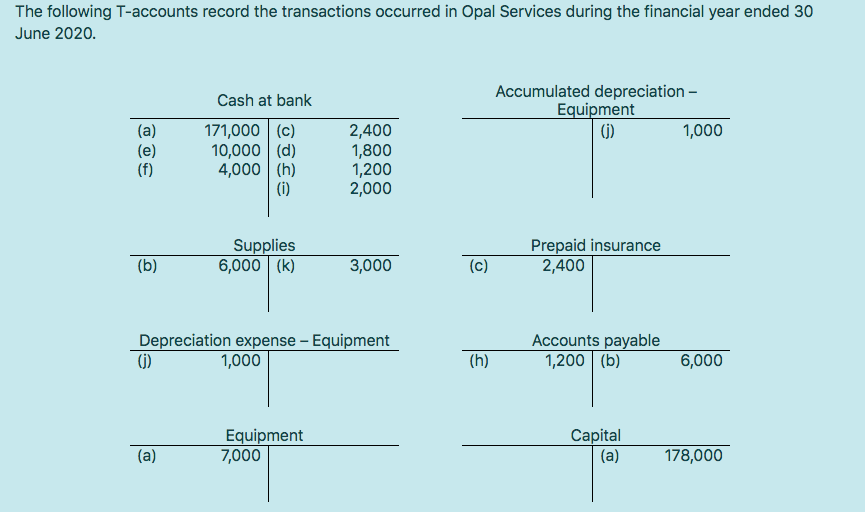

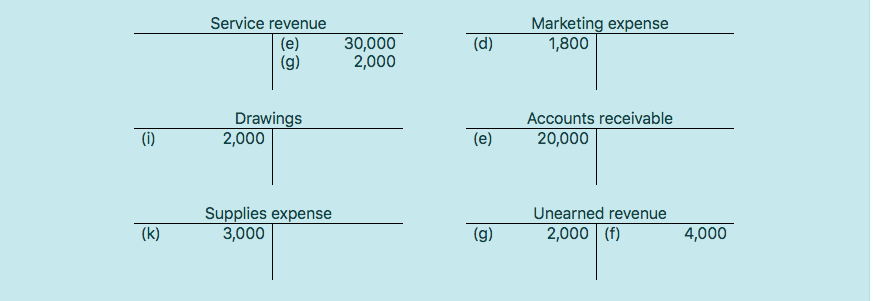

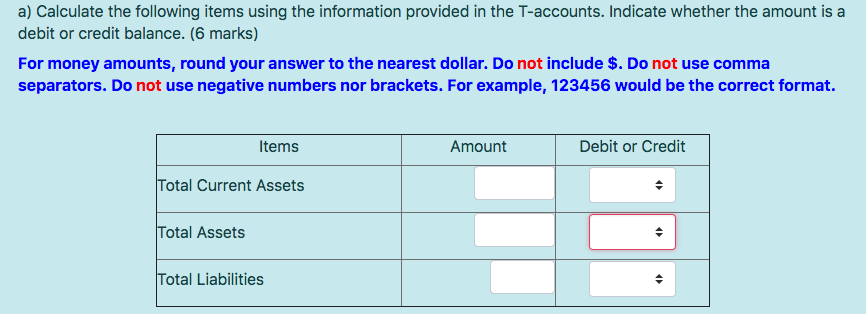

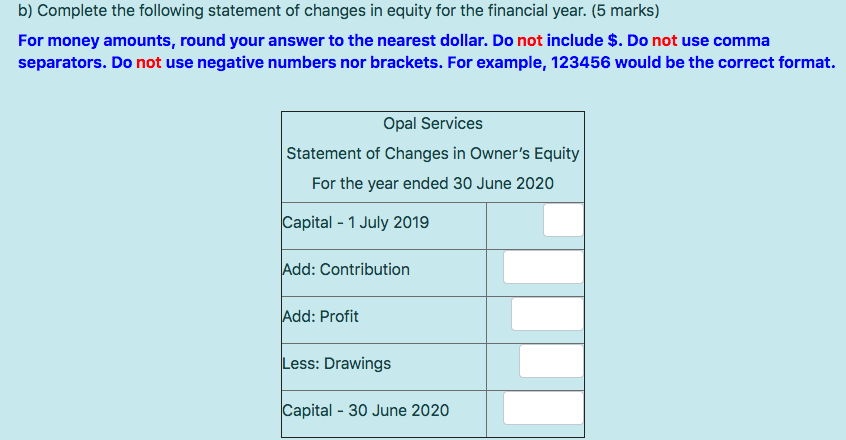

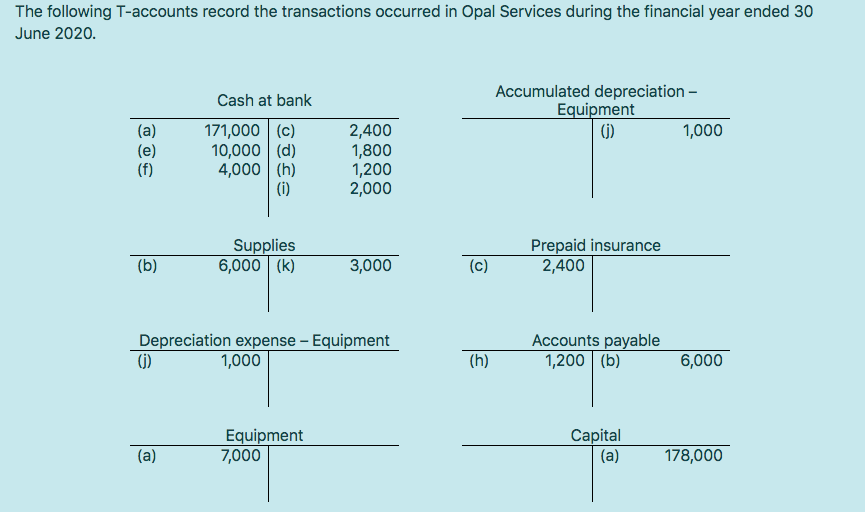

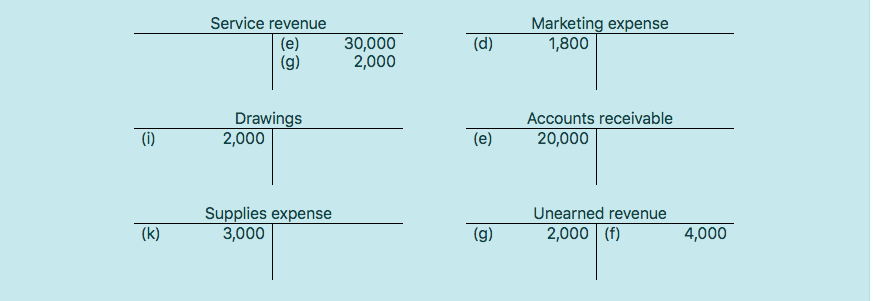

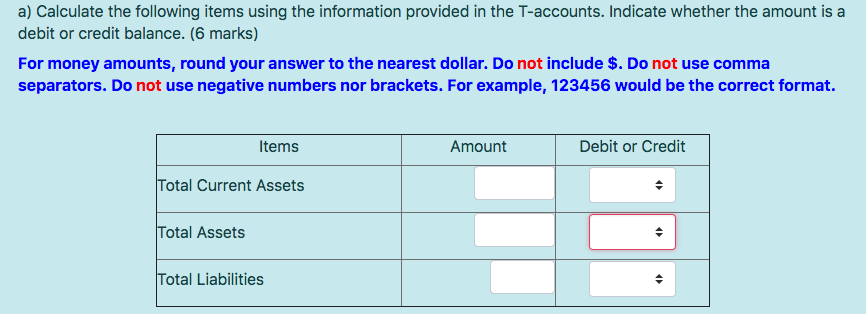

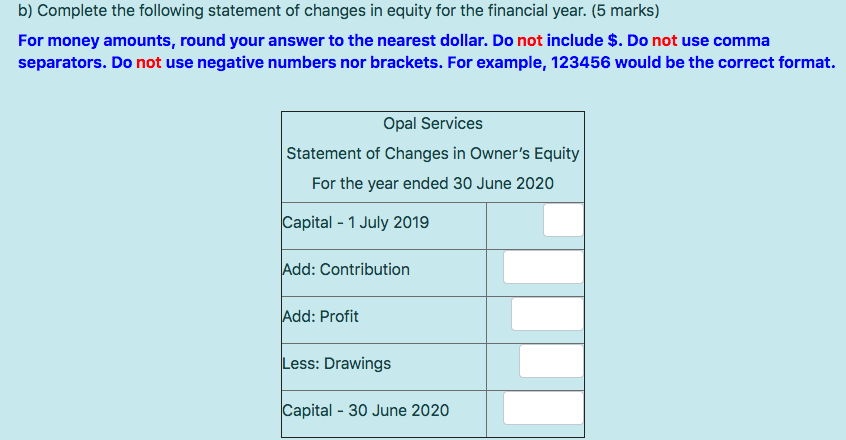

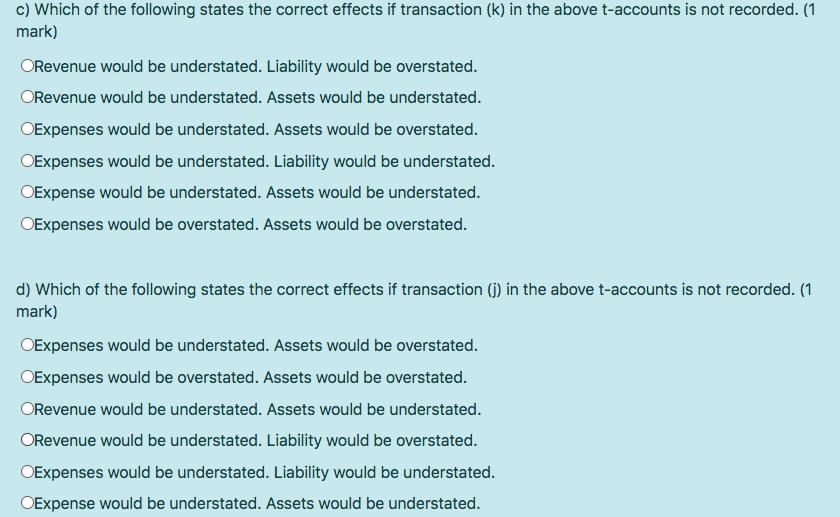

The following T-accounts record the transactions occurred in Opal Services during the financial year ended 30 June 2020. Accumulated depreciation - Equipment (1) 1,000 (a) (e) (f) Cash at bank 171,000 (c) 10,000 (d) 4,000(h) () 2,400 1,800 1,200 2,000 Supplies 6,000 (k) Prepaid insurance 2,400 (b) 3,000 (c) Depreciation expense - Equipment (1) 1,000 Accounts payable 1,200 (b) (h) 6,000 Equipment 7,000 Capital (a) (a) 178,000 Service revenue (e) (g) (d) 30,000 2,000 Marketing expense 1,800 Drawings 2,000 Accounts receivable 20,000 (0) (e) Supplies expense 3,000 