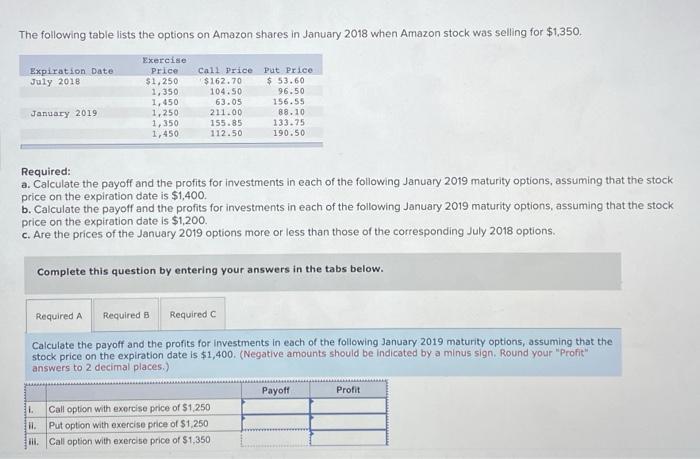

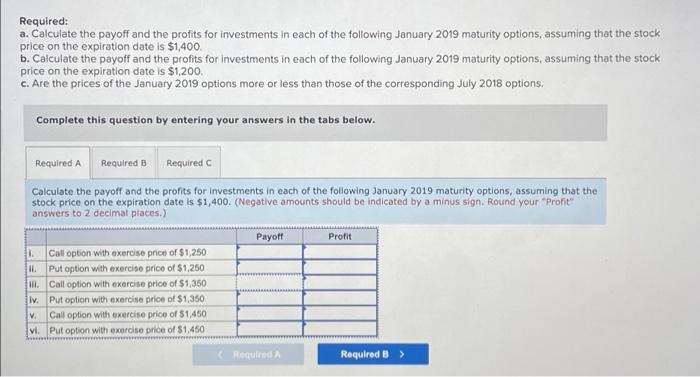

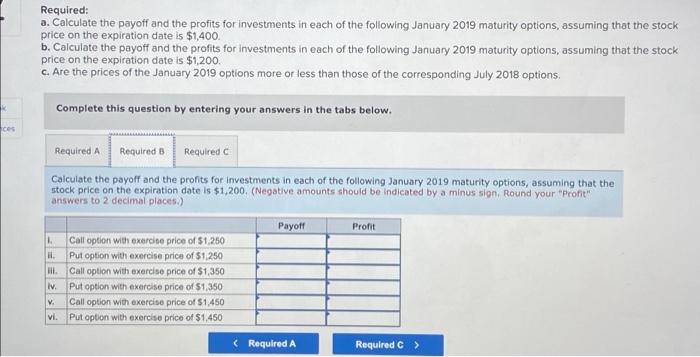

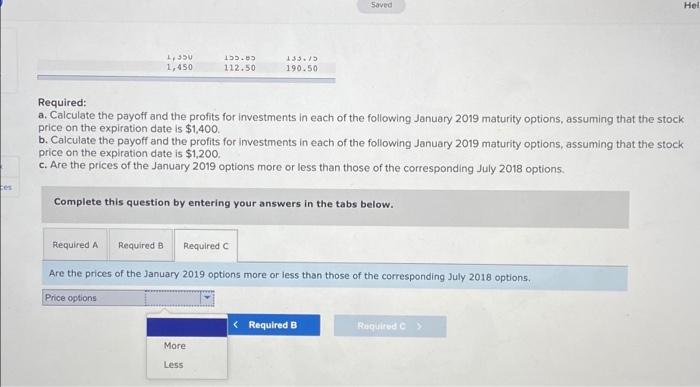

The following table lists the options on Amazon shares in January 2018 when Amazon stock was selling for $1.350. Expiration Date July 2018 Exercise Price $1,250 1,350 1.450 1,250 1,350 1,450 Call Price Put Price $162.70 $ 53.60 104.50 96.50 63.05 156.55 211.00 88.10 155.85 133.75 112.50 190.50 January 2019 Required: a. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400 b. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,200. c. Are the prices of the January 2019 options more or less than those of the corresponding July 2018 options. Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400. (Negative amounts should be indicated by a minus sign. Round your "Profit". answers to 2 decimal places) Payoff Profit 1. Call option with exercise price of $1,250 11. Put option with exercise price of $1,250 ill. Call option with exercise price of $1,350 Required: a. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400. b. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1.200 c. Are the prices of the January 2019 options more or less than those of the corresponding July 2018 options. Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400. (Negative amounts should be indicated by a minus sign. Round your profit" answers to 2 decimal places.) Payoff Profit 1 Call option with exercise price of $1,250 I Put option with exercise price of $1,250 H. Call option with exercise price of $1,350 lv. Put option with exercise price of $1,350 Call option with exercise price of $1,450 V. Put option with exercise price of $1,450 MA Required B > Required: a. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400. b. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,200. c. Are the prices of the January 2019 options more or less than those of the corresponding July 2018 options. Complete this question by entering your answers in the tabs below. ces Required A Required B Required Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,200. (Negative amounts should be indicated by a minus sign. Round your "Pront" answers to 2 decimal places) Payoff Profit Call option with exercise price of $1,250 Put option with exercise price of $1,250 HI Call option with exercise price of $1,350 lv. Put option with exercise price of $1,350 V. Call option with exercise price of $1.450 vi Put option with exercise price of $1,450 Saved Hel . 1 1,350 1,450 112.50 133/5 190.50 Required: a. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,400 b. Calculate the payoff and the profits for investments in each of the following January 2019 maturity options, assuming that the stock price on the expiration date is $1,200, c. Are the prices of the January 2019 options more or less than those of the corresponding July 2018 options Complete this question by entering your answers in the tabs below. Required A Required B Required Are the prices of the January 2019 options more or less than those of the corresponding July 2018 options, Price options (Required B Required More Less