Answered step by step

Verified Expert Solution

Question

1 Approved Answer

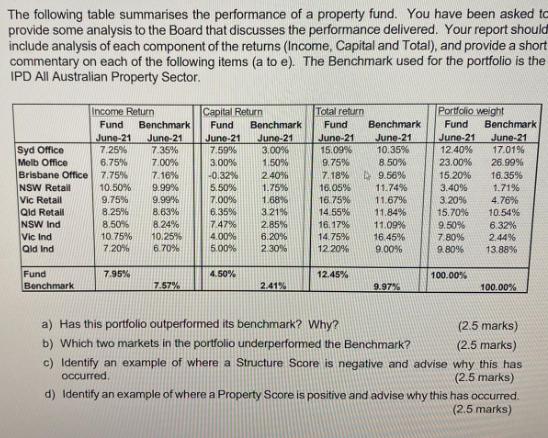

The following table summarises the performance of a property fund. You have been asked to provide some analysis to the Board that discusses the

The following table summarises the performance of a property fund. You have been asked to provide some analysis to the Board that discusses the performance delivered. Your report should include analysis of each component of the returns (Income, Capital and Total), and provide a short commentary on each of the following items (a to e). The Benchmark used for the portfolio is the IPD All Australian Property Sector. Syd Office Melb Office Brisbane Office NSW Retail Vic Retail Qld Retail NSW Ind Vic Ind Qid Ind Fund Benchmark Income Return Fund Benchmark June-21 June-21 7,25% 7.35% 6.75% 7.00% 7.75% 7.16% 10.50% 9.99% 9.99% 8.63% 8.50% 8.24% 10.75% 10.25% 7.20% 6.70% 9.75% 8.25% 7.95% 7.57% Capital Return Fund June-21 7.59% 3.00% -0.32% 5.50% 7.00% 6.35% 7.47% 4.00% 5.00% 4.50% Benchmark June-21 3.00% 1.50% 2.40% 1.75% 1.68% 3.21% 2.85% 6.20% 2.30% 2.41% Total return Fund June-21 15.09% 9.75% 7.18% 16.05% 16.75% 14.55% 16.17% 14.75% 12.20% 12.45% Benchmark June-21 10.35% 8.50% 9.56% 11.74% 11.67% 11.84% 11.09% 16.45% 9.00% 9.97% a) Has this portfolio outperformed its benchmark? Why? b) Which two markets in the portfolio underperformed the Benchmark? Portfolio weight Fund Benchmark June-21 17.01% 26.99% 15.20% 16.35% 3.40% 1.71% 3.20% 4.76% 15.70% 10.54% 9.50% 6.32% 7.80% 2.44% 9.80% 13.88% June-21 12.40% 23.00% 100.00% c) Identify an example of where a Structure Score is negative and advise occurred. 100.00% (2.5 marks) (2.5 marks) why this has (2.5 marks) d) Identify an example of where a Property Score is positive and advise why this has occurred. (2.5 marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Overall the portfolio has outperformed its benchmark This can be seen from the total returns colum...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started