Answered step by step

Verified Expert Solution

Question

1 Approved Answer

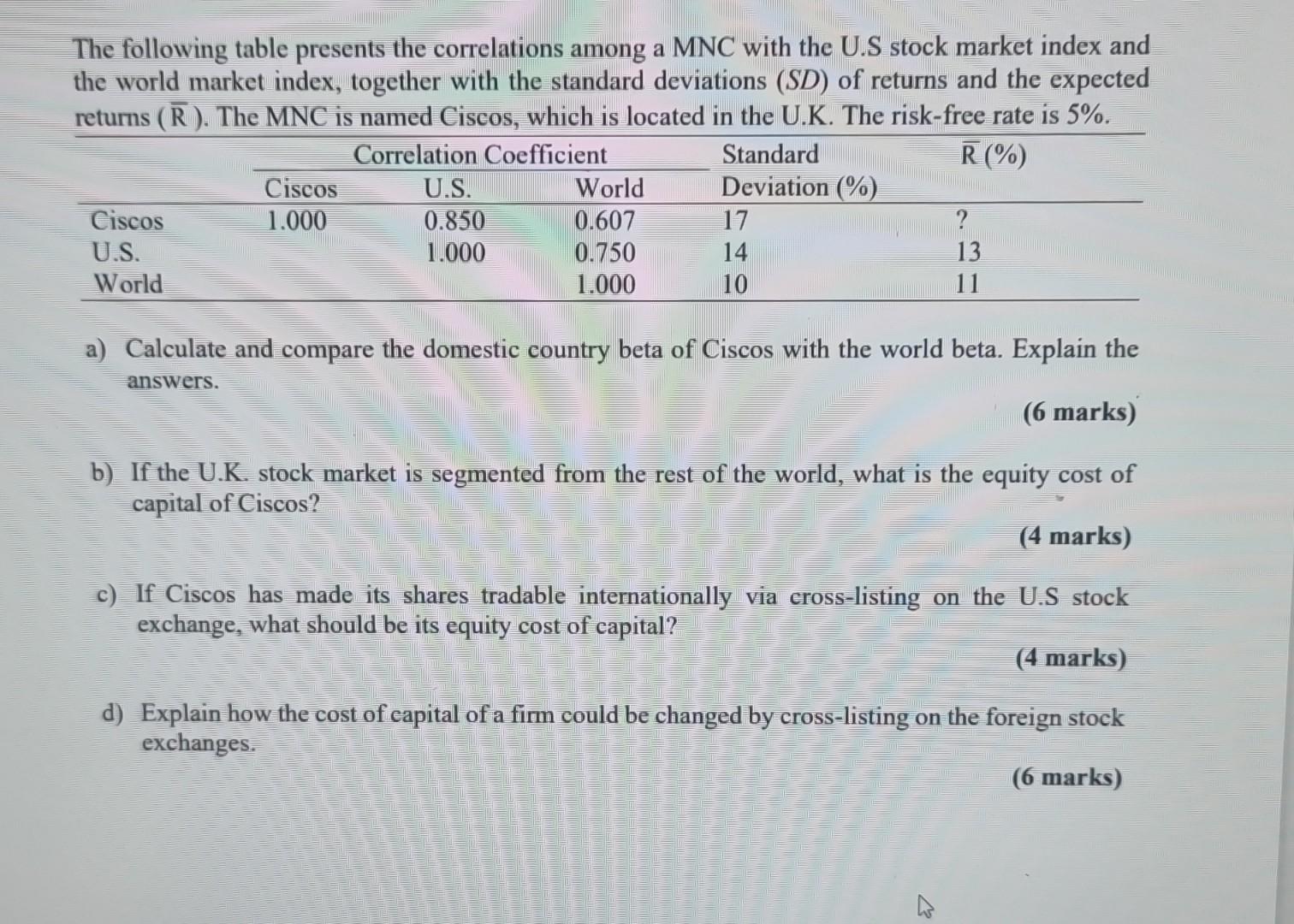

The following table presents the correlations among a MNC with the U.S stock market index and the world market index, together with the standard deviations

The following table presents the correlations among a MNC with the U.S stock market index and the world market index, together with the standard deviations (SD) of returns and the expected returns (R). The MNC is named Ciscos, which is located in the U.K. The risk-free rate is 5%. a) Calculate and compare the domestic country beta of Ciscos with the world beta. Explain the answers. (6 marks) b) If the U.K. stock market is segmented from the rest of the world, what is the equity cost of capital of Ciscos? (4 marks) c) If Ciscos has made its shares tradable internationally via cross-listing on the U.S stock exchange, what should be its equity cost of capital? (4 marks) d) Explain how the cost of eapital of a firm could be changed by cross-listing on the foreign stock exchanges. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started