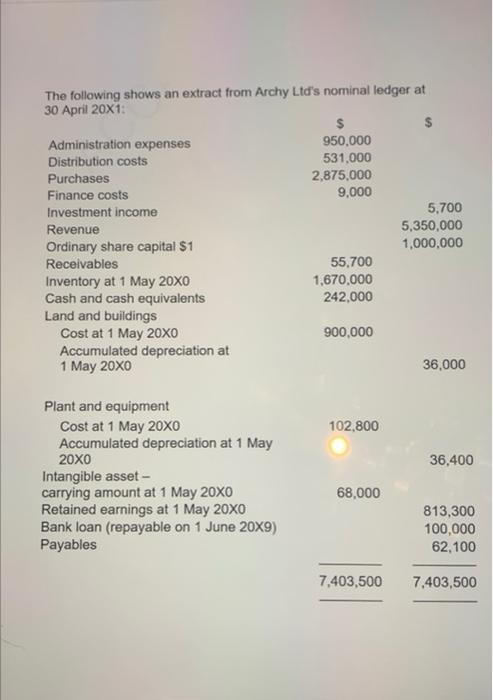

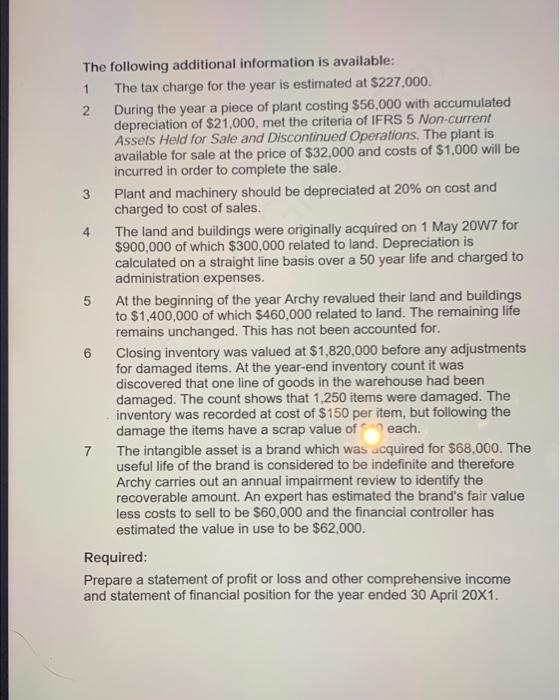

The following shows an extract from Archy Ltd's nominal ledger at 30 April 201: The following additional information is available: 1 The tax charge for the year is estimated at $227,000. 2 During the year a piece of plant costing $56,000 with accumulated depreciation of $21,000, met the criteria of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. The plant is available for sale at the price of $32,000 and costs of $1,000 will be incurred in order to complete the sale. 3 Plant and machinery should be depreciated at 20% on cost and charged to cost of sales. 4 The land and buildings were originally acquired on 1 May 20W7 for $900,000 of which $300,000 related to land. Depreciation is calculated on a straight line basis over a 50 year life and charged to administration expenses. 5 At the beginning of the year Archy revalued their land and buildings to $1,400,000 of which $460,000 related to land. The remaining life remains unchanged. This has not been accounted for. 6 Closing inventory was valued at $1,820,000 before any adjustments for damaged items. At the year-end inventory count it was discovered that one line of goods in the warehouse had been damaged. The count shows that 1,250 items were damaged. The inventory was recorded at cost of $150 per item, but following the damage the items have a scrap value of "? each. 7 The intangible asset is a brand which was acquired for $68,000. The useful life of the brand is considered to be indefinite and therefore Archy carries out an annual impairment review to identify the recoverable amount. An expert has estimated the brand's fair value less costs to sell to be $60,000 and the financial controller has estimated the value in use to be $62,000. Required: Prepare a statement of profit or loss and other comprehensive income and statement of financial position for the year ended 30 April 201. The following shows an extract from Archy Ltd's nominal ledger at 30 April 201: The following additional information is available: 1 The tax charge for the year is estimated at $227,000. 2 During the year a piece of plant costing $56,000 with accumulated depreciation of $21,000, met the criteria of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. The plant is available for sale at the price of $32,000 and costs of $1,000 will be incurred in order to complete the sale. 3 Plant and machinery should be depreciated at 20% on cost and charged to cost of sales. 4 The land and buildings were originally acquired on 1 May 20W7 for $900,000 of which $300,000 related to land. Depreciation is calculated on a straight line basis over a 50 year life and charged to administration expenses. 5 At the beginning of the year Archy revalued their land and buildings to $1,400,000 of which $460,000 related to land. The remaining life remains unchanged. This has not been accounted for. 6 Closing inventory was valued at $1,820,000 before any adjustments for damaged items. At the year-end inventory count it was discovered that one line of goods in the warehouse had been damaged. The count shows that 1,250 items were damaged. The inventory was recorded at cost of $150 per item, but following the damage the items have a scrap value of "? each. 7 The intangible asset is a brand which was acquired for $68,000. The useful life of the brand is considered to be indefinite and therefore Archy carries out an annual impairment review to identify the recoverable amount. An expert has estimated the brand's fair value less costs to sell to be $60,000 and the financial controller has estimated the value in use to be $62,000. Required: Prepare a statement of profit or loss and other comprehensive income and statement of financial position for the year ended 30 April 201