Answered step by step

Verified Expert Solution

Question

1 Approved Answer

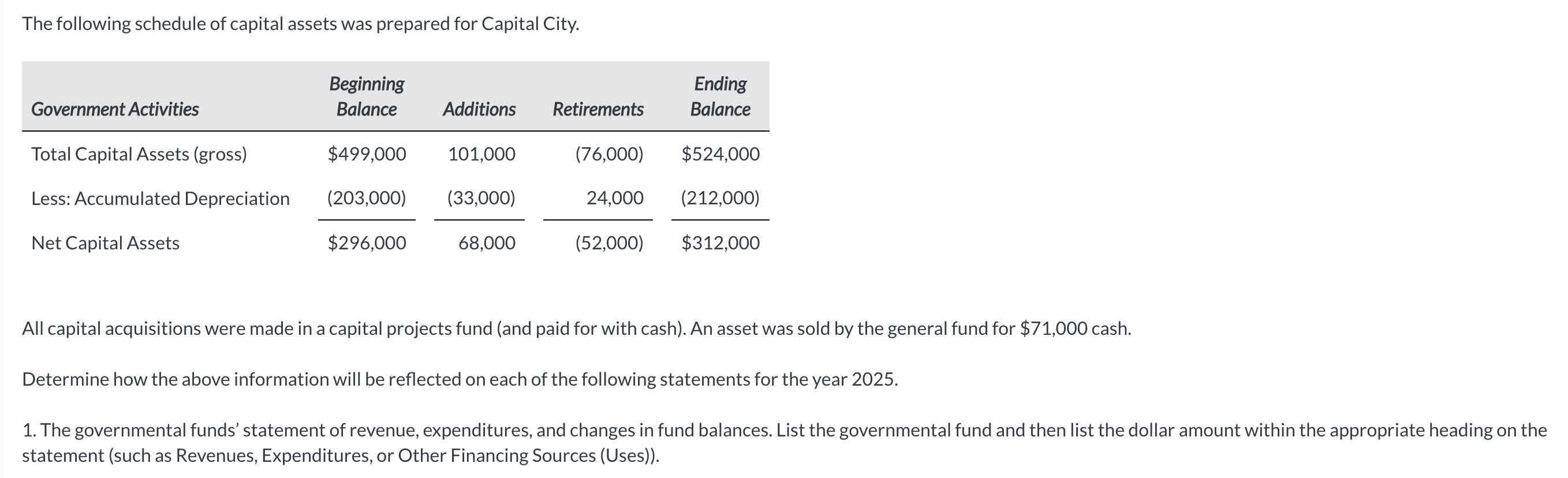

The following schedule of capital assets was prepared for Capital City. Government Activities Total Capital Assets (gross) Less: Accumulated Depreciation Net Capital Assets Beginning

The following schedule of capital assets was prepared for Capital City. Government Activities Total Capital Assets (gross) Less: Accumulated Depreciation Net Capital Assets Beginning Balance $499,000 101,000 (203,000) (33,000) $296,000 68,000 Additions Retirements Ending Balance (76,000) $524,000 24,000 (212,000) (52,000) $312,000 All capital acquisitions were made in a capital projects fund (and paid for with cash). An asset was sold by the general fund for $71,000 cash. Determine how the above information will be reflected on each of the following statements for the year 2025. 1. The governmental funds statement of revenue, expenditures, and changes in fund balances. List the governmental fund and then list the dollar amount within the appropriate heading on the statement (such as Revenues, Expenditures, or Other Financing Sources (Uses)). 2. The government-wide statement of net position. 3. The government-wide statement of activities.

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 The governmental funds statement of revenue expenditures and changes in fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started