Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table lists possible rates of returns together with the respective probabilities on ABC Inc. stock and on the market (M). RABC RM

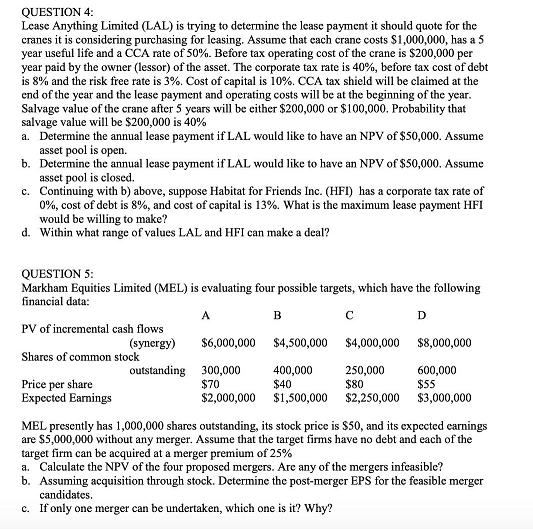

The following table lists possible rates of returns together with the respective probabilities on ABC Inc. stock and on the market (M). RABC RM 0.07 0.05 0.05 0.07 0.07 0.07 0.08 0.09 0.09 0.11 0.13 0.13 Probability (RABC, RM) 0.20 0.15 0.25 0.10 0.20 0.10 a. List the possible values for RABC and the probabilities that correspond to those values. Compute the expected value, variance, and standard deviation for RABC. b. List the possible values for RM and the probabilities that correspond to those values. Compute the expected value, variance, and standard deviation for RM. Calculate the covariance, and coefficient of correlation of RABC and RM. d. Calculate the beta for RABC. c. e. Determine the risk free rate of return. f. ABC is considering a project that will require an investment of $5,000,000 and will provide before tax cash flows of $2,000,000 one year from today, thereafter declining at 10% per year in perpetuity. ABC has a target Debt/Equity ratio of 1.5. It can issue bonds at par value with a coupon rate of 8%. It can also increase the use of accounts payable to finance the project. ABC assigns accounts payable same cost as the overall rwACC. It has a target accounts payable/(debt-accounts payable) ratio of 0.40. ABC has a 30% tax rate. Determine the rwAcc, and the project's NPV. QUESTION 2: AllEquity Limited an all equity firm, pays no corporate taxes. It has 1,000,000 shares outstanding which are trading at $100 each. Mr. NoMoney and Ms. MoneyTree are shareholders of AllEquityLimited. AllEquity, NoMoney and MoneyTree can borrow and lend money at 6%. NoMoney has a personal tax rate of 30% and MoneyTree of 25% on both equity income and debt income. The value of their holdings and their overall borrowing and lending positions are given below: Total Lending Value of AllEquity Shares $100,000 $300,000 0 200,000 0 AllEquity desires a debt/equity ratio of 3/5. To meet this desire the firm issued debt and used the proceeds to repurchase the shares. NoMoney Money Tree Total Borrowing 80,000 Show the value of each shareholder's holding, borrowing and lending positions, and the $ return before and after the change in capital structure. Show how each one of them can obtain the same $ return after the change in capital structure as obtained before the change. You can use E to indicate AllEquity's earnings before interest and taxes. QUESTION 4: Lease Anything Limited (LAL) is trying to determine the lease payment it should quote for the cranes it is considering purchasing for leasing. Assume that each crane costs $1,000,000, has a 5 year useful life and a CCA rate of 50%. Before tax operating cost of the crane is $200,000 per year paid by the owner (lessor) of the asset. The corporate tax rate is 40%, before tax cost of debt is 8% and the risk free rate is 3%. Cost of capital is 10%. CCA tax shield will be claimed at the end of the year and the lease payment and operating costs will be at the beginning of the year. Salvage value of the crane after 5 years will be either $200,000 or $100,000. Probability that salvage value will be $200,000 is 40% a. Determine the annual lease payment if LAL would like to have an NPV of $50,000. Assume asset pool is open. b. c. Continuing with b) above, suppose Habitat for Friends Inc. (HFI) has a corporate tax rate of 0%, cost of debt is 8%, and cost of capital is 13%. What is the maximum lease payment HFI would be willing to make? d. Within what range of values LAL and HFI can make a deal? Determine the annual lease payment if LAL would like to have an NPV of $50,000. Assume asset pool is closed. QUESTION 5: Markham Equities Limited (MEL) is evaluating four possible targets, which have the following financial data: A PV of incremental cash flows (synergy) Shares of common stock outstanding Price per share Expected Earnings $6,000,000 300,000 $70 $2,000,000 B $4,500,000 400,000 $40 $1,500,000 C $4,000,000 250,000 $80 $2,250,000 D $8,000,000 600,000 $55 $3,000,000 MEL presently has 1,000,000 shares outstanding, its stock price is $50, and its expected earnings are $5,000,000 without any merger. Assume that the target firms have no debt and each of the target firm can be acquired at a merger premium of 25% a. Calculate the NPV of the four proposed mergers. Are any of the mergers infeasible? b. Assuming acquisition through stock. Determine the post-merger EPS for the feasible merger candidates. c. If only one merger can be undertaken, which one is it? Why?

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Record the journal entries for each transaction January 3 1 Payroll payment Debit Payroll Expense 110000 Credit Cash 110000 2 Purchase of safety product inventory and raw materials Debit Safety Prod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started