Answered step by step

Verified Expert Solution

Question

1 Approved Answer

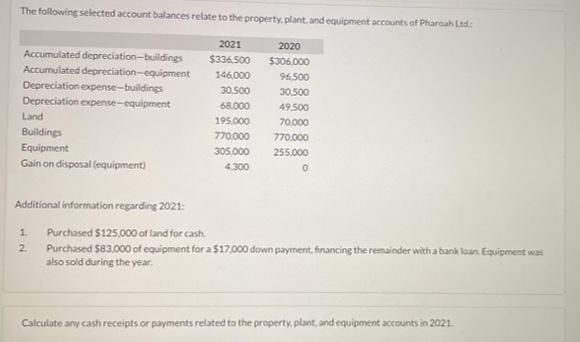

The following selected account balances relate to the property, plant, and equipment accounts of Pharoa aroah Ltd: 2020 2021 $336,500 $306,000 Accumulated depreciation-buildings Accumulated

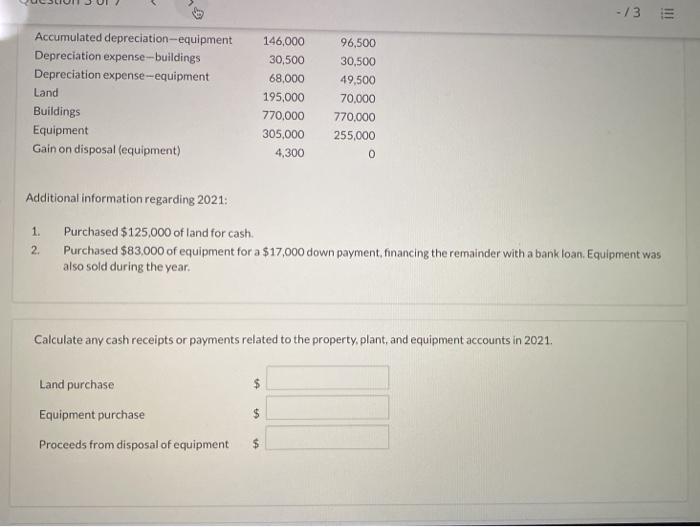

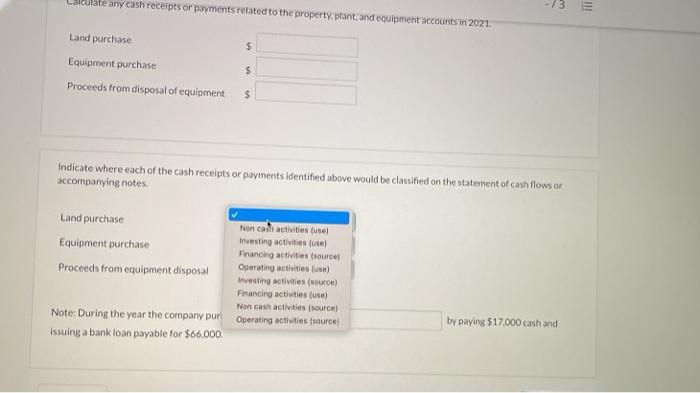

The following selected account balances relate to the property, plant, and equipment accounts of Pharoa aroah Ltd: 2020 2021 $336,500 $306,000 Accumulated depreciation-buildings Accumulated depreciation-equipment 146,000 96.500 Depreciation expense-buildings 30.500 30,500 Depreciation expense-equipment 68.000 49,500 Land 195.000 70,000 Buildings 770,000 770,000 Equipment 305,000 255.000 Gain on disposal (equipment) 4.300 0 Additional information regarding 2021: 1. Purchased $125,000 of land for cash. 2 Purchased $83,000 of equipment for a $17.000 down payment, financing the remainder with a bank loan Equipment was also sold during the year. Calculate any cash receipts or payments related to the property, plant, and equipment accounts in 2021 -/3 E Accumulated depreciation-equipment 146,000 96,500 Depreciation expense-buildings 30,500 30,500 Depreciation expense-equipment 68,000 49,500 Land 195,000 70,000 Buildings 770,000 770,000 Equipment 305,000 255,000 Gain on disposal (equipment) 4,300 0 Additional information regarding 2021: Purchased $125,000 of land for cash. 2. Purchased $83,000 of equipment for a $17,000 down payment, financing the remainder with a bank loan. Equipment was also sold during the year. Calculate any cash receipts or payments related to the property, plant, and equipment accounts in 2021. Land purchase $ Equipment purchase $ Proceeds from disposal of equipment $ SA 14 Calculate any cash receipts or payments related to the property, plant, and equipment accounts in 2021. Land purchase $ Equipment purchase $ Proceeds from disposal of equipment $ Indicate where each of the cash receipts or payments identified above would be classified on the statement of cash flows or accompanying notes. Land purchase Equipment purchase Proceeds from equipment disposal Non casts activities (use) Investing activities (use) Financing activities (source) Operating activities (use) Investing activities (source) Financing activities (use) Non cash activities (source) Operating activities (source) by paying $17,000 cash and Note: During the year the company pur issuing a bank loan payable for $66.000. >

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Cash receipts and payments Land purchase Equipment purchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started