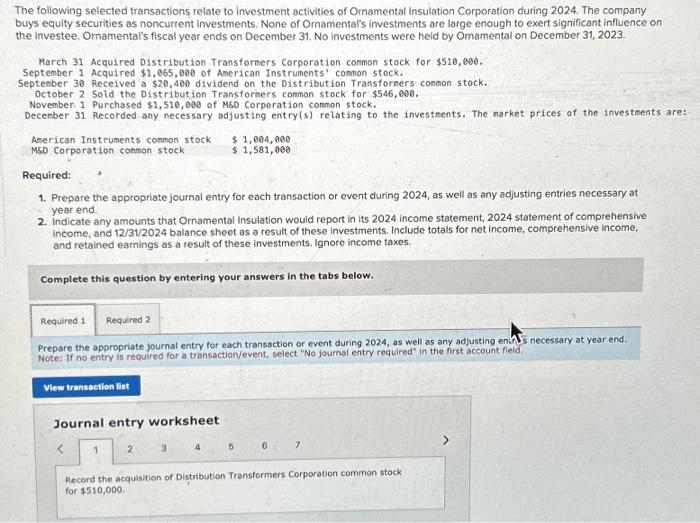

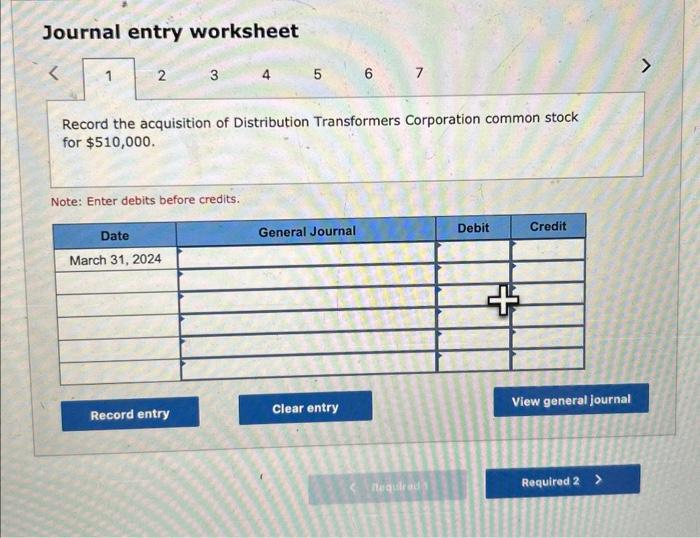

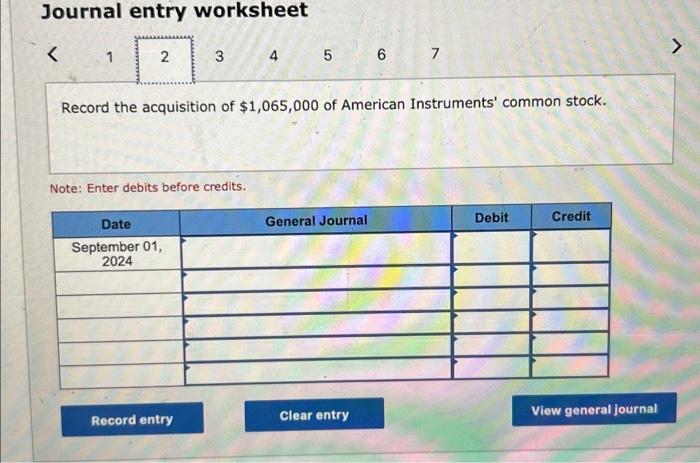

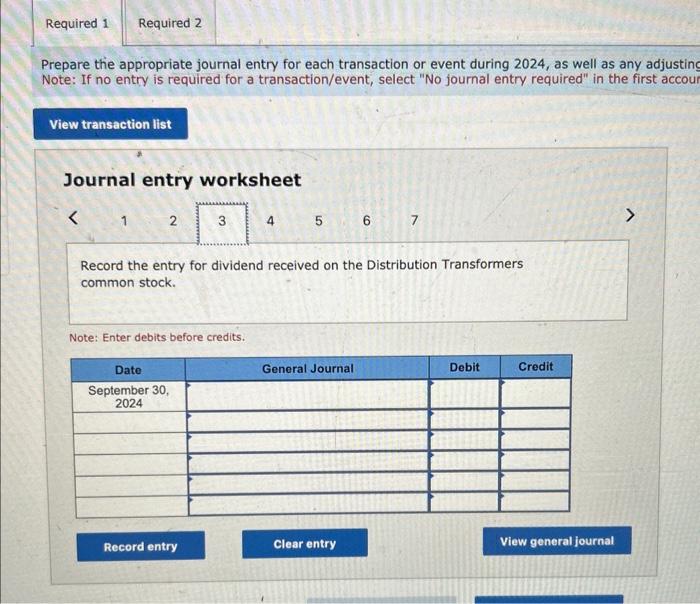

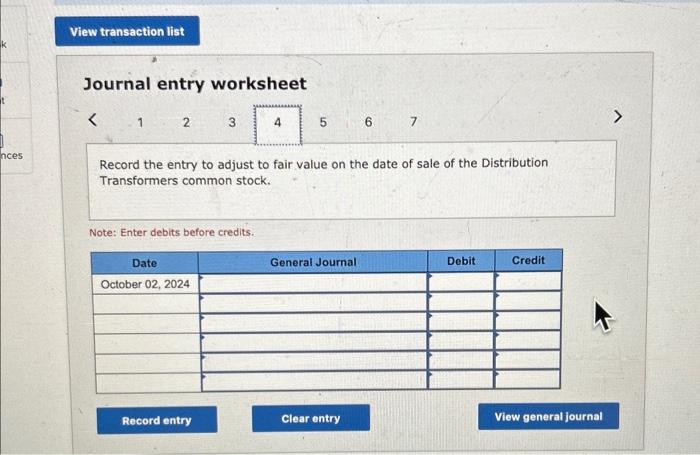

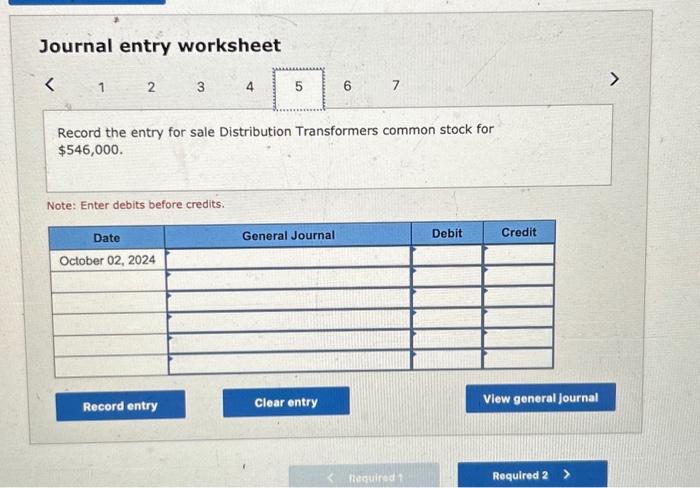

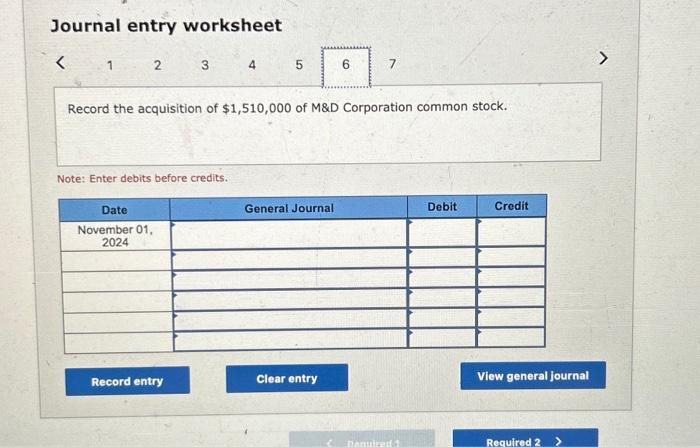

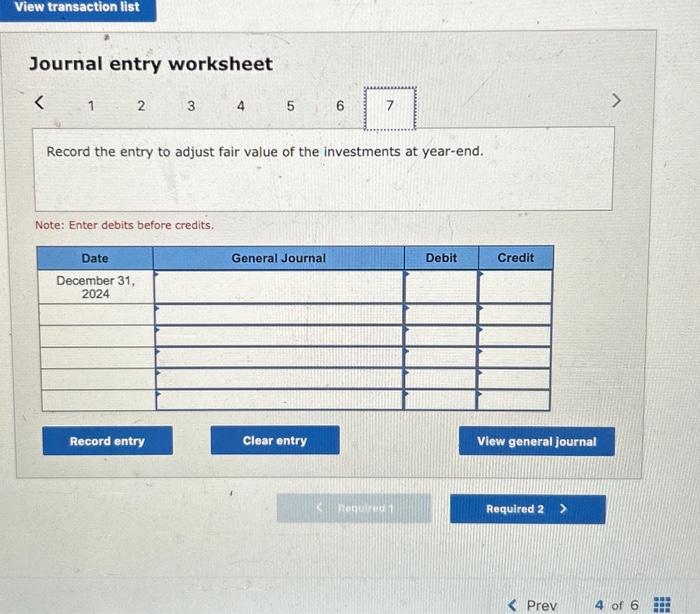

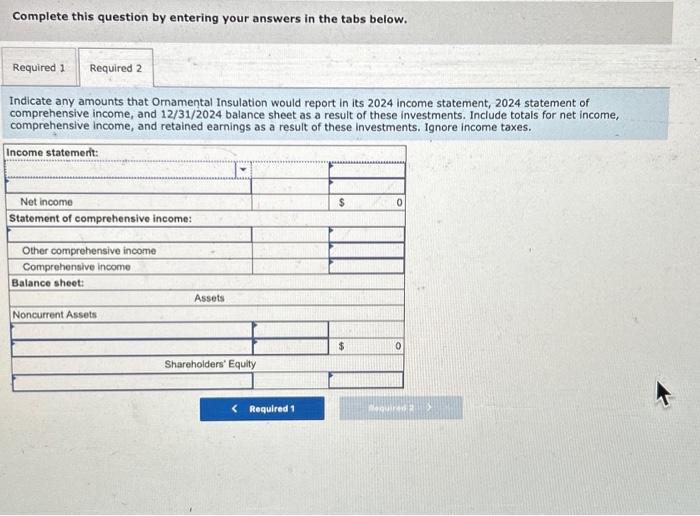

The following selected transactions relate to investment activities of Ornamental insulation Corporation during 2024. The company buys equity securities as noncurrent investments. None of Ornamental's investments are large enough to exert significant influence on the investee. Omamental's fiscal year ends on December 31. No investments were heid by Omamental on December 31, 2023. March 31 Acquired Distribution Transformers Corporation conmon stock for $510,000. September 1 Acquired $1,065,000 of American Instruments' common stock. Septenber 30 Received a $20,400 dividend on the Distribution Transforners comon stock. October 2 Sold the Distribution Transformers conmon stock for $546,000. November. 