Answered step by step

Verified Expert Solution

Question

1 Approved Answer

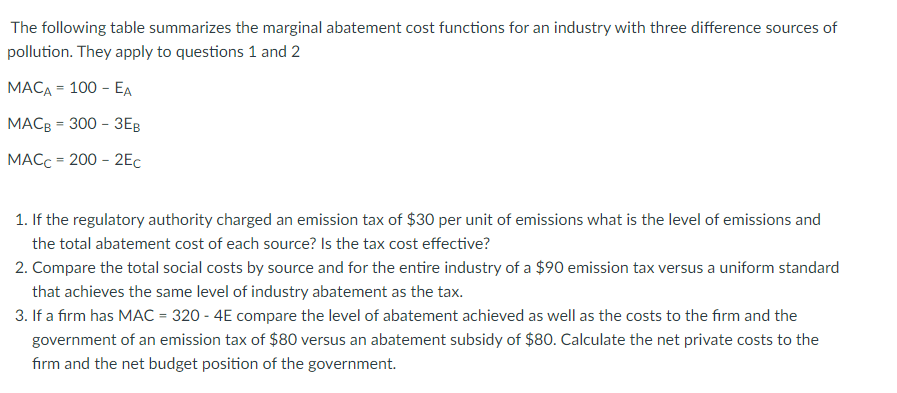

The following table summarizes the marginal abatement cost functions for an industry with three difference sources of pollution. They apply to questions 1 and

The following table summarizes the marginal abatement cost functions for an industry with three difference sources of pollution. They apply to questions 1 and 2 MACA = 100 - EA MACB - 300 - 3EB MACc = 200 - 2Ec 1. If the regulatory authority charged an emission tax of $30 per unit of emissions what is the level of emissions and the total abatement cost of each source? Is the tax cost effective? 2. Compare the total social costs by source and for the entire industry of a $90 emission tax versus a uniform standard that achieves the same level of industry abatement as the tax. 3. If a firm has MAC = 320 - 4E compare the level of abatement achieved as well as the costs to the firm and the government of an emission tax of $80 versus an abatement subsidy of $80. Calculate the net private costs to the firm and the net budget position of the government.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions well first need to understand the marginal abatement cost MAC functions given 1 For Source A MACA 100 EA 2 For Source B MACB ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started