Answered step by step

Verified Expert Solution

Question

1 Approved Answer

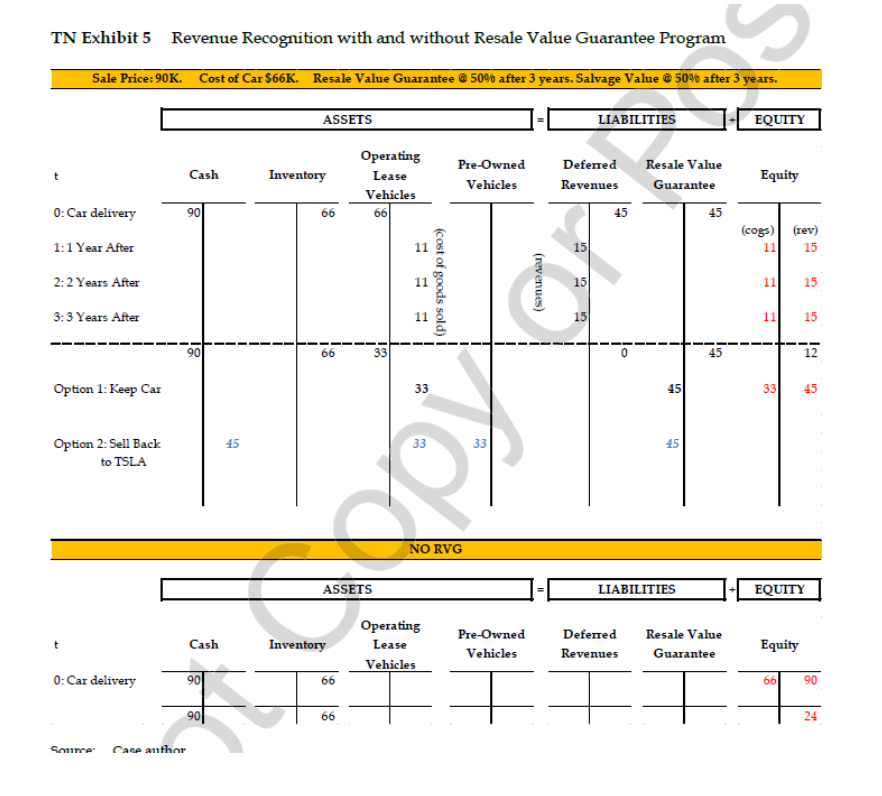

The following table provides an illustration of a sale of Tesla car at $90,000 with a RVG at 50% of the sale price after three

The following table provides an illustration of a sale of Tesla car at $90,000 with a RVG at 50% of the sale price after three years and a salvage value of 50 percent after three years. The upper panel of this table walks through each step of the economic transactions and illustrates how the accouting work after each year. Also, the table show how the financials differ under theses two choices and how the accounting would work if the car was sold without RGV.

TN Exhibit 5 Revenue Recognition with and without Resale Value Guarantee Program S Sale Price: 90K. Cost of Car $66K. Resale Value Guarantee 50% after 3 years. Salvage Value @ 50% after 3 years. ASSETS LIABILITIES EQUITY Cash Inventory Operating Lease Pre-Owned Deferred Vehicles Revenues Resale Value Guarantee Equity Vehicles 66 66 45 45 (cogs) (rev) 15 11 15 0: Car delivery 90 1:1 Year After 2:2 Years After 3:3 Years After Option 1: Keep Car Option 2: Sell Back to TSLA t 90 0: Car delivery 45 45 66 66 (cost of goods sold) = = 12 33 33 (revenues) 15 15 45 45 33 33 45 NO RVG 11 15 11 15 19 33 12 45 55 ASSETS LIABILITIES EQUITY Cash Inventory Operating Lease Vehicles Pre-Owned Vehicles Deferred Revenues Resale Value Guarantee Equity 90 90 66 66 90 24 66 Source Case author

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided table lets analyze the revenue recognition and financial impact of the sale of a Tesla car with a Resale Value Guarantee RVG pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started