Answered step by step

Verified Expert Solution

Question

1 Approved Answer

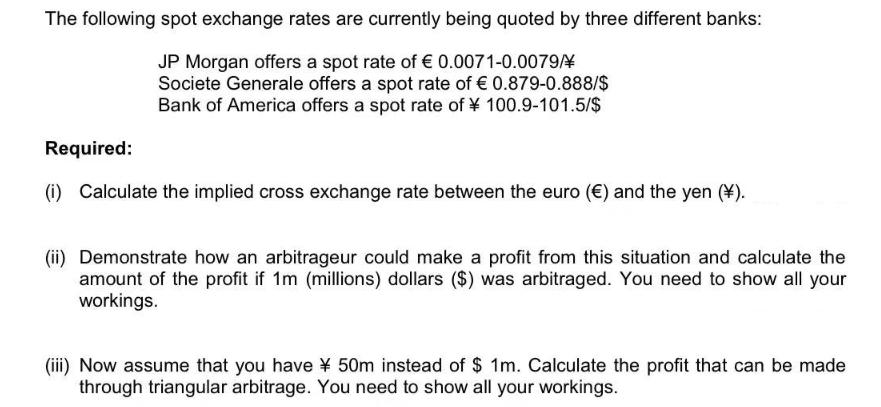

The following spot exchange rates are currently being quoted by three different banks: JP Morgan offers a spot rate of 0.0071-0.0079/ Societe Generale offers

The following spot exchange rates are currently being quoted by three different banks: JP Morgan offers a spot rate of 0.0071-0.0079/ Societe Generale offers a spot rate of 0.879-0.888/$ Bank of America offers a spot rate of 100.9-101.5/$ Required: (i) Calculate the implied cross exchange rate between the euro () and the yen (). (ii) Demonstrate how an arbitrageur could make a profit from this situation and calculate the amount of the profit if 1m (millions) dollars ($) was arbitraged. You need to show all your workings. (iii) Now assume that you have 50m instead of $ 1m. Calculate the profit that can be made through triangular arbitrage. You need to show all your workings.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the implied cross exchange rate between the euro and the yen we can use the bid and ask rates provided by the banks The cross rate can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started