Answered step by step

Verified Expert Solution

Question

1 Approved Answer

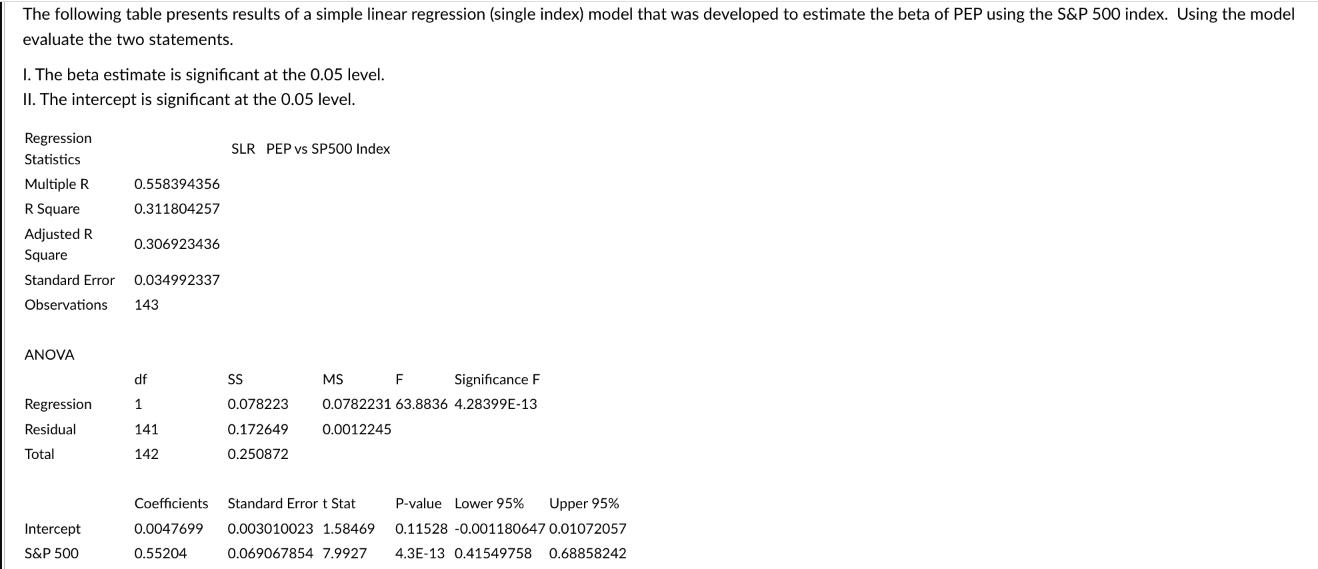

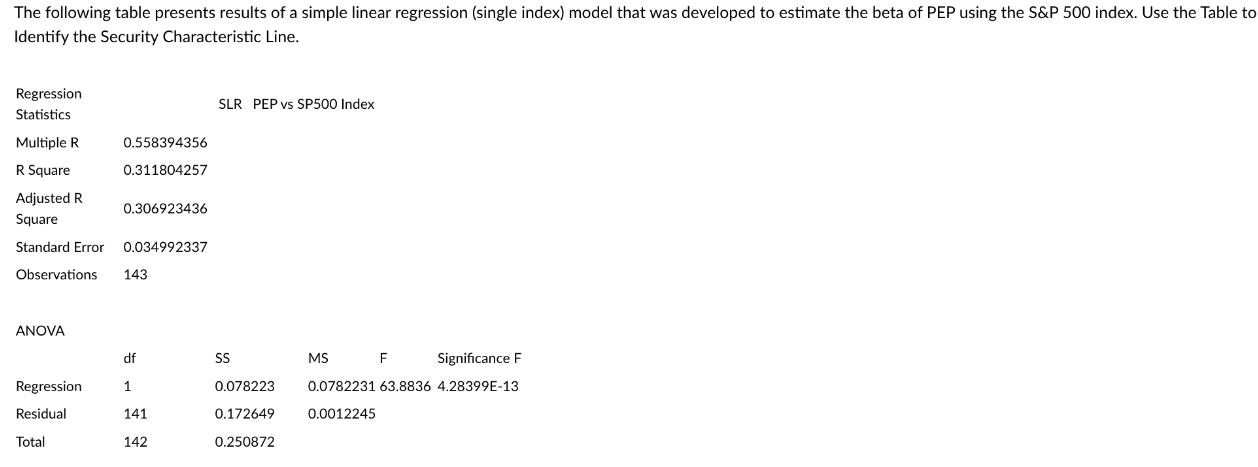

The following table presents results of a simple linear regression (single index) model that was developed to estimate the beta of PEP using the

