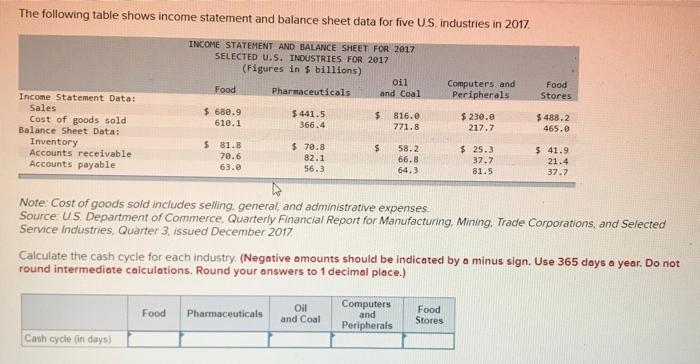

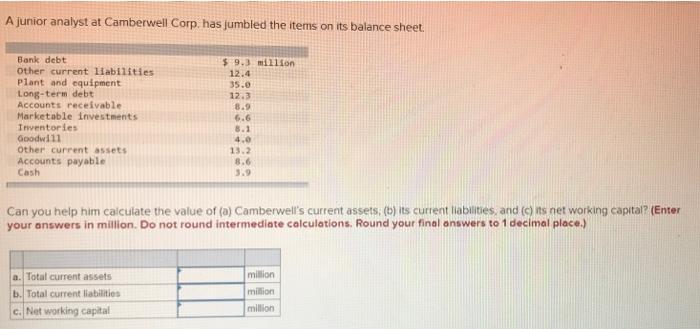

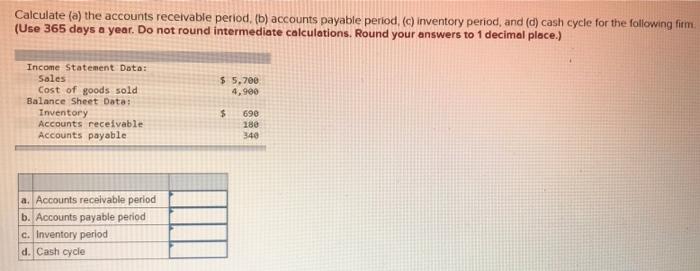

The following table shows income statement and balance sheet data for five U.S. industries in 2017 INCOME STATEMENT AND BALANCE SHEET FOR 2017 SELECTED U.S. INDUSTRIES FOR 2017 (Figures in $ billions) Oil Food Pharmaceuticals and Coal Computers and Peripherals Food Stores $ 680.9 610.1 $ 441.5 366.4 $ Income Statement Data: Sales Cost of goods sold Balance Sheet Data: Inventory Accounts receivable Accounts payable 816.0 771.8 $ 230.0 217.7 $ 488.2 465.0 $ $ 81.8 70.6 63.0 $ 70.8 82.1 56.3 58.2 66.8 64.3 $ 25.3 37.7 81.5 $ 41.9 21.4 37.7 Note: Cost of goods sold includes selling, general and administrative expenses. Source US Department of Commerce, Quarterly Financial Report for Manufacturing, Mining, Trade Corporations, and Selected Service Industries, Quarter 3, issued December 2017 Calculate the cash cycle for each industry. (Negative amounts should be indicated by a minus sign. Use 365 days a year. Do not round intermediate calculations. Round your answers to 1 decimal place.) Food Pharmaceuticals Oil and Coal Computers and Peripherals Food Stores Cash cycle (in days) A junior analyst at Camberwell Corp. has Jumbled the items on its balance sheet. Bank debt Other current liabilities plant and equipment Long-term debt Accounts receivable Marketable Investments Trventories Goodwi11 Other current assets Accounts payable Cash $ 9.3 million 12.4 35.0 12.3 8.9 6.6 8.1 4.0 13.2 8.6 Can you help him calculate the value of (a) Camberwell's current assets; (b) its current liabilities, and (c) is net working capital? (Enter your answers in million. Do not round intermediate calculations. Round your final answers to 1 decimal place.) a. Total current assets b. Total current liabilities c. Net working capital million million million Calculate (a) the accounts receivable period. (b) accounts payable period, (c) inventory period, and (d) cash cycle for the following firm (Use 365 days a year. Do not round intermediate calculations. Round your answers to 1 decimal place.) $ 5.700 4,900 Income Statement Data: Sales Cost of goods sold Balance Sheet Data! Inventory Accounts receivable Accounts payable $ 690 180 340 a. Accounts receivable period b. Accounts payable period c. Inventory period d. Cash cycle