Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following scenario describes PPC , a small plastics producer with $ 2 5 0 million in revenue and approximately 3 0 0 employees. PPC

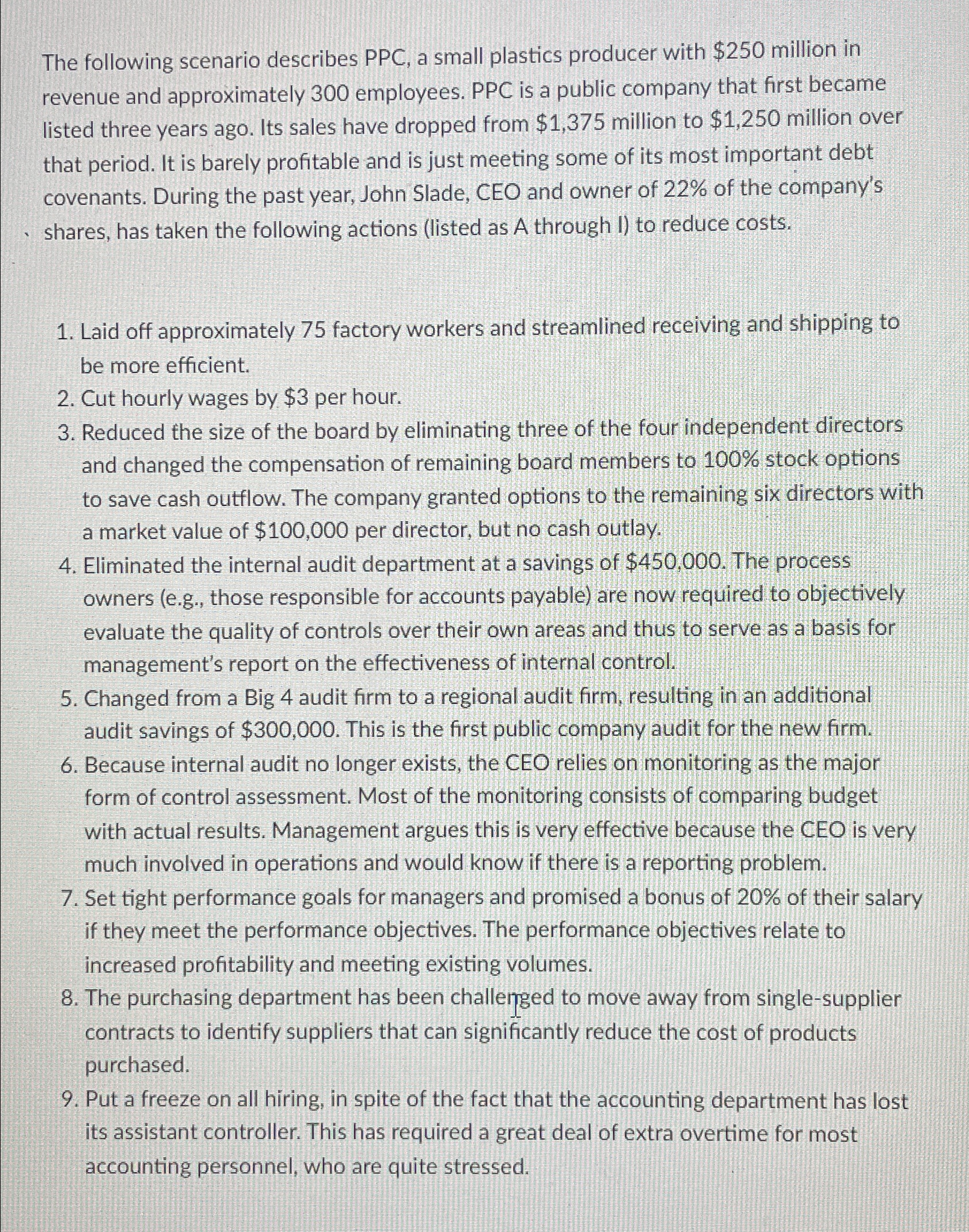

The following scenario describes PPC a small plastics producer with $ million in revenue and approximately employees. PPC is a public company that first became listed three years ago. Its sales have dropped from $ million to $ million over that period. It is barely profitable and is just meeting some of its most important debt covenants. During the past year, John Slade, CEO and owner of of the company's shares, has taken the following actions listed as A through I to reduce costs.

Laid off approximately factory workers and streamlined receiving and shipping to be more efficient.

Cut hourly wages by $ per hour.

Reduced the size of the board by eliminating three of the four independent directors and changed the compensation of remaining board members to stock options to save cash outflow. The company granted options to the remaining six directors with a market value of $ per director, but no cash outlay.

Eliminated the internal audit department at a savings of $ The process owners eg those responsible for accounts payable are now required to objectively evaluate the quality of controls over their own areas and thus to serve as a basis for management's report on the effectiveness of internal control.

Changed from a Big audit firm to a regional audit firm, resulting in an additional audit savings of $ This is the first public company audit for the new firm.

Because internal audit no longer exists, the CEO relies on monitoring as the major form of control assessment. Most of the monitoring consists of comparing budget with actual results. Management argues this is very effective because the CEO is very much involved in operations and would know if there is a reporting problem.

Set tight performance goals for managers and promised a bonus of of their salary if they meet the performance objectives. The performance objectives relate to increased profitability and meeting existing volumes.

The purchasing department has been challenged to move away from singlesupplier contracts to identify suppliers that can significantly reduce the cost of products purchased.

Put a freeze on all hiring, in spite of the fact that the accounting department has lost its assistant controller. This has required a great deal of extra overtime for most accounting personnel, who are quite stressed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started