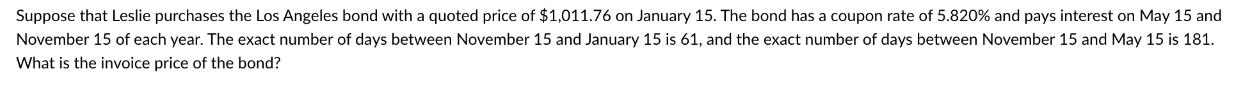

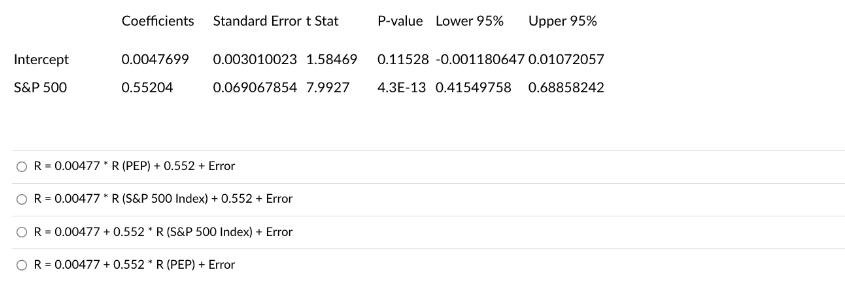

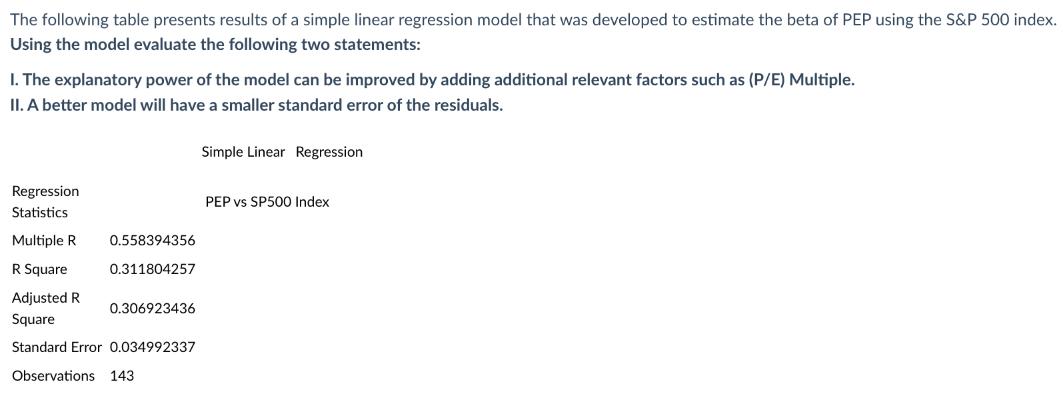

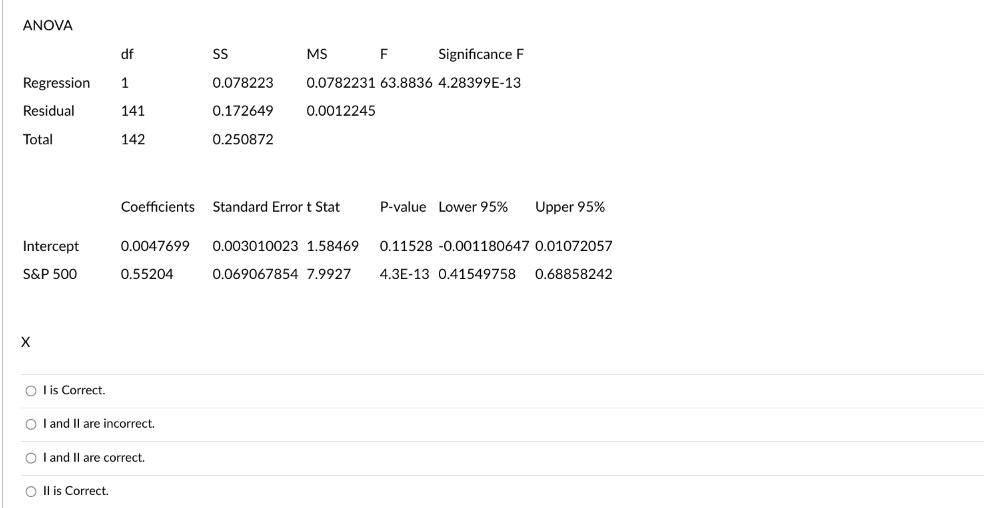

The following table presents results of a simple linear regression (single index) model that was developed to estimate the beta of PEP using the S&P 500 index. Using the model evaluate the two statements. 1. The beta estimate is significant at the 0.05 level. II. The intercept is significant at the 0.05 level. Regression Statistics Multiple R R Square Adjusted R Square Standard Error 0.034992337 Observations 143 ANOVA Regression Residual Total Intercept S&P 500 0.558394356 0.311804257 0.306923436 df 1 141 142 SLR PEP vs SP500 Index F Significance F 0.078223 0.0782231 63.8836 4.28399E-13 0.172649 0.0012245 0.250872 SS MS Coefficients Standard Error t Stat 0.0047699 0.003010023 1.58469 0.55204 0.069067854 7.9927 P-value Lower 95% Upper 95% 0.11528 -0.001180647 0.01072057 4.3E-13 0.41549758 0.68858242 I and II are Incorrect O I and II are correct. Olis Correct. Il is Correct. Suppose that Leslie purchases the Los Angeles bond with a quoted price of $1,011.76 on January 15. The bond has a coupon rate of 5.820% and pays interest on May 15 and November 15 of each year. The exact number of days between November 15 and January 15 is 61, and the exact number of days between November 15 and May 15 is 181. What is the invoice price of the bond? Suzan can be sure that a straight bond will sell at a premium to par when its coupon rate is less than its yield to maturity O its coupon rate is greater than its yield to maturity O its coupon rate is equal to its yield to maturity O its coupon rate is less than its conversion value The following table presents results of a simple linear regression (single index) model that was developed to estimate the beta of PEP using the S&P 500 index. Use the Table to Identify the Security Characteristic Line. Regression