Answered step by step

Verified Expert Solution

Question

1 Approved Answer

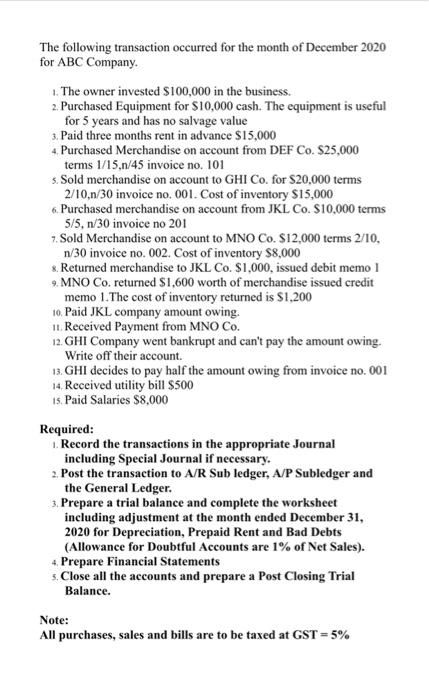

The following transaction occurred for the month of December 2020 for ABC Company. 1. The owner invested S100,000 in the business. 2. Purchased Equipment

The following transaction occurred for the month of December 2020 for ABC Company. 1. The owner invested S100,000 in the business. 2. Purchased Equipment for $10,000 cash. The equipment is useful for 5 years and has no salvage value 3. Paid three months rent in advance $15,000 4. Purchased Merchandise on account from DEF Co. $25,000 terms 1/15,n/45 invoice no. 101 s. Sold merchandise on account to GHI Co. for S20,000 terms 2/10,n/30 invoice no. 001. Cost of inventory $15,000 6 Purchased merchandise on account from JKL Co. $10,000 terms 5/5, n/30 invoice no 201 7. Sold Merchandise on account to MNO Co. S12,000 terms 2/10, n/30 invoice no. 002. Cost of inventory $8,000 &. Returned merchandise to JKL Co. $1,000, issued debit memo 1 9. MNO Co. returned $1,600 worth of merchandise issued credit memo 1.The cost of inventory returned is $1,200 10. Paid JKL company amount owing. I1. Received Payment from MNO Co. 12. GHI Company went bankrupt and can't pay the amount owing. Write off their account. 13. GHI decides to pay half the amount owing from invoice no. 001 14. Received utility bill $500 15. Paid Salaries $8,000 Required: 1. Record the transactions in the appropriate Journal including Special Journal if necessary. 2. Post the transaction to A/R Sub ledger, A/P Subledger and the General Ledger. 3. Prepare a trial balance and complete the worksheet including adjustment at the month ended December 31, 2020 for Depreciation, Prepaid Rent and Bad Debts (Allowance for Doubtful Accounts are 1% of Net Sales). 4. Prepare Financial Statements 5. Close all the accounts and prepare a Post Closing Trial Balance. Note: All purchases, sales and bills are to be taxed at GST = 5%

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Journal for the month of December 2020 for ABC Company Date Particulars Dr Cr 1 Cash Ac Dr 100000 To Capital Ac 100000 2 Equipment Ac Dr 10000 Input GST Ac Dr 500 To Cash Ac 10500 3 Prepaid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started