Answered step by step

Verified Expert Solution

Question

1 Approved Answer

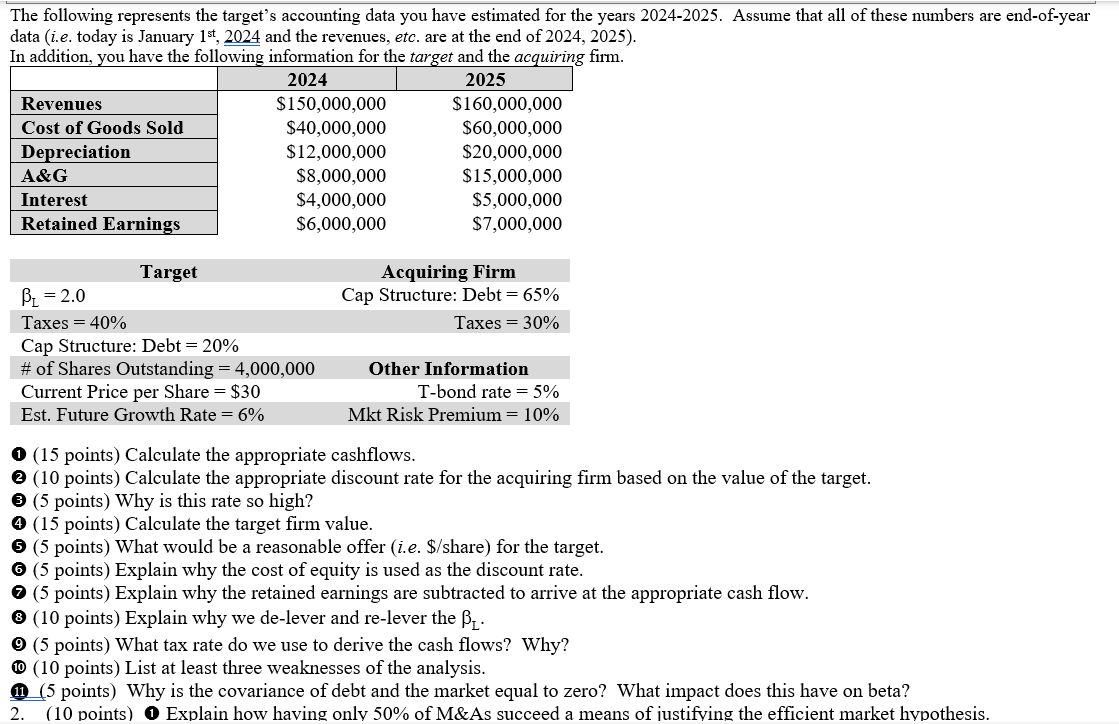

The following represents the target's accounting data you have estimated for the years 2 0 2 4 - 2 0 2 5 . Assume that

The following represents the target's accounting data you have estimated for the years Assume that all of these numbers are endofyear

data ie today is January and the revenues, etc. are at the end of

In addition, you have the following information for the target and the acquiring firm.

points Calculate the appropriate cashflows.

points Calculate the appropriate discount rate for the acquiring firm based on the value of the target.

points Why is this rate so high?

points Calculate the target firm value.

points What would be a reasonable offer ie share for the target.

points Explain why the cost of equity is used as the discount rate.

points Explain why the retained earnings are subtracted to arrive at the appropriate cash flow.

points Explain why we delever and relever the

points What tax rate do we use to derive the cash flows? Why?

points List at least three weaknesses of the analysis.

points Why is the covariance of debt and the market equal to zero? What impact does this have on beta?

points Explain how having only of & s succeed a means of iustifving the efficient market hypothesis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started