Question: The following return series comes from Global Financial Data. 1a. Calculate the average nominal return earned on large-company stocks. (Enter percentages as decimals and round

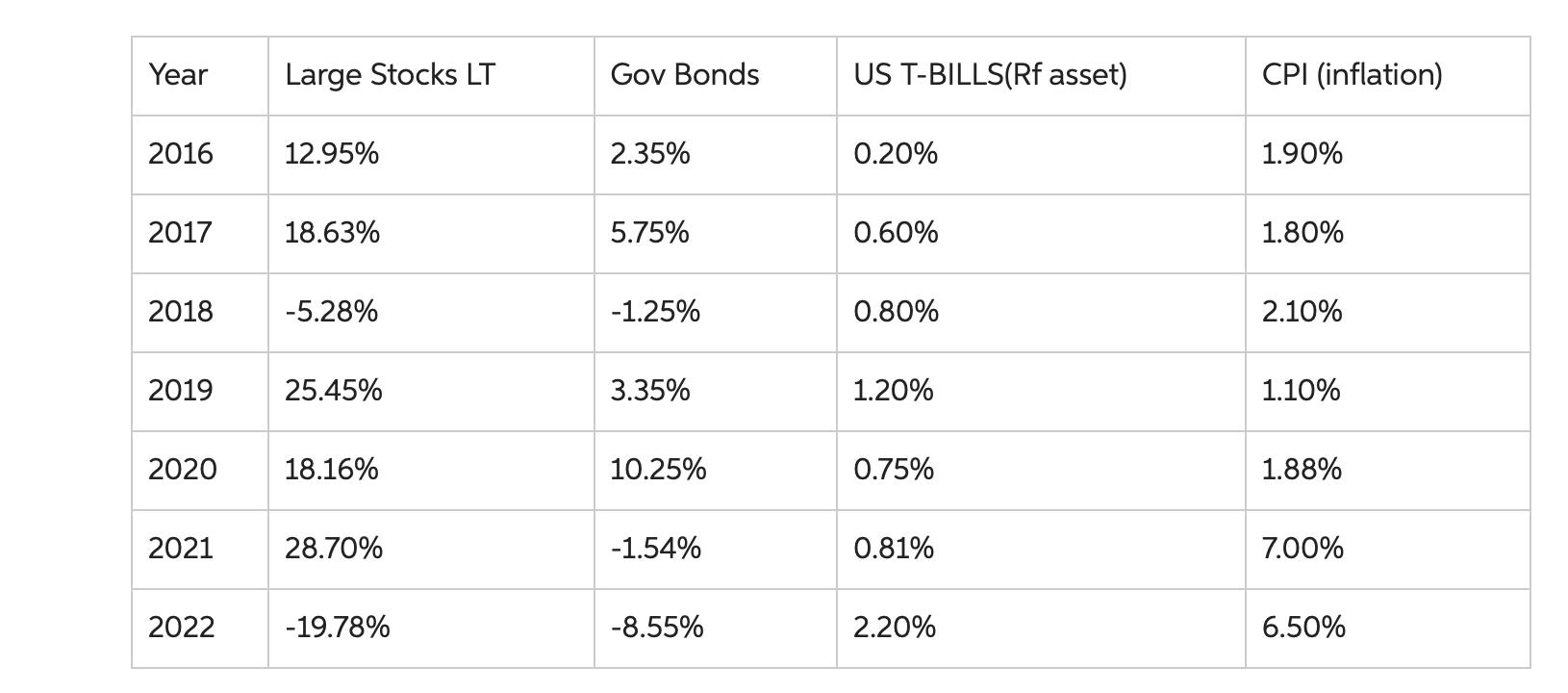

The following return series comes from Global Financial Data.

1a. Calculate the average nominal return earned on large-company stocks. (Enter percentages as decimals and round to 4 decimals)

1b. Calculate the average real return earned on large-company stocks using the approximate Fisher equation. (Enter percentages as decimals and round to 4 decimals)

1c. Calculate the average risk premium earned on large-company stocks. (Enter percentages as decimals and round to 4 decimals)

1d. Calculate the average real risk premium earned on large-company stocks using the approximate Fisher equation. (Enter percentages as decimals and round to 4 decimals)

1e. Calculate the average real return earned on US T-bills. (Enter percentages as decimals and round to 4 decimals)

1f. Calculate the average rate of inflation. (Enter percentages as decimals and round to 4 decimals)

Year 2016 2017 2018 2019 2020 2021 2022 Large Stocks LT 12.95% 18.63% -5.28% 25.45% 18.16% 28.70% -19.78% Gov Bonds 2.35% 5.75% -1.25% 3.35% 10.25% -1.54% -8.55% US T-BILLS(Rf asset) 0.20% 0.60% 0.80% 1.20% 0.75% 0.81% 2.20% CPI (inflation) 1.90% 1.80% 2.10% 1.10% 1.88% 7.00% 6.50%

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts