The following T accounts show transactions that were recorded in December 20X1 by Cedar Canyon Nursery and Landscape, a firm that specializes in residential

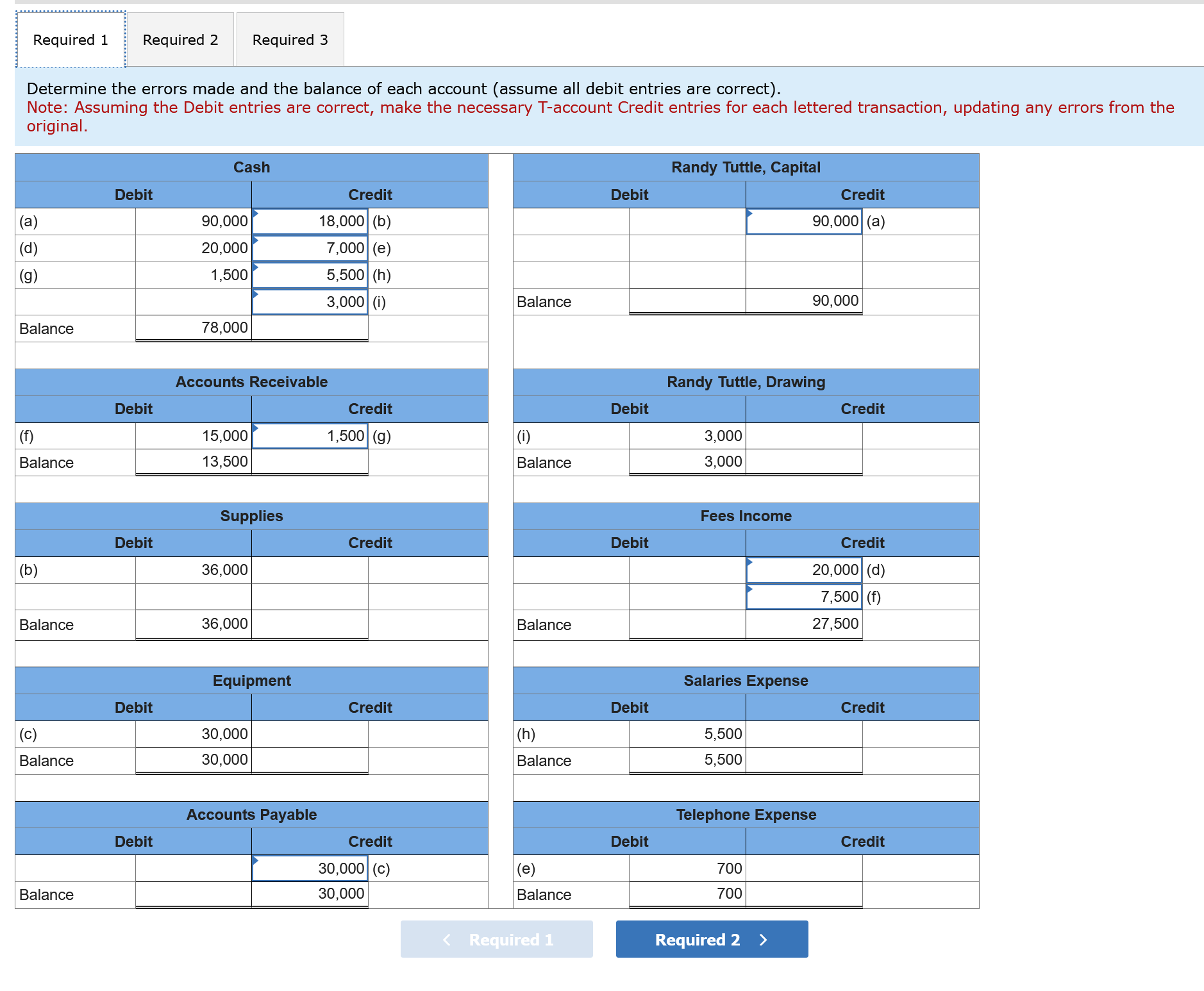

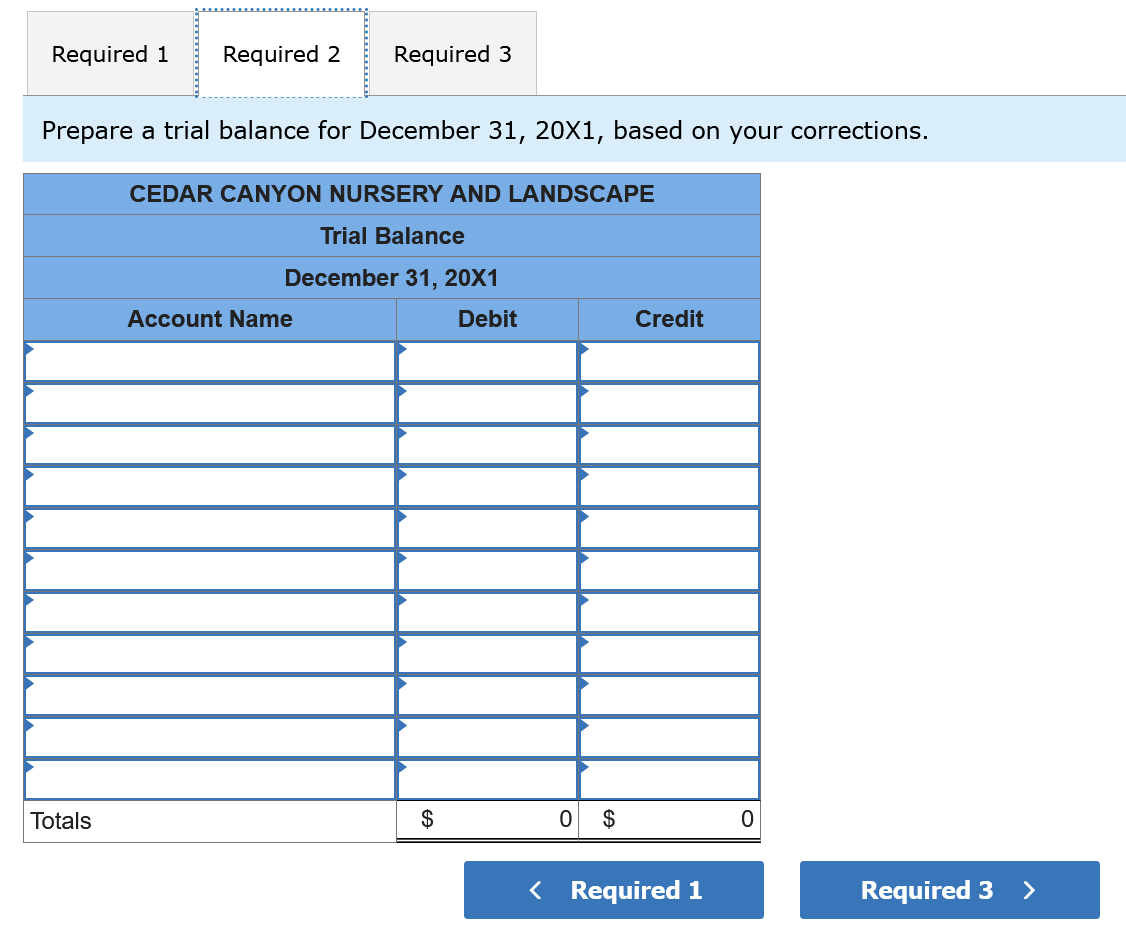

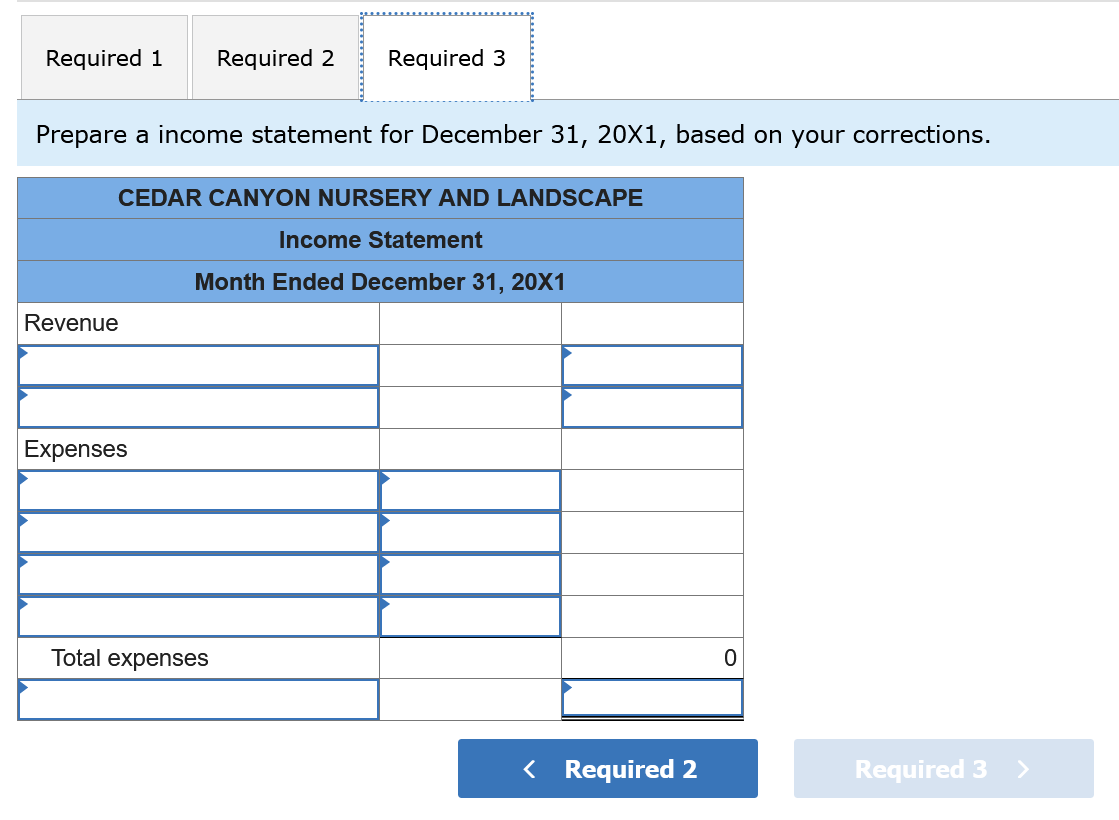

The following T accounts show transactions that were recorded in December 20X1 by Cedar Canyon Nursery and Landscape, a firm that specializes in residential and commercial landscaping. The entries for the first transaction are labeled with the letter (a), the entries for the second transaction with the letter (b), and so on. Debit (a) (d) (g) Credit (b) 18,000 (e) 7,000 (h) (i) Randy Tuttle, Drawing Debit (i) Cash 90,000 20,000 1,500 Debit (e) 3,000 Equipment Debit (c) 30,000 Credit Telephone Expense 700 Credit Credit 5,500 3,000 Randy Tuttle, Capital Debit Debit (b) Supplies Debit (h) 36,000 Credit (a) 100,000 Salaries Expense 5,500 Credit Credit Complete this question by entering your answers in the tabs