Answered step by step

Verified Expert Solution

Question

1 Approved Answer

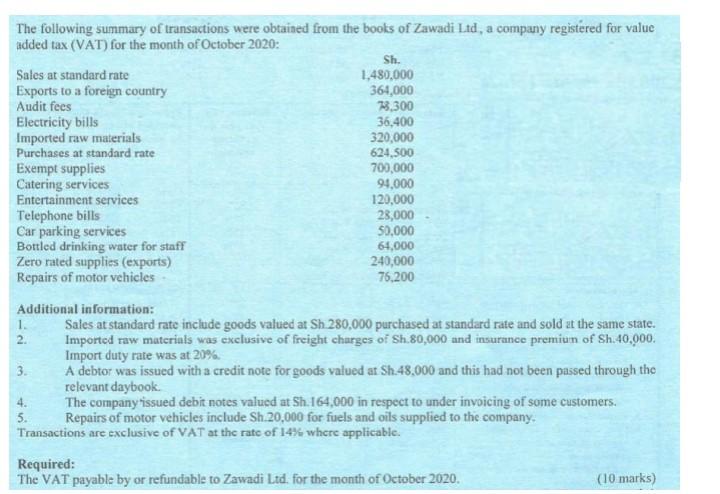

The following summary of transactions were obtaiaed from the books of Zawadi Ltd, a company registered for value added tax (VAT) for the month of

The following summary of transactions were obtaiaed from the books of Zawadi Ltd, a company registered for value added tax (VAT) for the month of October 2020: Additional information: 1. Sales at standard rate include goods valued at Sh. 280,000 purchased at standard rate and sold at the same state. 2. Imported raw materials was exclusive of freight charges of $h.80,000 and insurance premiun of Sh.40,000. Import duty rate was at 20%. 3. A debtor was issued with a credit note for goods valued at Sh.48,000 and this had not been passed through the relevant daybook. 4. The company issued debit notes valued at 5h.164,000 in respect to under invoicing of some customers. 5. Repairs of motor vehicles include Sh.20,000 for fuels and oils supplied to the company. Transactions are exclusive of VAT at the rate of 1414 where applicable. Required: The VAT nayahle by or refundable to Zawadiltd. for the month of October 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started