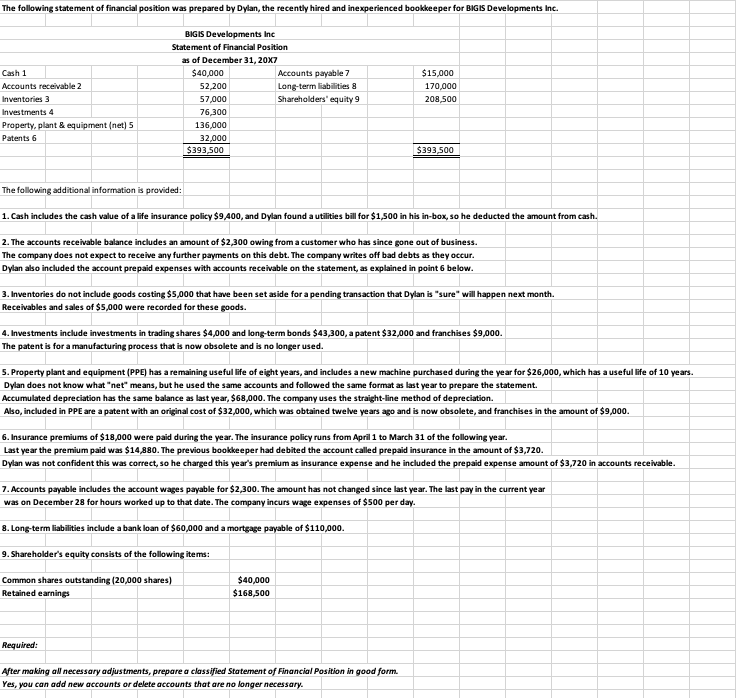

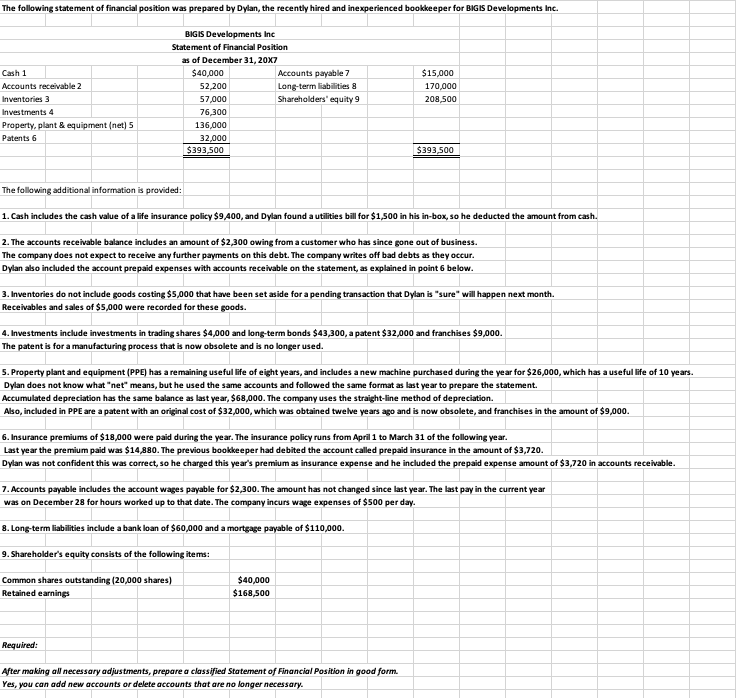

The following statement of financial position was prepared by Dylan, the recently hired and inexperienced bookkeeper for BIGIS Developments Inc. The following additional information is provided: 1. Cash includes the cash value of a life insurance policy $9,400, and Dylan found a utilities bill for $1,500 in his in-box, so he deducted the amount from cash. 2. The accounts receivable balance includes an amount of $2,300 owing from a customer who has since gone out of business. The company does not expect to receive any further payments on this debt. The company writes off bad debts as they occur. Dylan also included the account prepaid expenses with accounts receivable on the statement, as explained in point 6 below. 3. Inventories do not include goods costing $5,000 that have been set aside for a pending transaction that Dylan is "sure 7 will happen next month. Receivables and sales of $5,000 were recorded for these goods. 4. Investments include investments in trading shares $4,000 and long-term bonds $43,300, a patent $32,000 and franchises $9,000. The patent is for a manufacturing process that is now obsolete and is no longer used. Dylan does not know what "net" means, but he used the same accounts and followed the same format as last year to prepare the statement. Accumulated depreciation has the same balance as last year, $68,000. The company uses the straight-line method of depreciation. Also, included in PPE are a patent with an original cost of $32,000, which was obtained twelve years ago and is now obsolete, and franchises in the amount of $9,000. 6. Insurance premiums of $18,000 were paid during the year. The insurance policy runs from April 1 to March 31 of the following year. Last year the premium paid was $14,880. The previous bookkeeper had debited the account called prepaid insurance in the amount of $3,720. 7. Accounts payable includes the account wages payable for $2,300. The amount has not changed since last year. The last pary in the current year was on December 28 for hours worked up to that date. The company incurs wage expenses of $500 per dary. 8. Long-term liabilities include a bank loan of $60,000 and a mortgage payable of $110,000. Required: After making all necessary adjustments, prepare a classified Statement of Financial Position in good form. Yes, you can add new accounts or delete accounts that are no longer necessary. The following statement of financial position was prepared by Dylan, the recently hired and inexperienced bookkeeper for BIGIS Developments Inc. The following additional information is provided: 1. Cash includes the cash value of a life insurance policy $9,400, and Dylan found a utilities bill for $1,500 in his in-box, so he deducted the amount from cash. 2. The accounts receivable balance includes an amount of $2,300 owing from a customer who has since gone out of business. The company does not expect to receive any further payments on this debt. The company writes off bad debts as they occur. Dylan also included the account prepaid expenses with accounts receivable on the statement, as explained in point 6 below. 3. Inventories do not include goods costing $5,000 that have been set aside for a pending transaction that Dylan is "sure 7 will happen next month. Receivables and sales of $5,000 were recorded for these goods. 4. Investments include investments in trading shares $4,000 and long-term bonds $43,300, a patent $32,000 and franchises $9,000. The patent is for a manufacturing process that is now obsolete and is no longer used. Dylan does not know what "net" means, but he used the same accounts and followed the same format as last year to prepare the statement. Accumulated depreciation has the same balance as last year, $68,000. The company uses the straight-line method of depreciation. Also, included in PPE are a patent with an original cost of $32,000, which was obtained twelve years ago and is now obsolete, and franchises in the amount of $9,000. 6. Insurance premiums of $18,000 were paid during the year. The insurance policy runs from April 1 to March 31 of the following year. Last year the premium paid was $14,880. The previous bookkeeper had debited the account called prepaid insurance in the amount of $3,720. 7. Accounts payable includes the account wages payable for $2,300. The amount has not changed since last year. The last pary in the current year was on December 28 for hours worked up to that date. The company incurs wage expenses of $500 per dary. 8. Long-term liabilities include a bank loan of $60,000 and a mortgage payable of $110,000. Required: After making all necessary adjustments, prepare a classified Statement of Financial Position in good form. Yes, you can add new accounts or delete accounts that are no longer necessary