Unearned revenue 2,000 (f) (k) (g) 4,000 a) Calculate the following items using the information provided in the T-accounts. Indicate whether the amount is a debit or credit balance. (6 marks) For money amounts, round your answer to the nearest dollar. Do not include $. Do not use comma separators. Do not use negative numbers nor brackets. For example, 123456 would be the correct format. Items Amount Debit or Credit Total Current Assets Total Assets Total Liabilities b) Complete the following statement of changes in equity for the financial year. (5 marks) For money amounts, round your answer to the nearest dollar. Do not include $. Do not use comma separators. Do not use negative numbers nor brackets. For example, 123456 would be the correct format. Opal Services Statement of Changes in Owner's Equity For the year ended 30 June 2020 Capital - 1 July 2019 Add: Contribution Add: Profit Less: Drawings Capital - 30 June 2020 c) Which of the following states the correct effects if transaction (k) in the above t-accounts is not recorded. (1 mark) Revenue would be understated. Liability would be overstated. ORevenue would be understated. Assets would be understated. OExpenses would be understated. Assets would be overstated. Expenses would be understated. Liability would be understated. OExpense would be understated. Assets would be understated. Expenses would be overstated. Assets would be overstated. d) Which of the following states the correct effects if transaction () in the above t-accounts is not recorded. (1 mark) Expenses would be understated. Assets would be overstated. OExpenses would be overstated. Assets would be overstated. Revenue would be understated. Assets would be understated. ORevenue would be understated. Liability would be overstated. OExpenses would be understated. Liability would be understated. Expense would be understated. Assets would be understated