Answered step by step

Verified Expert Solution

Question

1 Approved Answer

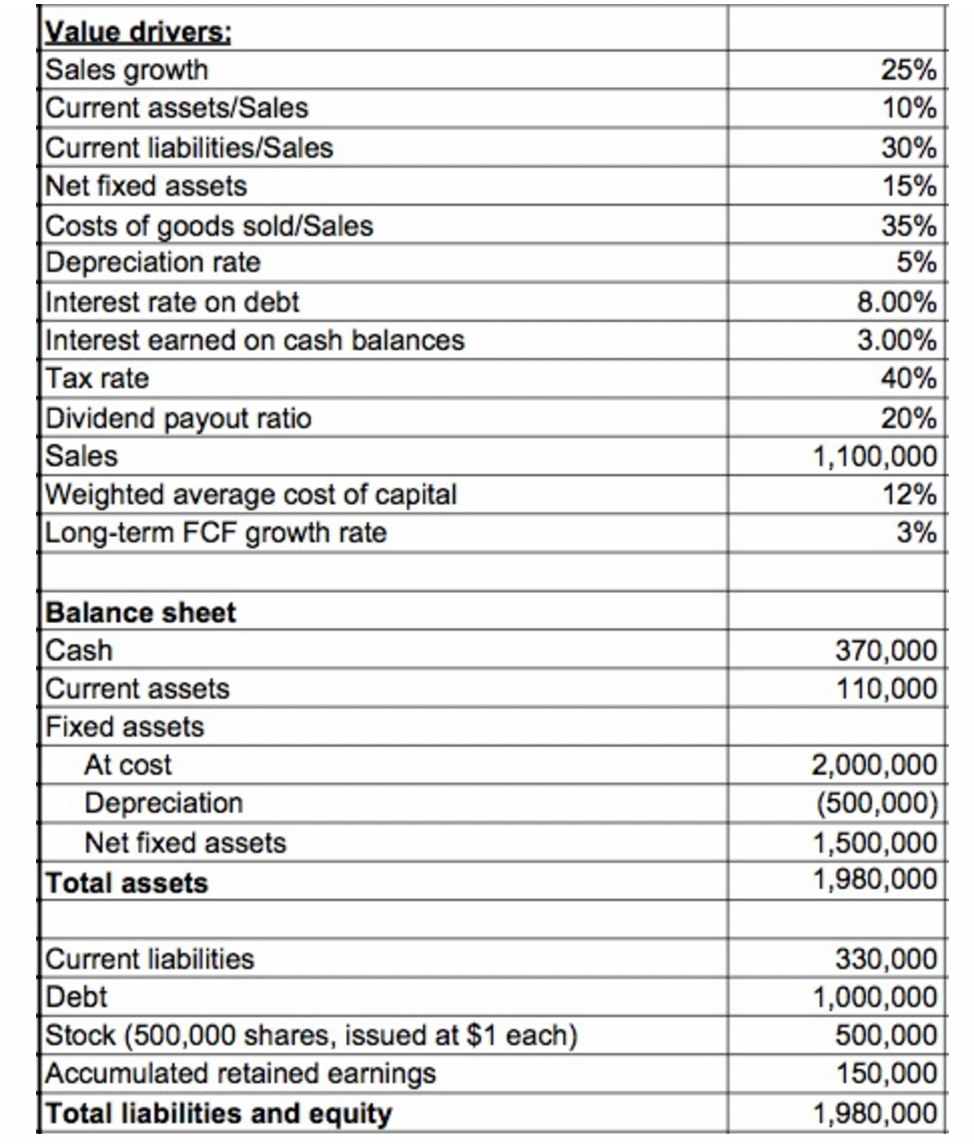

The following sheet presents the balance sheet and value drivers of Little India, a company that operates Indian food restaurant Additional model assumptions are as

The following sheet presents the balance sheet and value drivers of Little India, a company that operates Indian food restaurant

Additional model assumptions are as follows:

- The FCF evaluation is for a 5-year period. In addition, a terminal value should be determined

- using the long-term FCF growth rate.

- The debt principal repayments are $200,000 each year.

- Cash is a plug in the model.

- The depreciation rate is 5% of the average fixed assets at cost.

- The net fixed assets have a 15% growth rate.

- Interest payed on debt and interest earned on cash are based on the average balances.

Make a pro forma model including a DCF valuation to determine the company value and its estimated share value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started