Answered step by step

Verified Expert Solution

Question

1 Approved Answer

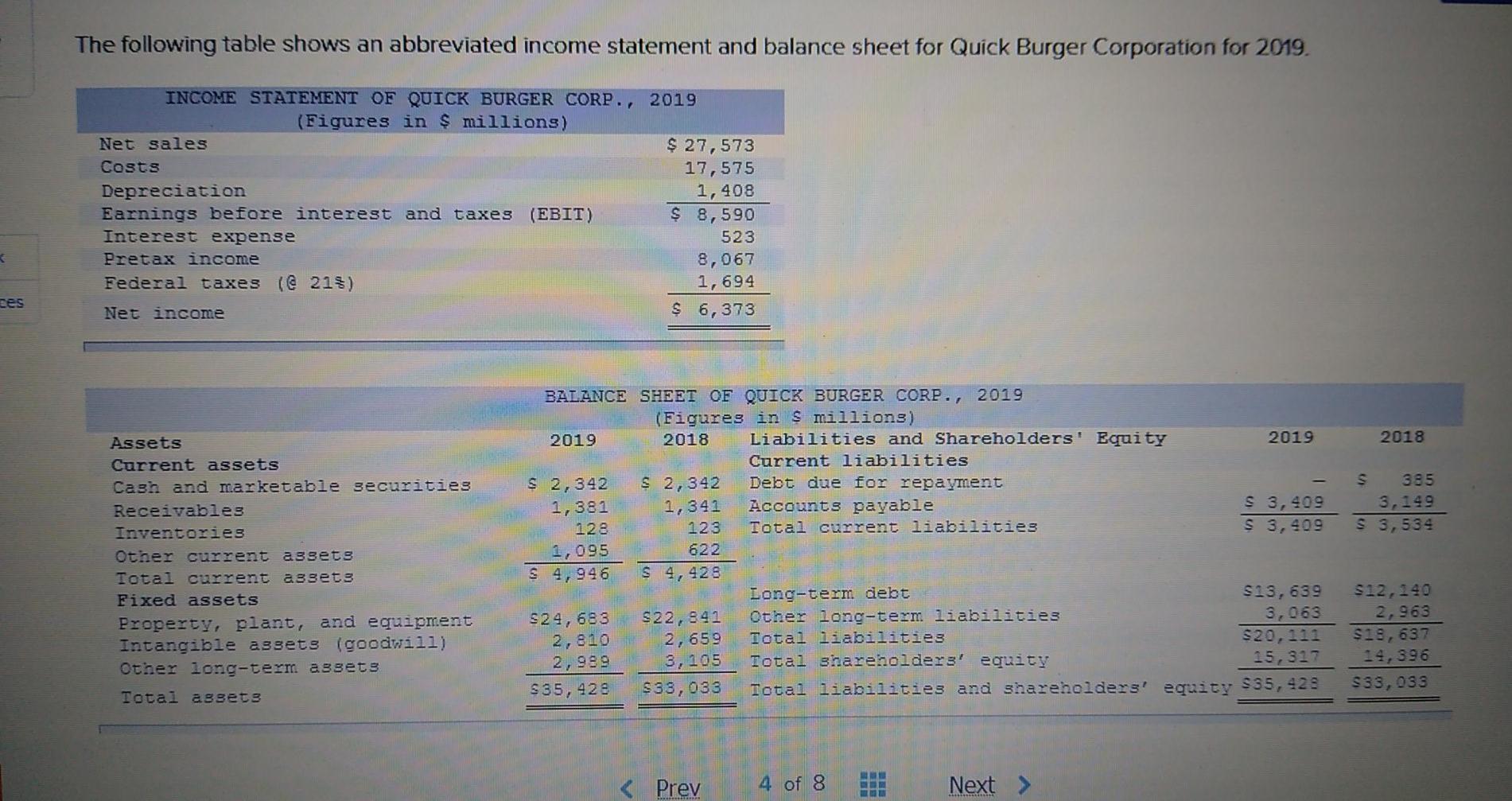

The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019, INCOME STATEMENT OF QUICK BURGER CORP., 2019 (Figures

