Question

The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2018. The company buys equity securities as investments. None of Ornamentals investments

The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2018. The company buys equity securities as investments. None of Ornamentals investments are large enough to exert significant influence on the investee. Ornamentals fiscal year ends on December 31. No investments were held by Ornamental on December 31, 2017.

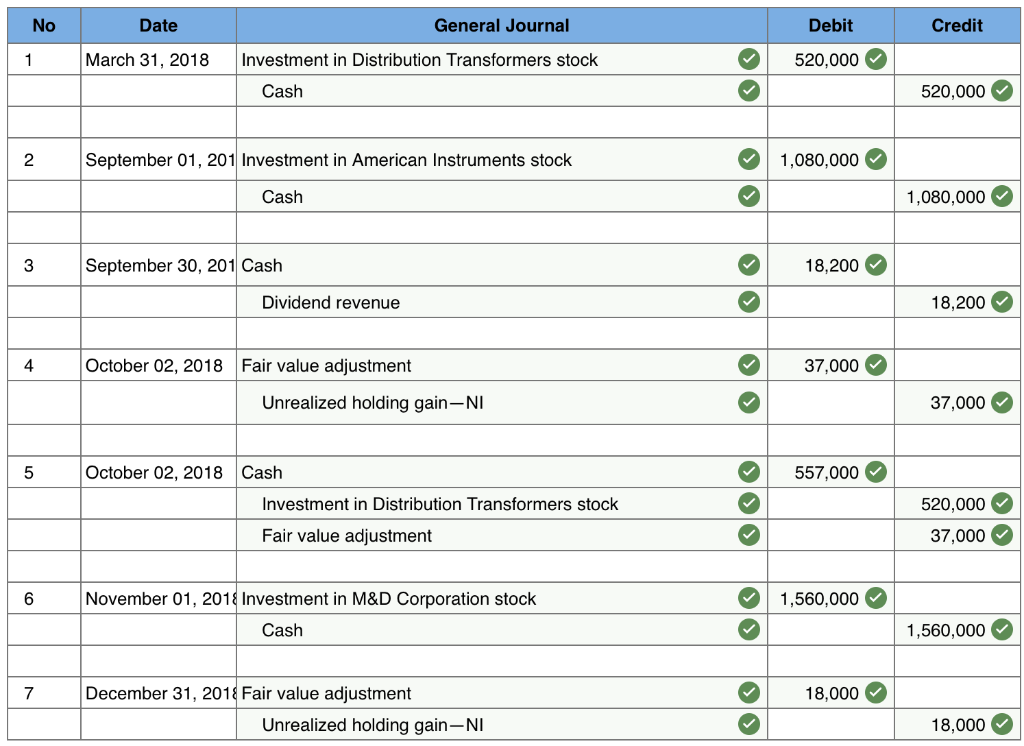

| Mar. | 31 | Acquired Distribution Transformers Corporation common stock for $520,000. | ||

| Sep. | 1 | Acquired $1,080,000 of American Instruments' common stock. | ||

| Sep. | 30 | Received a $18,200 dividend on the Distribution Transformers common stock. | ||

| Oct. | 2 | Sold the Distribution Transformers common stock for $557,000. | ||

| Nov. | 1 | Purchased $1,560,000 of M&D Corporation common stock. | ||

| Dec. | 31 | Recorded any necessary adjusting entry(s) relating to the investments. The market prices of the investments are: |

| American Instruments common stock | $ | 1,018,000 | |

| M&D Corporation common stock | $ | 1,640,000 | |

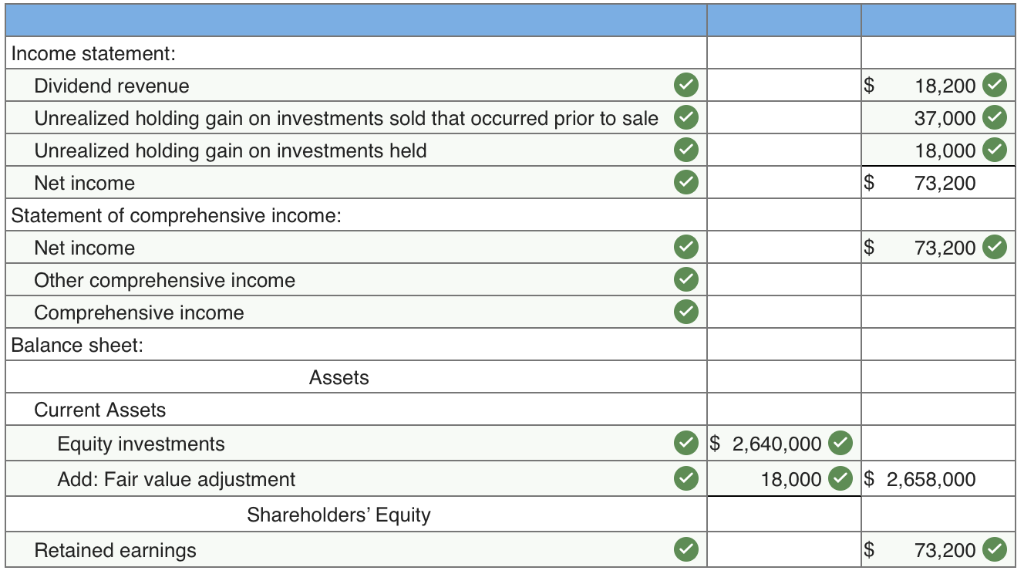

Required: 1. Prepare the appropriate journal entry for each transaction or event during 2018, as well as any adjusting entries necessary at year end. 2. Indicate any amounts that Ornamental Insulation would report in its 2018 income statement, 2018 statement of comprehensive income, and 12/31/2018 balance sheet as a result of these investments.

I'm trying to find the amounts for other comprehensive income and comprehensive income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started