Statistics Multiple R R Square Adjusted R Square Standard Error 0.034992337 Observations 143 ANOVA Regression Residual Total 0.558394356 0.311804257 0.306923436 df 1 141 142 SLR PEP vs SP500 Index SS 0.078223 0.172649 0.250872 MS F Significance F 0.0782231 63.8836 4.28399E-13 0.0012245 Intercept S&P 500 Coefficients Standard Errort Stat 0.0047699 0.55204 0.003010023 1.58469 0.069067854 7.9927 R = 0.00477* R (PEP) + 0.552+ Error R = 0.00477* R (S&P 500 Index) + 0.552 + Error R = 0.00477 + 0.552 * R (S&P 500 Index) + Error OR = 0.00477 +0.552 * R (PEP) + Error P-value Lower 95% Upper 95% 0.11528 -0.001180647 0.01072057 4.3E-13 0.41549758 0.68858242 The following table presents results of a simple linear regression model that was developed to estimate the beta of PEP using the S&P 500 index. Using the model evaluate the following two statements: 1. The explanatory power of the model can be improved by adding additional relevant factors such as (P/E) Multiple. II. A better model will have a smaller standard error of the residuals. Regression Statistics. Multiple R R Square Adjusted R Square Standard Error 0.034992337 Observations 143 0.558394356 0.311804257 0.306923436 Simple Linear Regression PEP vs SP500 Index ANOVA df Regression 1 Residual Total Intercept S&P 500 X Olis Correct. 141 142 Coefficients 0.0047699 0.55204 O I and II are incorrect. OI and II are correct. O II is Correct. SS Significance F 0.078223 0.0782231 63.8836 4.28399E-13 0.172649 0.0012245 0.250872 MS Standard Errort Stat F 0.003010023 1.58469 0.069067854 7.9927 P-value Lower 95% Upper 95% 0.11528 -0.001180647 0.01072057 4.3E-13 0.41549758 0.68858242

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Statement I The beta estimate is significant at the 005 level Statement II The intercept is significant at the 005 level Answer Based on the table of regression results both Statements I and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started