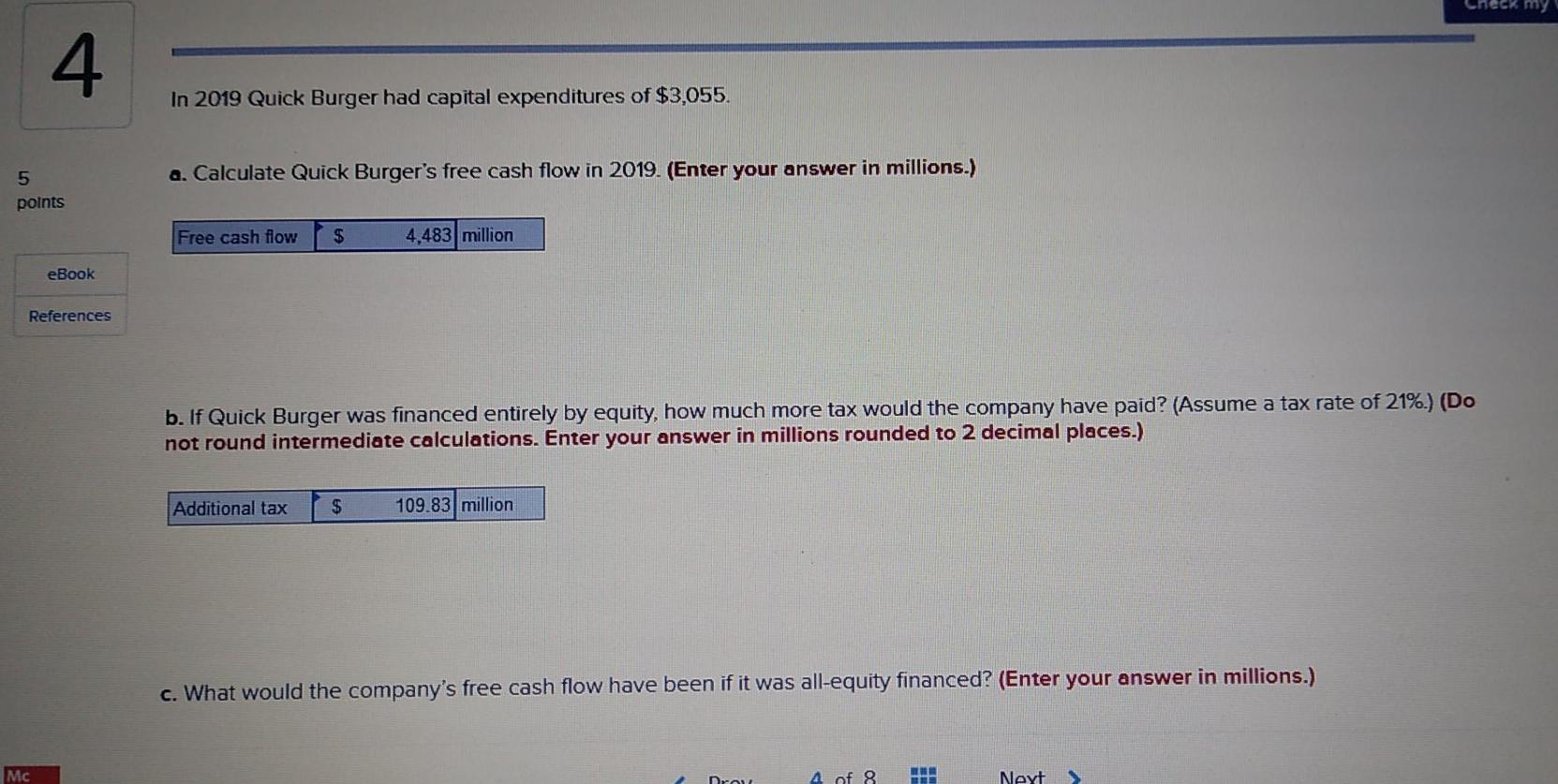

The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019, INCOME STATEMENT OF QUICK BURGER CORP., 2019 (Figures in $ millions) Net sales $ 27,573 Costs 17,575 Depreciation 1,408 Earnings before interest and taxes (EBIT) $ 8,590 Interest expense 523 Pretax income 8,067 Federal taxes (@ 213) 1,694 Net income $ 6,373 Check my 4 In 2019 Quick Burger had capital expenditures of $3,055. a. Calculate Quick Burger's free cash flow in 2019. (Enter your answer in millions.) 5 points Free cash flow $ 4,483 million eBook References b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) (Do not round intermediate calculations. Enter your answer in millions rounded 2 decimal places.) Additional tax $ 109.83 million c. What would the company's free cash flow have been if it was all-equity financed? (Enter your answer in millions.) Mc Dr 1 of 8 TI Neyt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started