Answered step by step

Verified Expert Solution

Question

1 Approved Answer

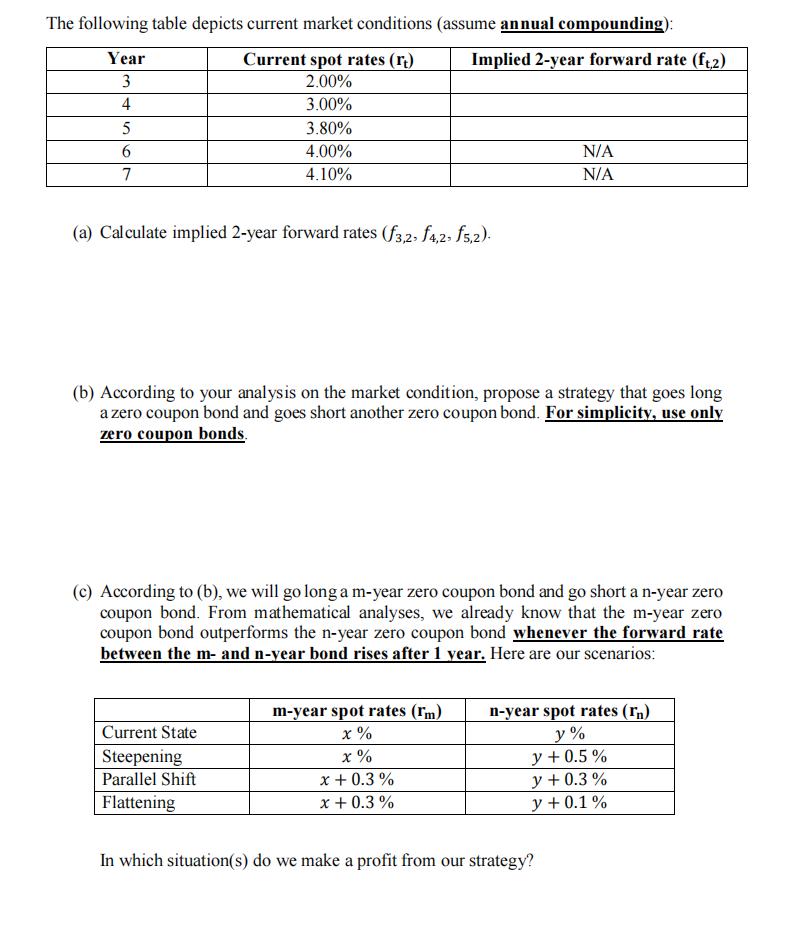

The following table depicts current market conditions (assume annual compounding): Current spot rates (r) 2.00% Implied 2-year forward rate (ft,2) 3.00% 3.80% 4.00% 4.10%

The following table depicts current market conditions (assume annual compounding): Current spot rates (r) 2.00% Implied 2-year forward rate (ft,2) 3.00% 3.80% 4.00% 4.10% Year 3 4 5 6 7 (a) Calculate implied 2-year forward rates (f3,2. f4,2. f5,2). (b) According to your analysis on the market condition, propose a strategy that goes long a zero coupon bond and goes short another zero coupon bond. For simplicity, use only zero coupon bonds. (c) According to (b), we will go long a m-year zero coupon bond and go short a n-year zero coupon bond. From mathematical analyses, we already know that the m-year zero coupon bond outperforms the n-year zero coupon bond whenever the forward rate between the m- and n-year bond rises after 1 year. Here are our scenarios: Current State Steepening Parallel Shift Flattening N/A N/A m-year spot rates (rm) x% x % x + 0.3% x + 0.3% n-year spot rates (rn) y% y + 0.5% y + 0.3% y + 0.1% In which situation(s) do we make a profit from our strategy?

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate implied 2year forward rates f32 f42 f52 The implied twoyear forward rate can be calculated using the formula Ftn 1 rt1 rtn 1 Where rt is the current spot rate in period t Therefore the imp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started