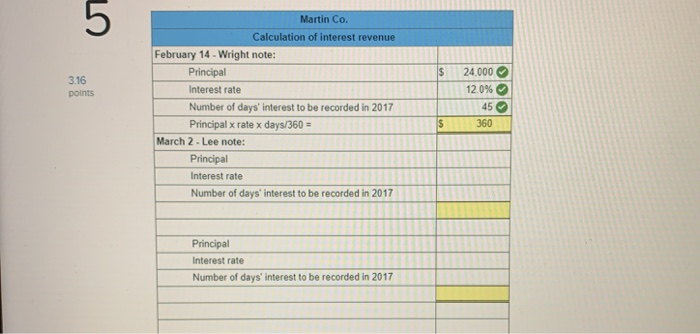

The following selected transactions are from Martin Company 2016 Dec. 16 Accepted a $24,000 60-day 12% note dated this day in granting Kay wright a time extension on his past-due account

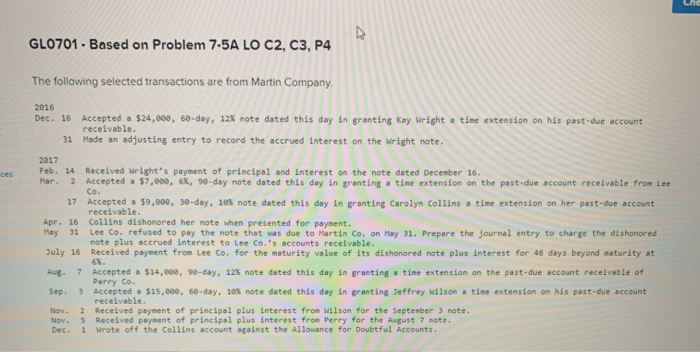

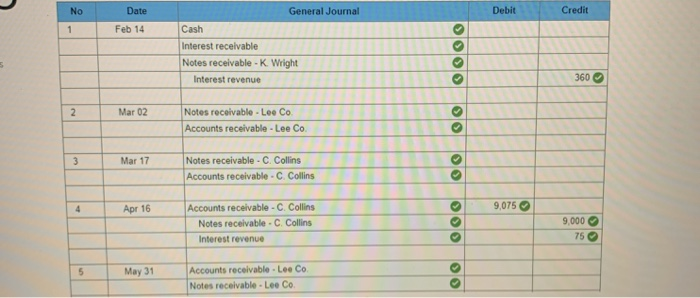

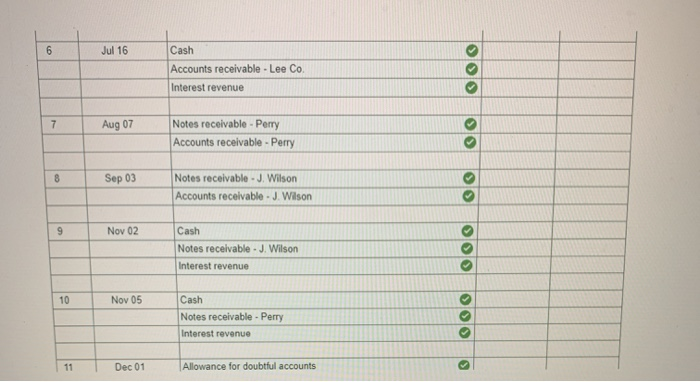

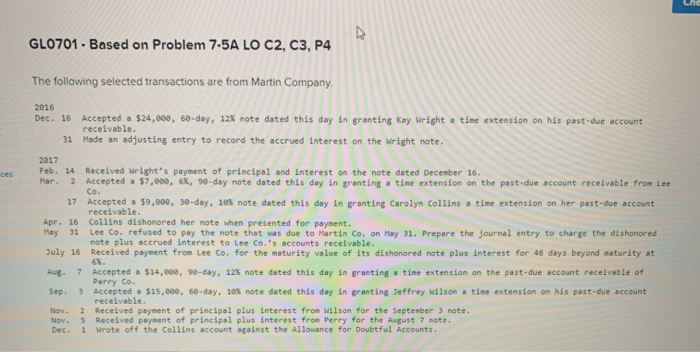

LIE A GL0701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Martin Company. ces Co. 2016 Dec. 16 Accepted $24,000, 60-day, 12% note dated this day in granting Kay Wright a time extension on his past due account receivable. 31 Made an adjusting entry to record the accrued interest on the Wright note. 2017 Feb. 14 Received Wright's payment of principal and interest on the note dated December 16. Mar. 2 Accepted = $7,000, 6%, 90-day note dated this day in granting a time extension on the post-due account receivable from Lee 17 Accepted a $9,000, 30-day, 10% note dated this day in granting Carolyn Collins a time extension on her past-due account receivable. Apr. 16 Collins dishonored her note when presented for payment. May 31 Lee Co. refused to pay the note that was due to Martin Co. on May 31. Prepare the journal entry to charge the dishonored note plus accrued interest to Lee Co.'s accounts receivable. July 16 Received payment from Lee Co. for the maturity value of its dishonored note plus interest for 46 days beyond maturity at 6%. Aug. 7 Accepted a $14,000, 90-day, 12% note dated this day in granting a time extension on the past-due account receivable of Perry Co. Sep. Accepted a $15,000, 60-day, 10% note dated this day in granting Jeffrey Wilson a time extension on his past due account receivable Received payment of principal plus interest from Wilson for the September 3 note. 5 Received payment of principal plus interest from Perry for the August 7 note. Dec Wrote off the Collins account against the Allowance for Doubtful Accounts. Nov. Nov. 1 No General Journal Debit Credit Date Feb 14 1 Cash Interest receivable Notes receivable - K. Wright Interest revenue OOOO > 360 2 Mar 02 Notes receivable - Lee Co Accounts receivable - Lee Co. slo 3 Mar 17 Notes receivable - C. Collins Accounts receivable - C. Collins 4 Apr 16 9.075 Accounts receivable - C. Collins Notes receivable. C. Collins Interest revenue OOO 9,000 75 5 May 31 Accounts receivable. Lee Co. Notes receivable - Lee Co. 6 Jul 16 Cash Accounts receivable - Lee Co. Interest revenue OOO 7 Aug 07 Notes receivable - Perry Accounts receivable - Perry 8 Sep 03 Notes receivable - J. Wilson Accounts receivable - J. Wilson slo 9 Nov 02 Cash Notes receivable - J. Wilson Interest revenue OOO 10 Nov 05 Cash Notes receivable - Perry Interest revenue OO 11 11 Dec 01 Allowance for doubtful accounts