Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following scenarios are independent from each other. You are required to show detailed calculation for each scenario. 1. Calculate the net working capital

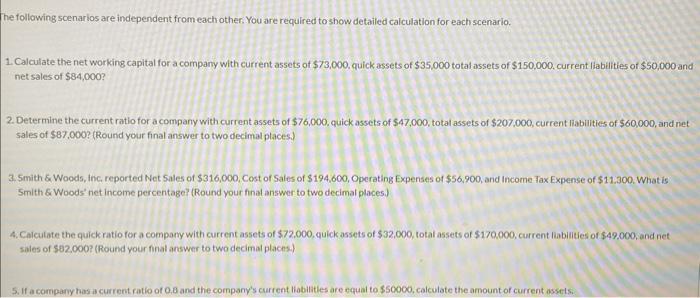

The following scenarios are independent from each other. You are required to show detailed calculation for each scenario. 1. Calculate the net working capital for a company with current assets of $73,000, quick assets of $35,000 total assets of $150,000, current liabilities of $50,000 and net sales of $84,000? 2. Determine the current ratio for a company with current assets of $76,000, quick assets of $47,000, total assets of $207,000, current liabilities of $60,000, and net sales of $87,000? (Round your final answer to two decimal places.) 3. Smith & Woods, Inc. reported Net Sales of $316,000, Cost of Sales of $194,600, Operating Expenses of $56,900, and Income Tax Expense of $11.300. What is Smith & Woods' net income percentage? (Round your final answer to two decimal places) 4. Calculate the quick ratio for a company with current assets of $72,000, quick assets of $32,000, total assets of $170,000, current liabilities of $49,000, and net sales of $82,000? (Round your final answer to two decimal places.) 5. If a company has a current ratio of 0.8 and the company's current liabilities are equal to $50000, calculate the amount of current assets.

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Net working capital NWC is calculated by subtracting current liabilities from current assets NWC Cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started