Answered step by step

Verified Expert Solution

Question

1 Approved Answer

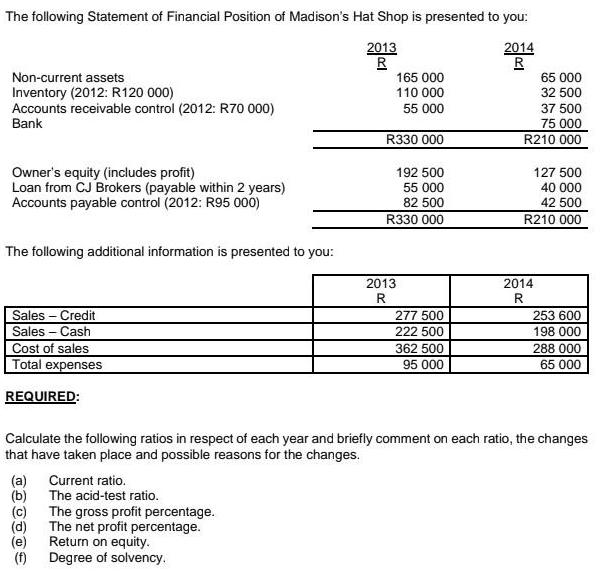

The following Statement of Financial Position of Madison's Hat Shop is presented to you: 2013 2014 R R Non-current assets Inventory (2012: R120 000)

The following Statement of Financial Position of Madison's Hat Shop is presented to you: 2013 2014 R R Non-current assets Inventory (2012: R120 000) Accounts receivable control (2012: R70 000) Bank Owner's equity (includes profit) Loan from CJ Brokers (payable within 2 years) Accounts payable control (2012: R95 000) The following additional information is presented to you: Sales - Credit Sales-Cash Cost of sales Total expenses REQUIRED: (a) Current ratio. (b) (c) (d) (e) (f) The acid-test ratio. The gross profit percentage. The net profit percentage. 165 000 110 000 55 000 R330 000 Return on equity. Degree of solvency. 192 500 55 000 82 500 R330 000 2013 R 277 500 222 500 362 500 95 000 65 000 32 500 37 500 75 000 R210.000 Calculate the following ratios in respect of each year and briefly comment on each ratio, the changes that have taken place and possible reasons for the changes. 127 500 40 000 42 500 R210 000 2014 R 253 600 198 000 288 000 65 000

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate and analyze the ratios for Madisons Hat Shop for the years 2013 and 2014 using the provided financial information a Current Ratio Curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started