Question

The following standard costs were developed for one of the products of LT Inc. Materials: 2 lbs. x P8 per lb. P16 Direct labor: 1.5

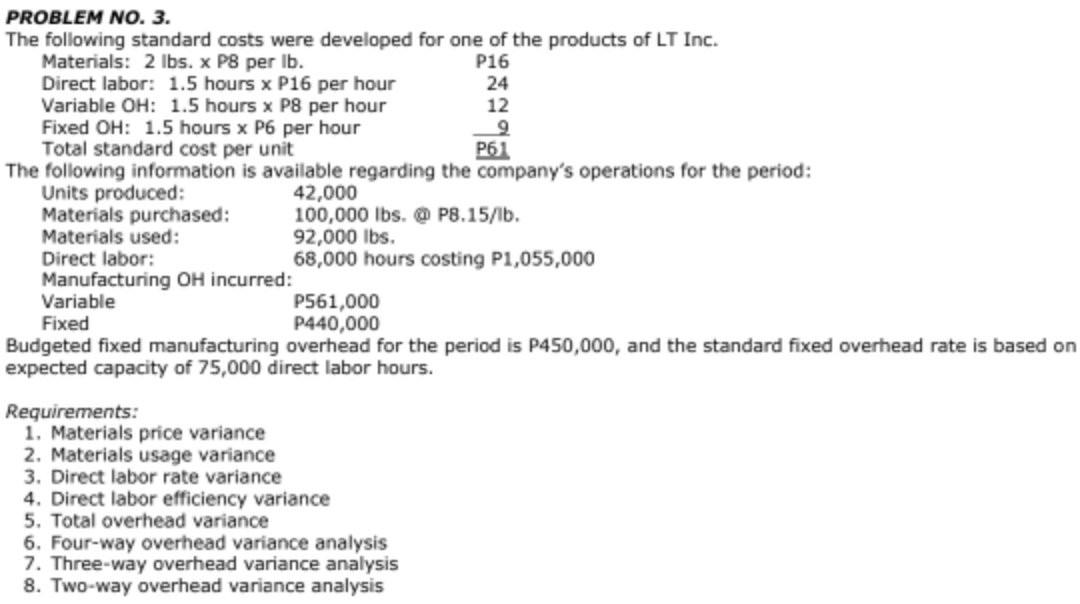

The following standard costs were developed for one of the products of LT Inc. Materials: 2 lbs. x P8 per lb. P16 Direct labor: 1.5 hours x P16 per hour 24 Variable OH: 1.5 hours x P8 per hour 12 Fixed OH: 1.5 hours x P6 per hour 9 Total standard cost per unit P61 The following information is available regarding the companys operations for the period: Units produced: 42,000 Materials purchased: 100,000 lbs. @ P8.15/lb. Materials used: 92,000 lbs. Direct labor: 68,000 hours costing P1,055,000 Manufacturing OH incurred: Variable P561,000 Fixed P440,000 Budgeted fixed manufacturing overhead for the period is P450,000, and the standard fixed overhead rate is based on expected capacity of 75,000 direct labor hours.

Requirements: 5. Total overhead variance 6. Four-way overhead variance analysis 7. Three-way overhead variance analysis 8.Two-way overhead variance analysis

PROBLEM NO. 3. The following standard costs were developed for one of the products of LT Inc. Materials: 2 lbs. x P8 per lb. P16 Direct labor: 1.5 hours x P16 per hour 24 Variable OH: 1.5 hours x P8 per hour 12 Fixed OH: 1.5 hours x P6 per hour 9 Total standard cost per unit P61 The following information is available regarding the company's operations for the period: Units produced: 42,000 Materials purchased: 100,000 lbs. @ P8.15/1b. Materials used: 92,000 lbs. Direct labor: 68,000 hours costing P1,055,000 Manufacturing OH incurred: Variable P561,000 Fixed P440,000 Budgeted fixed manufacturing overhead for the period is P450,000, and the standard fixed overhead rate is based on expected capacity of 75,000 direct labor hours. Requirements: 1. Materials price variance 2. Materials usage variance 3. Direct labor rate variance 4. Direct labor efficiency variance 5. Total overhead variance 6. Four-way overhead variance analysis 7. Three-way overhead variance analysis 8. Two-way overhead variance analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started