Answered step by step

Verified Expert Solution

Question

1 Approved Answer

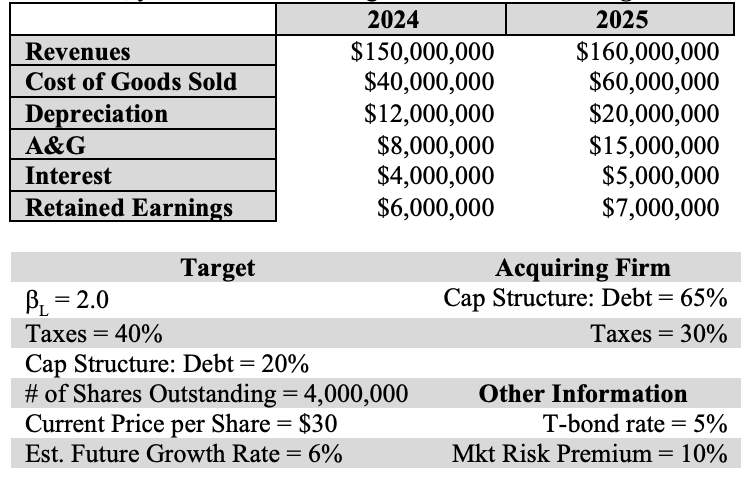

The following represents the target's accounting data you have estimated for the years 2 0 2 4 - 2 0 2 5 . Assume that

The following represents the target's accounting data you have estimated for the years Assume that all of these numbers are end of year data ie today is Jan and the revenues, etc. are at the end of

In addition, you have the following info for the target and the acquiring firm pictured Calculate the appropriate cashflows. Calculate the appropriate discount rate for the acquiring firm based on the value of the target. Why is this rate so high? Calculate the target firm value. what would be a reasonable offer ie $share for the target. Explain why the cost of equity is used as the discount rate. Explain why the retained earnings are subtracted to arrive at the appropriate cash flow. Explain why we delever and relever the BL Beta symbol little L What tax rate do we use to derive the cash flows, why? List at least weaknesses of the analysis. why is the covariance of debt and the market equal to zero? What impact does this have on beta?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started