Question

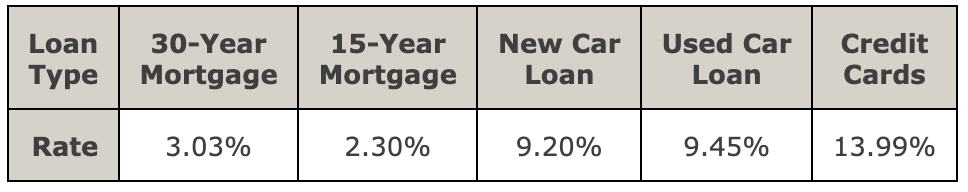

The following table shows annual rates for various types of loans in 2021. Assume monthly payments and compounding periods. HINT [See Examples 5 and 7.]

The following table shows annual rates for various types of loans in 2021. Assume monthly payments and compounding periods. HINT [See Examples 5 and 7.]

a) You purchased a new car using a 5-year $30,000 loan in 2021. With the same monthly payments, how much could you have financed had the interest rate been 9.00%? (Do not round the payment amount to the nearest cent. Round the final amount you could have financed to the nearest cent.)

$

b) With the same monthly payments, how much could you have financed had the interest rate been 9.50%? (Do not round the payment amount to the nearest cent. Round the final amount you could have financed to the nearest cent.)

$

\begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{c} Loan \\ Type \end{tabular} & \begin{tabular}{c} 30 Year \\ Mortgage \end{tabular} & \begin{tabular}{c} 15-Year \\ Mortgage \end{tabular} & \begin{tabular}{c} New Car \\ Loan \end{tabular} & \begin{tabular}{c} Used Car \\ Loan \end{tabular} & \begin{tabular}{c} Credit \\ Cards \end{tabular} \\ \hline Rate & 3.03% & 2.30% & 9.20% & 9.45% & 13.99% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started