Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following selected data were taken from the records of the Fisher Foil Company. The company uses a job costing system to account for

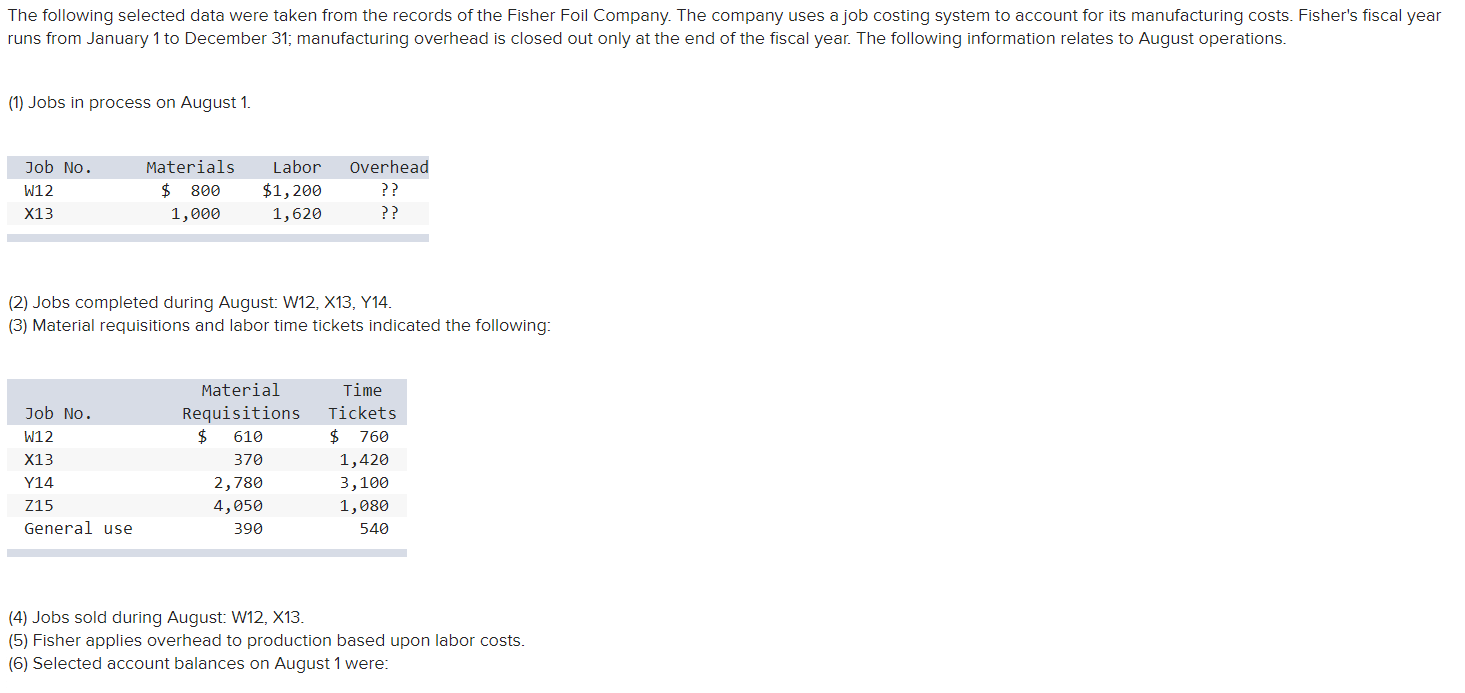

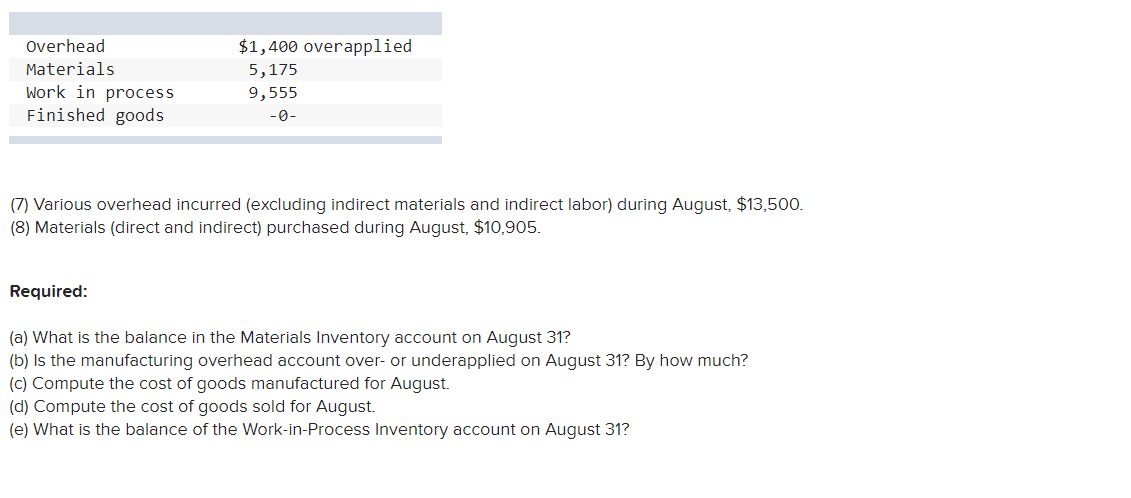

The following selected data were taken from the records of the Fisher Foil Company. The company uses a job costing system to account for its manufacturing costs. Fisher's fiscal year runs from January 1 to December 31; manufacturing overhead is closed out only at the end of the fiscal year. The following information relates to August operations. (1) Jobs in process on August 1. Job No. W12 X13 Materials $ 800 1,000 Labor Overhead $1,200 ?? 1,620 ?? (2) Jobs completed during August: W12, X13, Y14. (3) Material requisitions and labor time tickets indicated the following: Job No. Material Requisitions Time Tickets W12 $ 610 $ 760 X13 370 1,420 Y14 2,780 3,100 Z15 4,050 1,080 General use 390 540 (4) Jobs sold during August: W12, X13. (5) Fisher applies overhead to production based upon labor costs. (6) Selected account balances on August 1 were: Overhead $1,400 over applied 5,175 Materials Work in process Finished goods 9,555 -0- (7) Various overhead incurred (excluding indirect materials and indirect labor) during August, $13,500. (8) Materials (direct and indirect) purchased during August, $10,905. Required: (a) What is the balance in the Materials Inventory account on August 31? (b) Is the manufacturing overhead account over- or underapplied on August 31? By how much? (c) Compute the cost of goods manufactured for August. (d) Compute the cost of goods sold for August. (e) What is the balance of the Work-in-Process Inventory account on August 31?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Materials balance on August 31 Beginning balance August 1 5175 Plus materials purchased 10905 Less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started