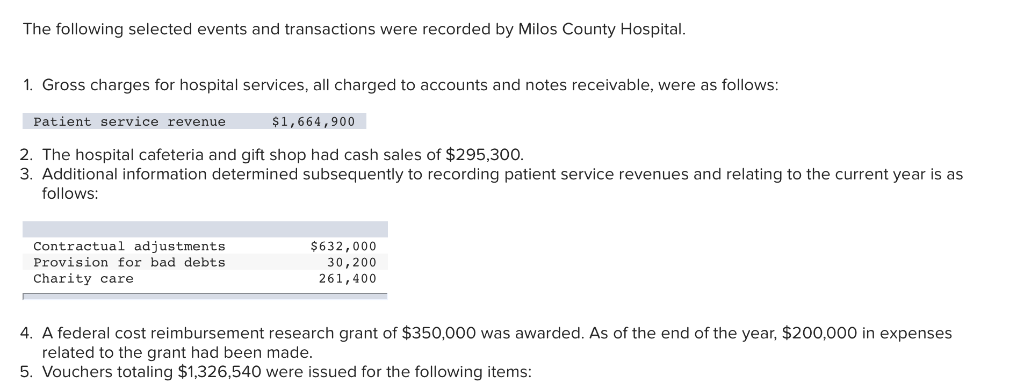

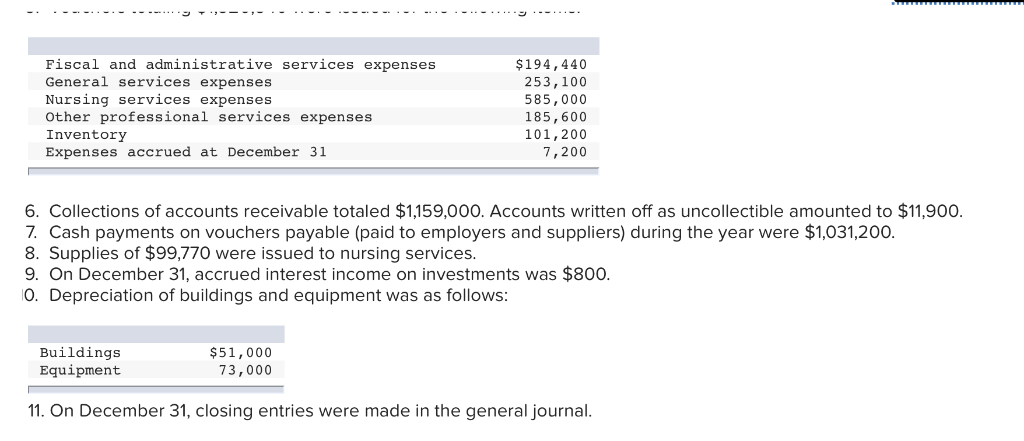

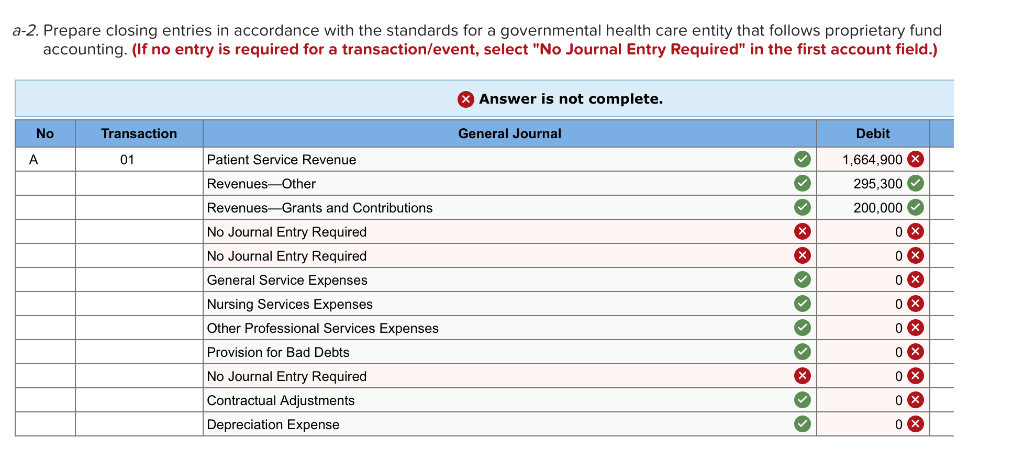

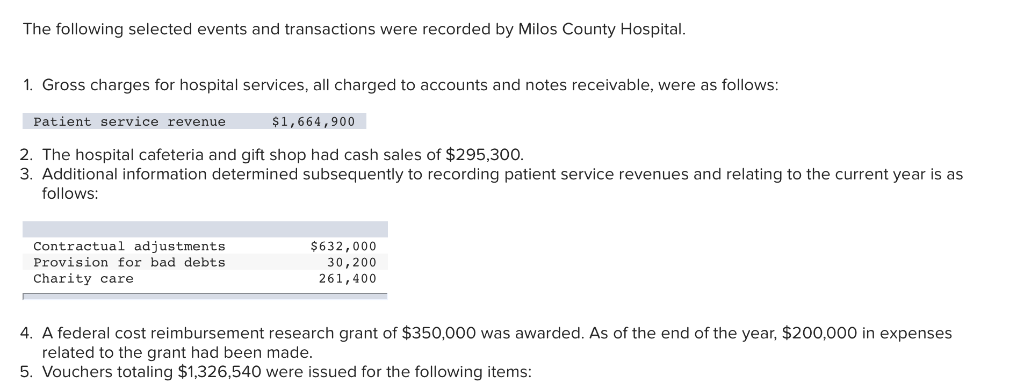

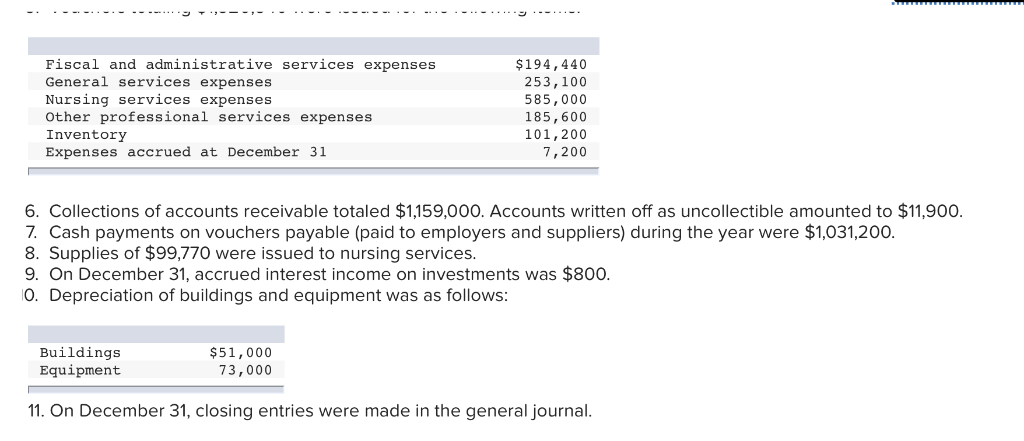

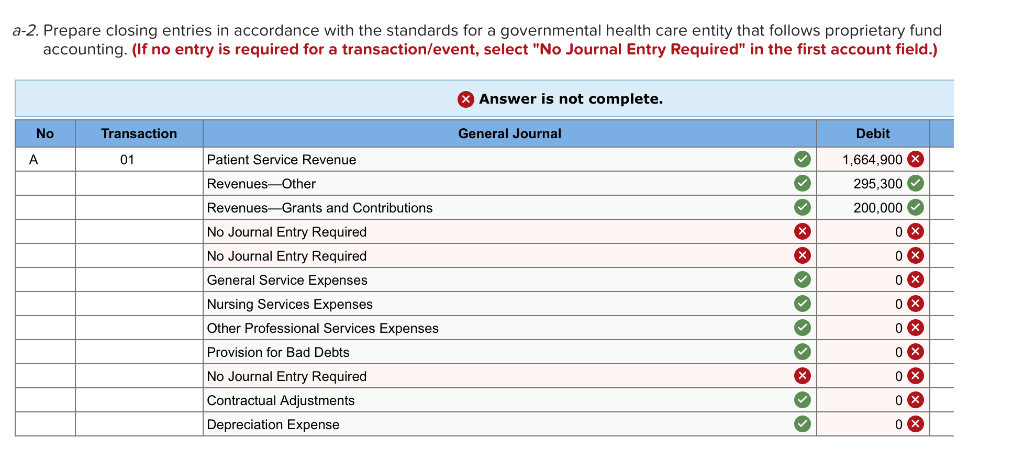

The following selected events and transactions were recorded by Milos County Hospital. 1. Gross charges for hospital services, all charged to accounts and notes receivable, were as follows Patient service revenue $1,664,900 2. The hospital cafeteria and gift shop had cash sales of $295,300. 3. Additional information determined subsequently to recording patient service revenues and relating to the current year is as follows: Contractual adjustments Provision for bad debts Charity care $632,000 30,200 261,400 4. A federal cost reimbursement research grant of $350,000 was awarded. As of the end of the year, $200,000 in expenses related to the grant had been made. 5. Vouchers totaling $1,326,540 were issued for the following items: Fiscal and administrative services expenses General services expenses Nursing services expenses Other professional services expenses Inventory Expenses accrued at December 31 $194,440 253,100 585,000 185,600 101,200 7,200 6. Collections of accounts receivable totaled $1,159,000. Accounts written off as uncollectible amounted to $11,900 7. Cash payments on vouchers payable (paid to employers and suppliers) during the year were $1,031,200. 8. Supplies of $99,770 were issued to nursing services 9. On December 31, accrued interest income on investments was $800 O. Depreciation of buildings and equipment was as follows: Buildings Equipment $51,000 73,000 11. On December 31, closing entries were made in the general journal a-2. Prepare closing entries in accordance with the standards for a governmental health care entity that follows proprietary fund accounting. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete Transaction General Journal Debit 01 1,664,900 Patient Service Revenue Revenues-Other Revenues-Grants and Contributions No Journal Entry Required No Journal Entry Required General Service Expenses Nursing Services Expenses Other Professional Services Expenses Provision for Bad Debts No Journal Entry Required Contractual Adjustments Depreciation Expense 295, 3000 200,000