Answered step by step

Verified Expert Solution

Question

1 Approved Answer

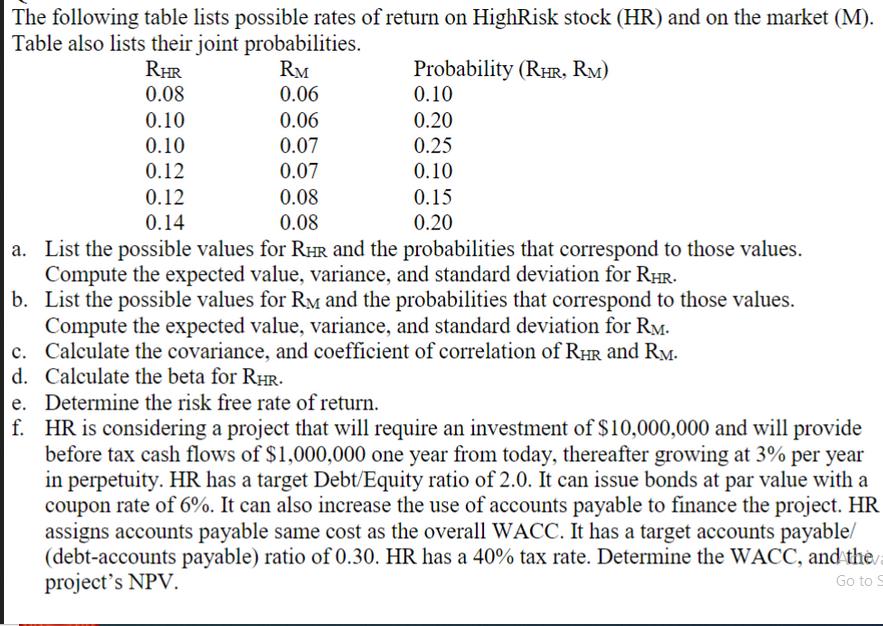

The following table lists possible rates of return on HighRisk stock (HR) and on the market (M). Table also lists their joint probabilities. Probability

The following table lists possible rates of return on HighRisk stock (HR) and on the market (M). Table also lists their joint probabilities. Probability (RHR, RM) RHR RM 0.08 0.06 0.10 0.10 0.06 0.20 0.10 0.07 0.25 0.12 0.07 0.10 0.12 0.08 0.08 0.15 0.20 0.14 a. List the possible values for RHR and the probabilities that correspond to those values. Compute the expected value, variance, and standard deviation for RHR. b. List the possible values for RM and the probabilities that correspond to those values. Compute the expected value, variance, and standard deviation for RM. c. Calculate the covariance, and coefficient of correlation of RHR and RM. d. Calculate the beta for RHR. e. Determine the risk free rate of return. f. HR is considering a project that will require an investment of $10,000,000 and will provide before tax cash flows of $1,000,000 one year from today, thereafter growing at 3% per year in perpetuity. HR has a target Debt/Equity ratio of 2.0. It can issue bonds at par value with a coupon rate of 6%. It can also increase the use of accounts payable to finance the project. HR assigns accounts payable same cost as the overall WACC. It has a target accounts payable/ (debt-accounts payable) ratio of 0.30. HR has a 40% tax rate. Determine the WACC, and the project's NPV. Go to S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started