Question

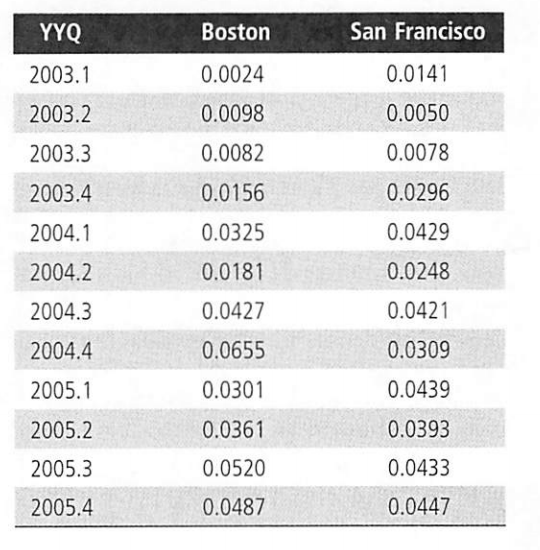

The following table gives the NPI total return for a three-year (12-quarter) period for Boston and San Francisco. Compute the following quarterly statistics for both

The following table gives the NPI total return for a three-year (12-quarter) period for Boston and San Francisco.

Compute the following quarterly statistics for both cities to the nearest basis point, and answer the subsequent questions. (Hint: We suggest using a computer spreadsheet.]

a. The arithmetic average return (use the AVERAGE function in Excel)

b. The standard deviation of the return (volatility, use STDEV in Excel)

c. The geometric mean return (you can use the Excel statistical function GEOMEAN, but you have to add unity to each return in the series, and then subtract unity from the GEOMEAN result, or just apply the geometric mean return formula directly by compounding the returns in the spreadsheet)

d. Why are the arithmetic means higher than the geometric means?

e. Based on the geometric mean, and factoring up to a per-annum rate, by how many basis points did San Francisco beat Boston during this period?

YYQ Boston San Francisco 2003.1 0.0024 0.0141 0.0050 0.0098 2003.2 2003.3 0.0082 0.0156 0.0078 0.0296 2003.4 2004.1 0.0325 0.0429 2004.2 0.0181 0.0248 2004.3 0.0427 0.0421 2004.4 0.0655 0.0309 2005.1 0.0301 0.0439 2005.2 0.0361 0.0393 2005.3 0.0433 0.0520 0.0487 2005.4 0.0447 YYQ Boston San Francisco 2003.1 0.0024 0.0141 0.0050 0.0098 2003.2 2003.3 0.0082 0.0156 0.0078 0.0296 2003.4 2004.1 0.0325 0.0429 2004.2 0.0181 0.0248 2004.3 0.0427 0.0421 2004.4 0.0655 0.0309 2005.1 0.0301 0.0439 2005.2 0.0361 0.0393 2005.3 0.0433 0.0520 0.0487 2005.4 0.0447Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started