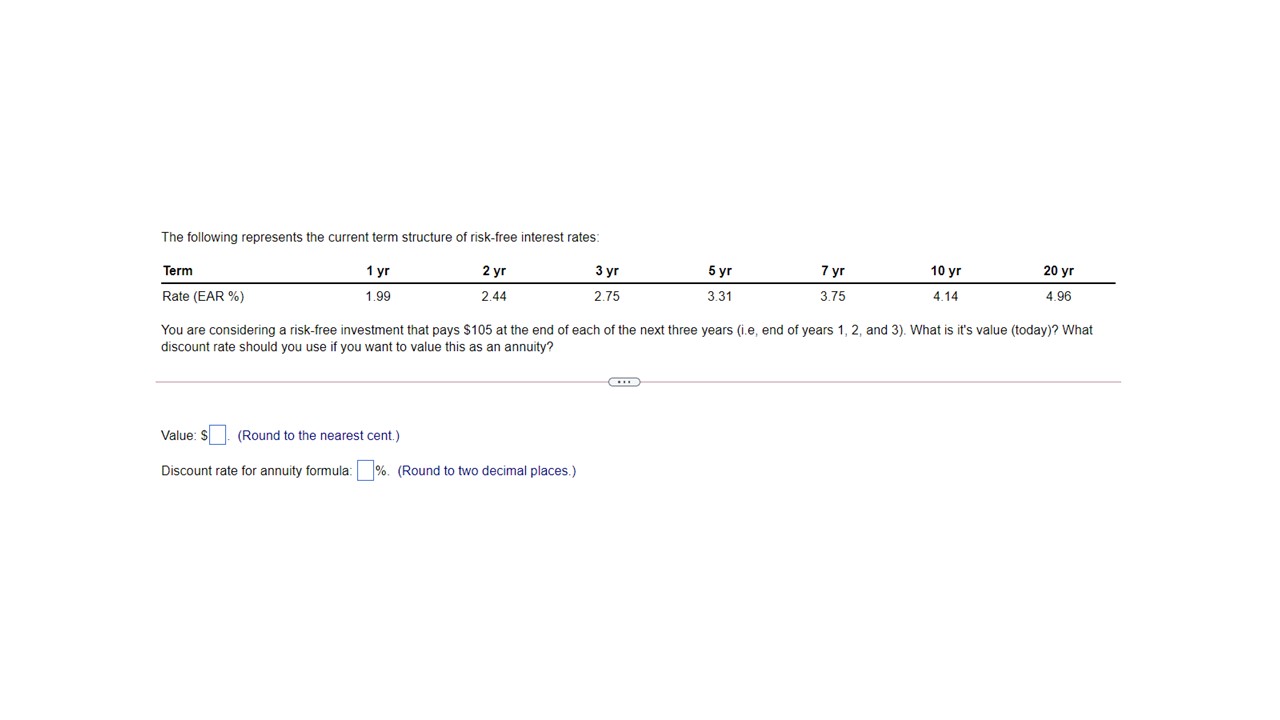

The following represents the current term structure of risk-free interest rates: 1 yr 1.99 2 yr 2.44 Term Rate (EAR %) 3 yr 2.75

The following represents the current term structure of risk-free interest rates: 1 yr 1.99 2 yr 2.44 Term Rate (EAR %) 3 yr 2.75 Value: S (Round to the nearest cent.) Discount rate for annuity formula:%. (Round to two decimal places.) 5 yr 3.31 7 yr 3.75 10 yr 4.14 20 yr 4.96 You are considering a risk-free investment that pays $105 at the end of each of the next three years (i.e, end of years 1, 2, and 3). What is it's value (today)? What discount rate should you use if you want to value this as an annuity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Present Value can be calculated by using the formula Amount 1 rateperiods Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Securities Valuation Risk and Risk Management

Authors: Pietro Veronesi

1st edition

0470109106, 978-0470109106

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App