1 Purchased $1,510,009 of MSD Corporation common stock. Decenber 31 Recorded any necessary adjusting entry(s) relating to the investments. The narket prices of the investments are: AmericanInstrumentscommonstockMsoCorporationconmonstock$1,004,000$1,581,000 MSO Corporation conmon stock $1,581,000 Required: 1. Prepare the appropriate journal entry for each transaction or event during 2024, as well as any adjusting entries necessary at year end. 2. Indicate any amounts that Ornamental Insulation would report in its 2024 income statement, 2024 statement of comprehensive income, and 12/31/2024 balance sheot as a result of these investments. Include totals for net income, comprehensive income, and retained earnings as a result of these investments. Ignore income taxes. Complete this question by entering your answers in the tabs below. Prepare the appropriate journal entry for each transaction or event during 2024, as well as any adjusting enhis secessary at year end. Note: If no entry is required for a transactionvevent, select "No journal entry required" in the first account field: Journal entry worksheet 234567 Record the acquistion of Distribution Transformers Corporation common stock for $510,000. Journal entry worksheet Record the acquisition of $1,065,000 of American Instruments' common stock. Note: Enter debits before credits. Prepare the appropriate journal entry for each transaction or event during 2024, as well as any adjustin Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accou Journal entry worksheet 1 6 7 Record the entry for dividend received on the Distribution Transformers common stock. Note: Enter debits before credits. Journal entry worksheet 1 7 Record the entry to adjust to fair value on the date of sale of the Distribution Transformers common stock. Note: Enter debits before credits. Journal entry worksheet Record the entry for sale Distribution Transformers common stock for $546,000. Note: Enter debits before credits. Journal entry worksheet Record the acquisition of $1,510,000 of M\&D Corporation common stock. Note: Enter debits before credits. Journal entry worksheet Record the entry to adjust fair value of the investments at year-end. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Indicate any amounts that Ornamental Insulation would report in its 2024 income statement, 2024 statement of comprehensive income, and 12/31/2024 balance sheet as a result of these investments. Include totais for net income, comprehensive income, and retained earnings as a result of these investments. Ignore income taxes