Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table provides the latest market prices of three MBS, UMBS 2.5, UMBS 3.0 and UMBS 3.5. The number in the MBS name

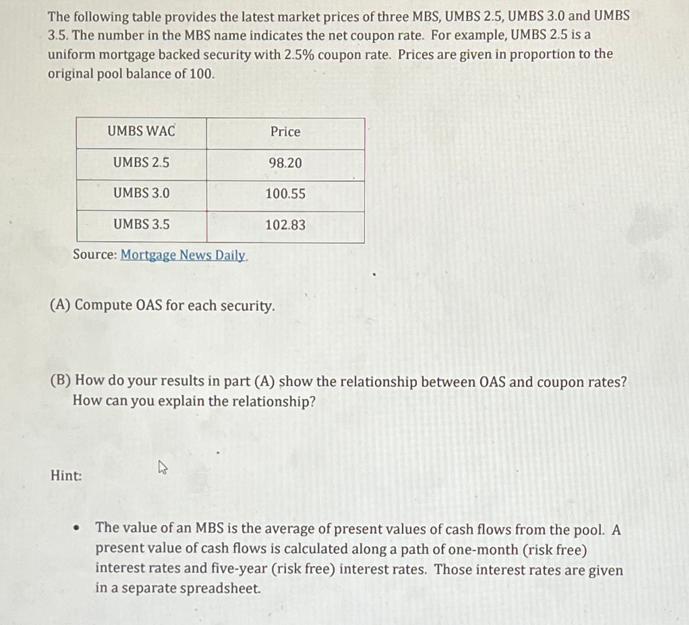

The following table provides the latest market prices of three MBS, UMBS 2.5, UMBS 3.0 and UMBS 3.5. The number in the MBS name indicates the net coupon rate. For example, UMBS 2.5 is a uniform mortgage backed security with 2.5% coupon rate. Prices are given in proportion to the original pool balance of 100. UMBS WAC UMBS 2.5 UMBS 3.0 UMBS 3.5 Source: Mortgage News Daily. Hint: Price 98.20 100.55 102.83 (A) Compute OAS for each security. (B) How do your results in part (A) show the relationship between OAS and coupon rates? How can you explain the relationship? The value of an MBS is the average of present values of cash flows from the pool. A present value of cash flows is calculated along a path of one-month (risk free) interest rates and five-year (risk free) interest rates. Those interest rates are given in a separate spreadsheet.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Answer A OAS stands for Option Adjusted Spread It is a measure of the MBSs yield spread to the und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started