Question

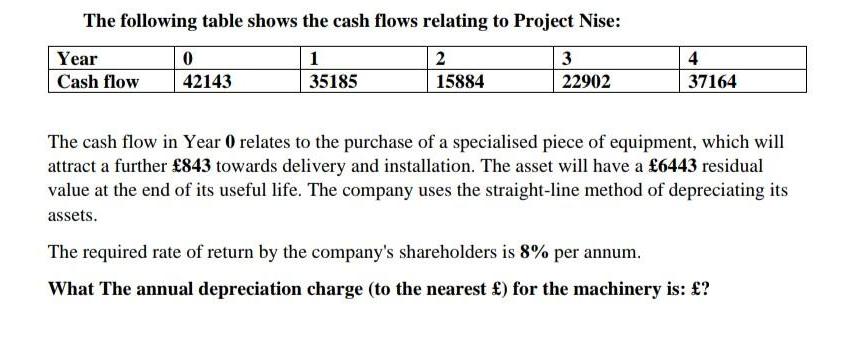

The following table shows the cash flows relating to Project Nise: Year Cash flow 0 42143 1 35185 2 15884 3 22902 4 37164

The following table shows the cash flows relating to Project Nise: Year Cash flow 0 42143 1 35185 2 15884 3 22902 4 37164 The cash flow in Year 0 relates to the purchase of a specialised piece of equipment, which will attract a further 843 towards delivery and installation. The asset will have a 6443 residual value at the end of its useful life. The company uses the straight-line method of depreciating its assets. The required rate of return by the company's shareholders is 8% per annum. What The annual depreciation charge (to the nearest ) for the machinery is: ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep Cash flow in Year 0 is 42143 which relate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Regression Analysis And Other Multivariable Methods

Authors: David G. Kleinbaum, Lawrence L. Kupper, Azhar Nizam, Eli S. Rosenberg

5th Edition

1285051084, 978-1285963754, 128596375X, 978-1285051086

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App