Question

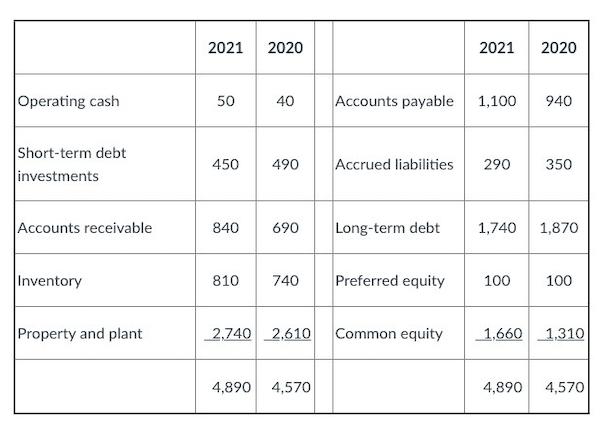

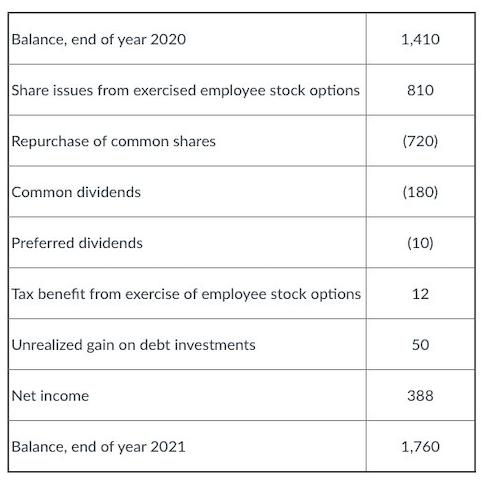

The following shows EFG Corporation's balance sheet for 2021 and 2021 (in millions of dollars): The following is EFG Corporation's 2021 shareholder's equity statement (in

The following shows EFG Corporation's balance sheet for 2021 and 2021 (in millions of dollars):

The following is EFG Corporation's 2021 shareholder's equity statement (in millions of dollars):

The company's marginal tax rate is 30%. For the year 2021, the company recorded $10 million in interest income and $90 million in interest expense.

1(a) Prepare a reformulated balance sheet for 2020 and 2021.

1(b) Prepare a reformulated statement of common shareholder's equity for 2021.

1(c) Estimate the firm's free cash flow for 2021.

Operating cash Short-term debt investments Accounts receivable Inventory Property and plant 2021 2020 50 40 450 490 840 690 810 740 2,740 2,610 4,890 4,570 Accounts payable Accrued liabilities Long-term debt Preferred equity Common equity 2021 2020 1,100 290 940 100 350 1,740 1,870 100 1,660 1,310 4,890 4,570

Step by Step Solution

3.26 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

A Sure here is a reformulated balance sheet for 2020 and 2021 Item 2020 in millions 2021 in millions Assets Current Assets Current Assets Cash and cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started