Answered step by step

Verified Expert Solution

Question

1 Approved Answer

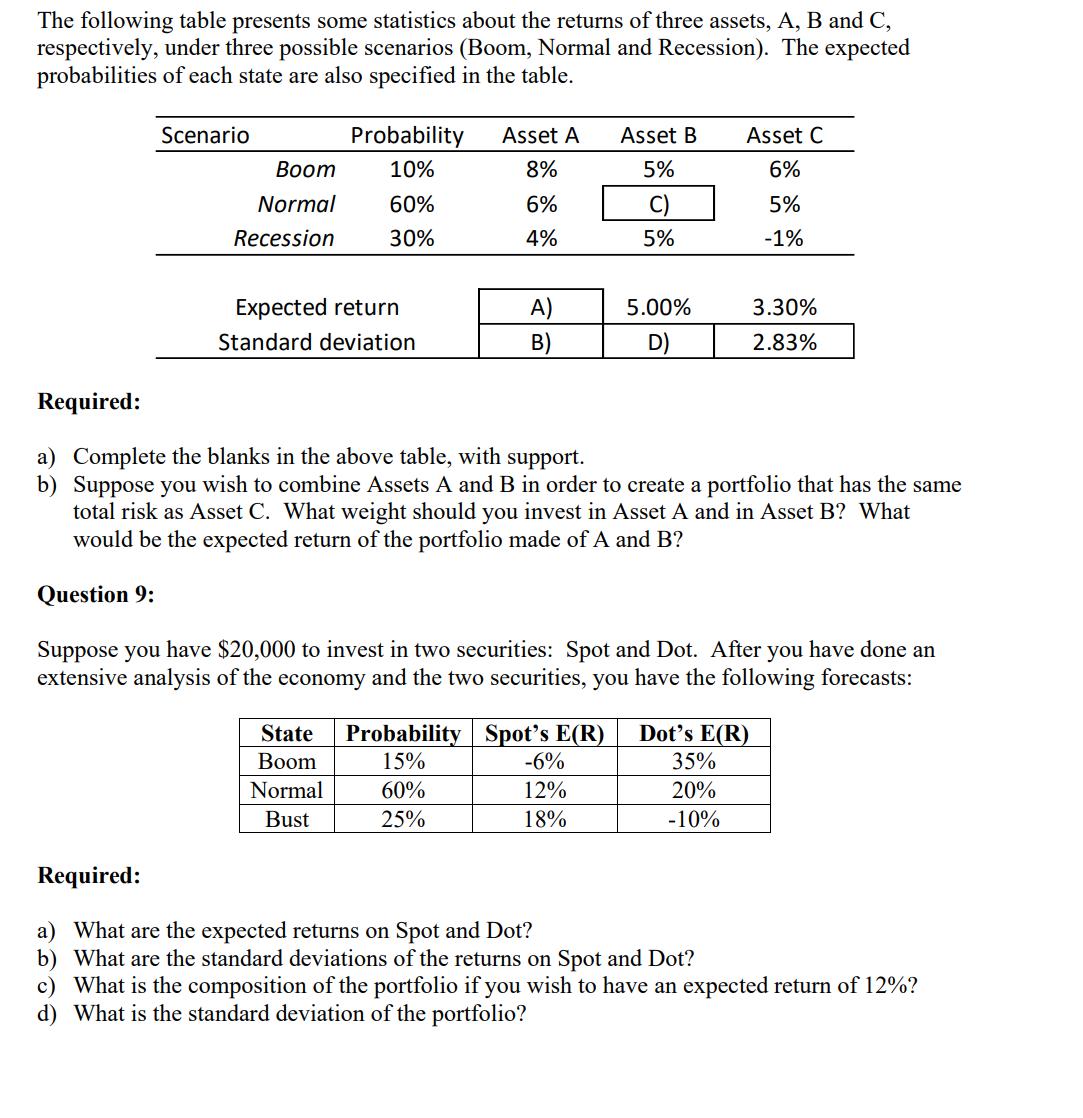

The following table presents some statistics about the returns of three assets, A, B and C, respectively, under three possible scenarios (Boom, Normal and

The following table presents some statistics about the returns of three assets, A, B and C, respectively, under three possible scenarios (Boom, Normal and Recession). The expected probabilities of each state are also specified in the table. Scenario Boom Normal Recession Probability 10% 60% 30% Expected return Standard deviation State Boom Normal Bust Asset A 8% 6% 4% A) B) Asset B 5% C) 5% Probability Spot's E(R) 15% 60% 25% 5.00% Required: a) Complete the blanks in the above table, with support. b) Suppose you wish to combine Assets A and B in order to create a portfolio that has the same total risk as Asset C. What weight should you invest in Asset A and in Asset B? What would be the expected return of the portfolio made of A and B? Question 9: -6% 12% 18% Asset C 6% 5% -1% Suppose you have $20,000 to invest in two securities: Spot and Dot. After you have done an extensive analysis of the economy and the two securities, you have the following forecasts: 3.30% 2.83% Dot's E(R) 35% 20% -10% Required: a) What are the expected returns on Spot and Dot? b) What are the standard deviations of the returns on Spot and Dot? c) What is the composition of the portfolio if you wish to have an expected return of 12%? d) What is the standard deviation of the portfolio?

Step by Step Solution

★★★★★

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started