below. Accounts Receivable Debit (f) Debit Debit 15,000 Fees Income Required: 1. Determine the errors made and the balance of each account (assume all debit entries are correct). 2. Prepare a trial balance for December 31, 20X1, based on your corrections. 3. Prepare a income statement for December 31, 20X1, based on your corrections. Credit (g) Accounts Payable Credit (d) 20,000 (f) 7,500 Credit 1,500 (c) 30,000 Required 1 Required 2 Required 3 Determine the errors made and the balance of each account (assume all debit entries are correct). Note: Assuming the Debit entries are correct, make the necessary T-account Credit entries for each lettered transaction, updating any errors from the original. (a) (d) (g) Balance (f) Balance (b) Balance (c) Balance Balance Debit Debit Debit Debit Debit Cash 90,000 20,000 1,500 78,000 Accounts Receivable 15,000 13,500 Supplies 36,000 36,000 Equipment 30,000 30,000 Credit 18,000 (b) 7,000 (e) 5,500 (h) 3,000 (i) Accounts Payable Credit 1,500 (g) Credit Credit Credit 30,000 (c) 30,000 Balance (i) Balance Balance (h) Balance (e) Balance < Required 1 Debit Debit Debit Debit Debit Randy Tuttle, Capital 3,000 3,000 Randy Tuttle, Drawing Fees Income Salaries Expense 5,500 5,500 700 700 Credit 90,000 (a) Required 2 90,000 Telephone Expense > Credit Credit 20,000 (d) 7,500 (f) 27,500 Credit Credit Required 1 Required 2 Required 3 Prepare a trial balance for December 31, 20X1, based on your corrections. Totals CEDAR CANYON NURSERY AND LANDSCAPE Trial Balance December 31, 20X1 Debit Account Name $ 0 $ Credit < Required 1 0 Required 3 > Required 1 Required 2 Required 3 Prepare a income statement for December 31, 20X1, based on your corrections. Revenue CEDAR CANYON NURSERY AND LANDSCAPE Expenses Income Statement Month Ended December 31, 20X1 Total expenses < Required 2 0 Required 3 >

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 The errors identified are as follows The credit of the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started