Answered step by step

Verified Expert Solution

Question

1 Approved Answer

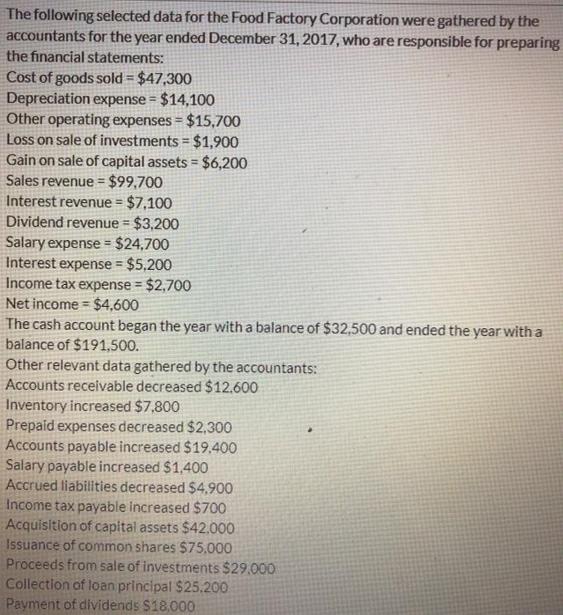

The following selected data for the Food Factory Corporation were gathered by the accountants for the year ended December 31, 2017, who are responsible

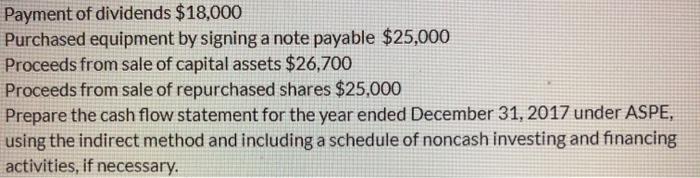

The following selected data for the Food Factory Corporation were gathered by the accountants for the year ended December 31, 2017, who are responsible for preparing the financial statements: Cost of goods sold = $47,300 Depreciation expense = $14,100 Other operating expenses = $15,700 Loss on sale of investments = $1,900 Gain on sale of capital assets = $6,200 Sales revenue = = $99,700 Interest revenue = $7,100 Dividend revenue = $3,200 Salary expense = $24,700 Interest expense = $5,200 Income tax expense = $2,700 Net income = $4,600 The cash account began the year with a balance of $32,500 and ended the year with a balance of $191,500. Other relevant data gathered by the accountants: Accounts receivable decreased $12.600 Inventory increased $7,800 Prepaid expenses decreased $2,300 Accounts payable increased $19.400 Salary payable increased $1,400 Accrued liabilities decreased $4.900 Income tax payable increased $700 Acquisition of capital assets $42.000 Issuance of common shares $75,000 Proceeds from sale of investments $29.000 Collection of loan principal $25.200 Payment of dividends $18,000 Payment of dividends $18,000 Purchased equipment by signing a note payable $25,000 Proceeds from sale of capital assets $26,700 Proceeds from sale of repurchased shares $25,000 Prepare the cash flow statement for the year ended December 31, 2017 under ASPE, using the indirect method and including a schedule of noncash investing and financing activities, if necessary.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started