Answered step by step

Verified Expert Solution

Question

1 Approved Answer

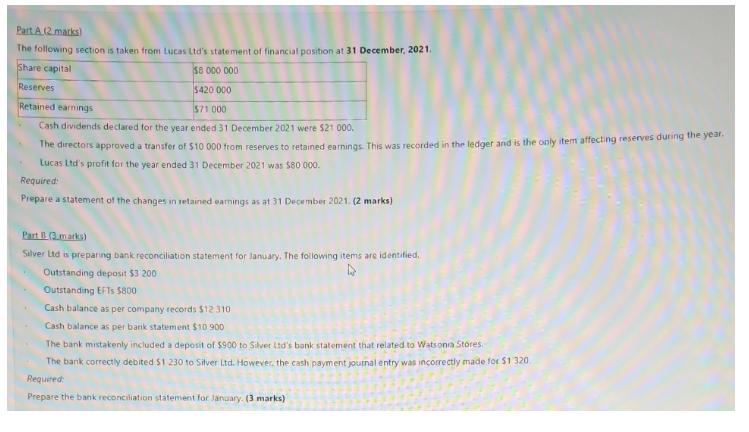

The following section is taken from Lucas Ltd's statement of financial position at 31 December, 2021. Share capital 58 000 000 Reserves $420 000

The following section is taken from Lucas Ltd's statement of financial position at 31 December, 2021. Share capital 58 000 000 Reserves $420 000 Retained earnings $71.000 Cash dividends declared for the year ended 31 December 2021 were $21 000. The directors approved a transfer of $10 000 from reserves to retained earnings. This was recorded in the ledger and is the only item affecting reserves during the year. Lucas Ltd's profit for the year ended 31 December 2021 was $80 000. Required: Prepare a statement of the changes in retained earnings as at 31 December 2021. (2 marks) Part B. (3.marks) Silver Ltd is preparing bank reconciliation statement for January. The following items are identified. D Outstanding deposit $3 200 Outstanding EFTs $800 Cash balance as per company records $12.310 Cash balance as per bank statement $10 900 The bank mistakenly included a deposit of $900 to Silver Ltd's bank statement that related to Watsonia Stores The bank correctly debited $1 230 to Silver Ltd. However, the cash payment journal entry was incorrectly made for $1 320 Required: Prepare the bank reconciliation statement for January (3 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started