Answered step by step

Verified Expert Solution

Question

1 Approved Answer

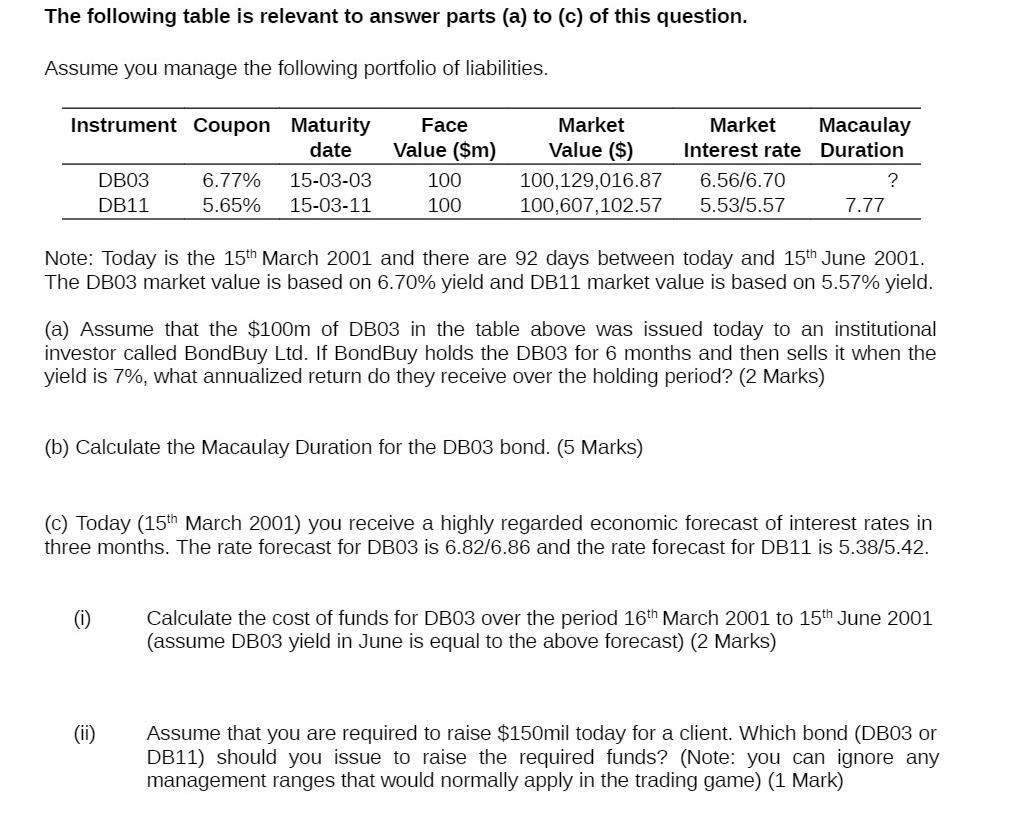

The following table is relevant to answer parts (a) to (c) of this question. Assume you manage the following portfolio of liabilities. Instrument Coupon

The following table is relevant to answer parts (a) to (c) of this question. Assume you manage the following portfolio of liabilities. Instrument Coupon Maturity date DB03 DB11 6.77% 5.65% 15-03-03 15-03-11 (1) Face Value ($m) (ii) 100 100 Market Value ($) 100,129,016.87 100,607,102.57 (b) Calculate the Macaulay Duration for the DB03 bond. (5 Marks) Market Macaulay Interest rate Duration 6.56/6.70 5.53/5.57 Note: Today is the 15th March 2001 and there are 92 days between today and 15th June 2001. The DB03 market value is based on 6.70% yield and DB11 market value is based on 5.57% yield. 7.77 (a) Assume that the $100m of DB03 in the table above was issued today to an institutional investor called BondBuy Ltd. If BondBuy holds the DB03 for 6 months and then sells it when the yield is 7%, what annualized return do they receive over the holding period? (2 Marks) ? (c) Today (15th March 2001) you receive a highly regarded economic forecast of interest rates in three months. The rate forecast for DB03 is 6.82/6.86 and the rate forecast for DB11 is 5.38/5.42. Calculate the cost of funds for DB03 over the period 16th March 2001 to 15th June 2001 (assume DB03 yield in June is equal to the above forecast) (2 Marks) Assume that you are required to raise $150mil today for a client. Which bond (DB03 or DB11) should you issue to raise the required funds? (Note: you can ignore any management ranges that would normally apply in the trading game) (1 Mark)

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you with the questions about the table Part a To calculate the annualized return for BondBuy Ltd we can use the following formula Annu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started