Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table shows the zero-coupon bond prices per $1 of maturity payment (i.e., the face value is $1) at different maturities. Maturity (in

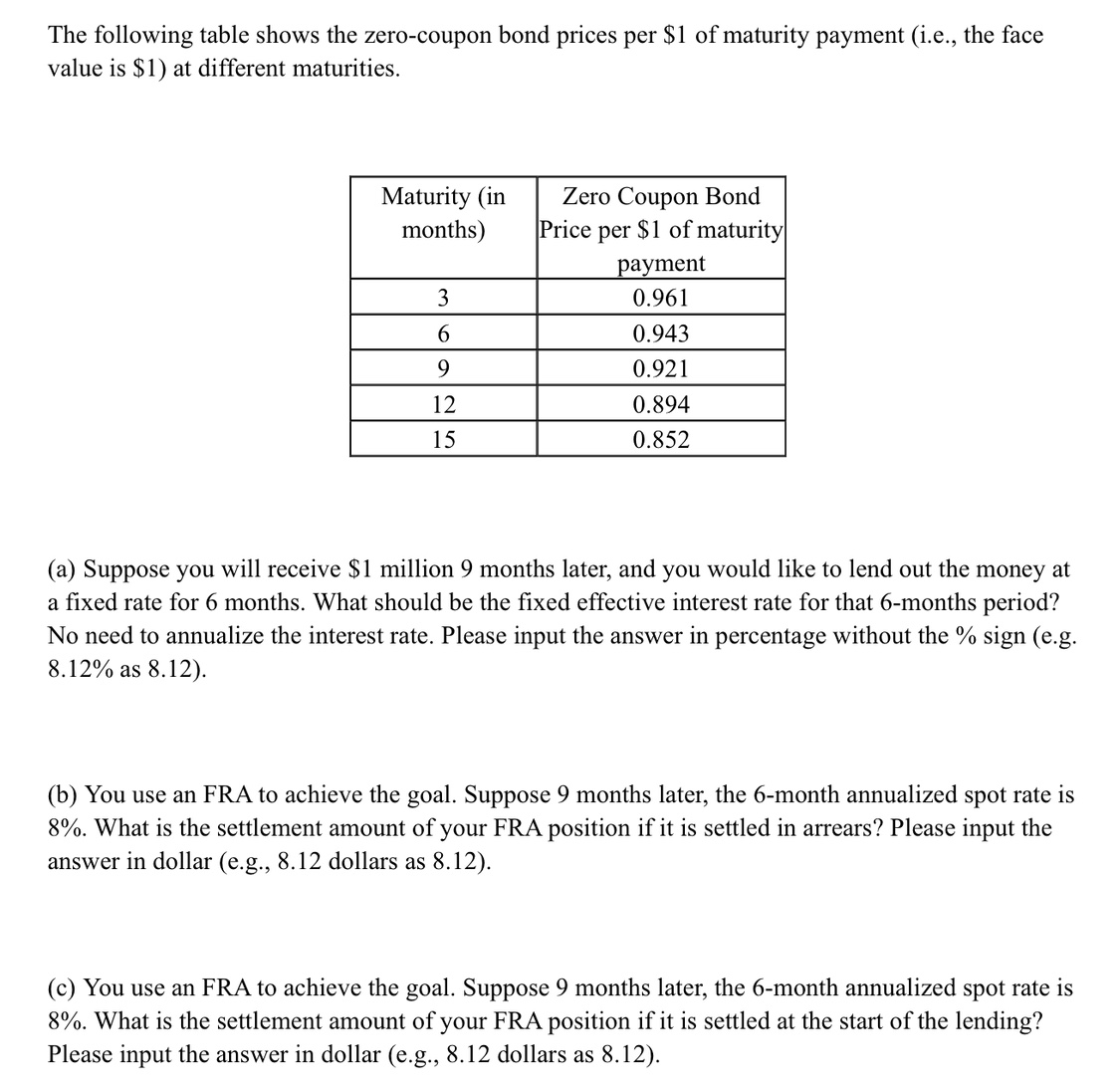

The following table shows the zero-coupon bond prices per $1 of maturity payment (i.e., the face value is $1) at different maturities. Maturity (in months) 3 6 9 12 15 Zero Coupon Bond Price per $1 of maturity payment 0.961 0.943 0.921 0.894 0.852 (a) Suppose you will receive $1 million 9 months later, and you would like to lend out the money at a fixed rate for 6 months. What should be the fixed effective interest rate for that 6-months period? No need to annualize the interest rate. Please input the answer in percentage without the % sign (e.g. 8.12% as 8.12). (b) You use an FRA to achieve the goal. Suppose 9 months later, the 6-month annualized spot rate is 8%. What is the settlement amount of your FRA position if it is settled in arrears? Please input the answer in dollar (e.g., 8.12 dollars as 8.12). (c) You use an FRA to achieve the goal. Suppose 9 months later, the 6-month annualized spot rate is 8%. What is the settlement amount of your FRA position if it is settled at the start of the lending? Please input the answer in dollar (e.g., 8.12 dollars as 8.12).

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To find the fixed effective interest rate for a 6month period you need to use the zerocoupon bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started